Risk Management Specialist is a cutting-edge AI-powered solution designed to enhance and streamline risk management processes across various industries. It's not just a tool; it's a digital teammate that works alongside human risk managers, augmenting their capabilities and providing unprecedented insights into potential threats and opportunities.

Risk Management Specialist boasts several game-changing features:1. Advanced data analytics: It can process vast amounts of structured and unstructured data at lightning speed.2. Predictive modeling: Using machine learning algorithms, it can forecast potential risks and their impacts.3. Real-time monitoring: It continuously scans for emerging threats across multiple domains.4. Pattern recognition: It identifies subtle correlations and trends that might escape human notice.5. Adaptive learning: The system evolves and improves its models based on new data and outcomes.6. Scenario simulation: It can run thousands of "what-if" scenarios to test different risk mitigation strategies.7. Natural language processing: It can interpret and analyze text-based information from various sources.8. Customizable risk dashboards: It provides clear, actionable insights tailored to different stakeholders.

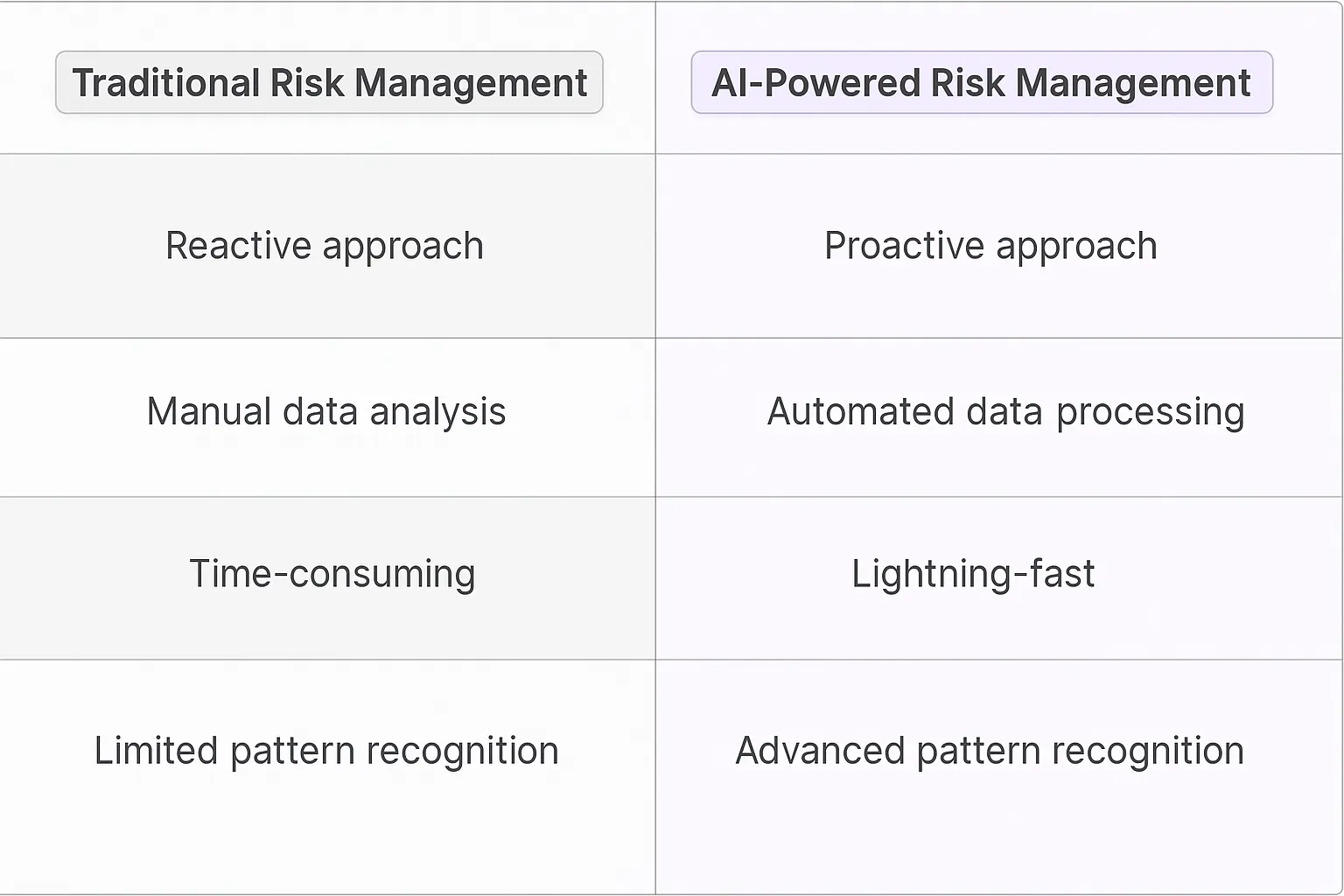

Before AI agents entered the risk management arena, companies relied on a patchwork of tools and human expertise. Think Excel spreadsheets on steroids, coupled with legacy software systems that were about as flexible as a brick wall. Risk analysts would spend countless hours manually crunching numbers, poring over reports, and trying to connect dots across disparate data sources. It was like trying to solve a 1000-piece jigsaw puzzle while blindfolded – possible, but painfully slow and prone to errors.

Enter AI agents, and suddenly we're playing a whole new ballgame. These digital teammates are like having a team of genius interns who never sleep, never complain, and have perfect recall. They're transforming risk management from a reactive, rear-view mirror exercise into a proactive, real-time strategic advantage.

First off, AI agents are data-crunching beasts. They can ingest and analyze vast amounts of structured and unstructured data at speeds that make human analysts look like they're moving in slow motion. This means companies can now spot emerging risks and opportunities faster than ever before, giving them a crucial edge in today's volatile markets.

But it's not just about speed. AI agents bring a level of pattern recognition and predictive capability that's simply beyond human capacity. They can identify subtle correlations and trends that would be invisible to even the most experienced risk managers. It's like giving your risk team a set of superhuman goggles that let them see through the noise and focus on what really matters.

Moreover, AI agents are learning machines. They get smarter and more accurate over time, continuously refining their models based on new data and outcomes. This means your risk management capabilities are constantly evolving and improving, without the need for constant manual updates or retraining.

Perhaps most importantly, AI agents free up human risk managers to focus on what they do best: strategic thinking and decision-making. Instead of getting bogged down in data processing and routine analysis, risk professionals can now spend their time interpreting AI-generated insights, crafting innovative risk mitigation strategies, and communicating with stakeholders.

The bottom line? AI agents are turning risk management from a cost center into a value driver. They're enabling companies to navigate uncertainty with greater confidence, seize opportunities faster, and build more resilient business models. In a world where change is the only constant, that's not just an advantage – it's a necessity for survival and growth.

Risk management is a complex field that requires constant vigilance and adaptability. AI agents are poised to transform how risk specialists operate, offering a level of analysis and foresight that was previously unattainable. These digital teammates can sift through vast amounts of data, identify patterns, and predict potential risks with uncanny accuracy.

One of the most compelling use cases is in the realm of financial risk assessment. AI agents can analyze market trends, economic indicators, and company-specific data to provide real-time risk profiles. They're not just crunching numbers; they're learning from historical data and adapting their models to account for new variables and emerging risks.

In cybersecurity, AI agents are becoming indispensable. They can monitor network traffic, detect anomalies, and respond to threats faster than any human team. What's fascinating is how these agents can predict and prevent attacks by understanding the evolving tactics of cybercriminals.

On a more granular level, AI agents are taking on specific tasks that were once the domain of human risk specialists. They're not replacing humans, but rather augmenting their capabilities in ways that are truly game-changing.

For instance, in compliance monitoring, AI agents can keep track of regulatory changes across multiple jurisdictions, flagging potential issues and suggesting policy updates. This task, which once required teams of legal experts, can now be handled with greater efficiency and accuracy.

Another intriguing application is in supply chain risk management. AI agents can analyze global events, weather patterns, and geopolitical shifts to predict potential disruptions. They can then suggest alternative suppliers or routes, ensuring business continuity in the face of unforeseen challenges.

In the insurance industry, AI agents are revolutionizing underwriting processes. They can assess risk factors for individual policies with a level of nuance that was previously impossible, leading to more accurate pricing and reduced exposure for insurance companies.

What's particularly exciting about these use cases is the potential for AI agents to learn and improve over time. As they handle more tasks and process more data, their predictive capabilities become increasingly refined. This creates a virtuous cycle where the risk management function becomes more proactive and less reactive.

The integration of AI agents into risk management isn't just about efficiency gains or cost savings. It's about fundamentally changing how we approach risk. These digital teammates allow risk specialists to shift their focus from routine tasks to strategic decision-making, leveraging AI-generated insights to drive business value.

As we look to the future, the potential applications of AI in risk management seem limitless. From predicting natural disasters to assessing geopolitical risks, these agents will continue to push the boundaries of what's possible in the field. The challenge for risk management specialists will be to harness this potential, integrating AI agents into their workflows in ways that complement and enhance human expertise.

Risk management specialist AI agents are reshaping how businesses handle uncertainty and potential threats. These digital teammates bring a unique blend of data processing power, pattern recognition, and predictive analytics to the table. Let's dive into some industry-specific scenarios where these AI agents are making waves and transforming traditional risk management approaches.

From finance to healthcare, manufacturing to cybersecurity, these AI-powered risk management specialists are proving their worth by identifying potential pitfalls, suggesting mitigation strategies, and even predicting future risks before they materialize. They're not just crunching numbers; they're providing insights that human risk managers might overlook, creating a symbiotic relationship between human expertise and machine intelligence.

In the following examples, we'll explore how these AI agents are being deployed across different sectors, the unique challenges they're addressing, and the tangible benefits they're bringing to organizations. Get ready to see how risk management is evolving in the age of AI, and why forward-thinking companies are embracing these digital risk specialists to stay ahead of the curve.

The fintech industry is a high-stakes playground where fortunes are made and lost in milliseconds. Enter the Risk Management Specialist AI Agent – a digital teammate that's about to flip the script on how we handle financial risk.

Picture a bustling trading floor. Traders are glued to screens, algorithms are humming, and millions are changing hands every second. Amidst this controlled chaos, our AI agent is silently crunching numbers, analyzing patterns, and sniffing out anomalies that human eyes might miss.

This isn't your grandpa's risk management system. It's a hyper-intelligent entity that's gobbling up real-time market data, news feeds, social media sentiment, and even weather patterns. Why weather? Because a storm in the Gulf could spike oil prices, triggering a domino effect across markets.

The magic happens when this AI spots a potential risk. It doesn't just raise a red flag – it runs thousands of simulations in seconds, predicting how this risk could play out across different scenarios. It's like having a crystal ball, but one powered by petaflops of computing muscle.

But here's where it gets really interesting. This AI isn't just reactive; it's proactive. It's constantly learning, adapting its models based on outcomes. Did a particular risk assessment pan out? The AI takes note, fine-tuning its algorithms for next time.

And let's talk about communication. This isn't some black box spitting out incomprehensible data. Our AI agent translates complex risk scenarios into clear, actionable insights. It's like having a seasoned risk analyst whispering in your ear, but one that never sleeps, never takes a coffee break, and can process information at superhuman speeds.

The result? A fintech company that's not just surviving in a volatile market – it's thriving. It's making smarter trades, avoiding pitfalls, and staying one step ahead of the competition. All thanks to a digital teammate that's redefining what's possible in risk management.

This isn't just an incremental improvement. It's a paradigm shift that could reshape the entire fintech landscape. And the companies that embrace this technology first? They're not just playing the game – they're changing it entirely.

The aerospace industry is a realm where precision isn't just desired—it's absolutely critical. A single miscalculation can lead to catastrophic consequences. This is where AI agents are making their mark, transforming risk management from a reactive process to a proactive powerhouse.

Consider the complexity of managing risk in aerospace manufacturing. You're dealing with intricate supply chains, cutting-edge materials, and engineering tolerances measured in microns. Traditional risk management approaches simply can't keep up with the sheer volume and velocity of data involved.

Enter the Risk Management Specialist AI Agent. This digital teammate is constantly monitoring every aspect of the manufacturing processes, from raw material sourcing to final assembly. It's analyzing data from thousands of sensors, scrutinizing quality control reports, and even factoring in geopolitical events that could disrupt the supply chain.

But what sets this AI apart is its ability to connect dots that humans might miss. It might notice a subtle correlation between a specific batch of alloy and a slight increase in micro-fractures during stress testing. This seemingly minor detail could be the early warning sign of a potential catastrophic failure down the line.

The AI doesn't just flag these issues—it proposes solutions. By running countless simulations, it can suggest optimal adjustments to manufacturing processes, predict maintenance needs before failures occur, and even recommend strategic shifts in supplier relationships to mitigate future risks.

What's truly game-changing is how this AI learns and adapts. Every decision, every outcome feeds back into its models, continuously refining its predictive capabilities. It's like having a risk management expert with decades of experience, but one that's constantly updating its knowledge base in real-time.

The impact on the aerospace industry is profound. Companies leveraging these AI agents are seeing dramatic reductions in manufacturing defects, improved safety records, and significant cost savings. But more importantly, they're pushing the boundaries of what's possible in aerospace engineering, confident in their ability to manage the associated risks.

This isn't just about making better planes or spacecraft. It's about fundamentally changing how we approach innovation in high-stakes industries. With AI agents as their risk management partners, aerospace companies can dare to dream bigger, push harder, and fly higher—both literally and figuratively.

The aerospace industry is just the beginning. As these AI risk management agents evolve, we'll see them revolutionizing other complex, high-risk sectors. The companies that embrace this technology now won't just be market leaders—they'll be defining entirely new markets.

Implementing a Risk Management Specialist AI Agent isn't a walk in the park. It's more like trying to teach a computer to play 4D chess while blindfolded. The first hurdle? Data quality and quantity. These digital teammates are only as good as the information they're fed, and risk management requires a buffet of complex, often unstructured data.

Then there's the challenge of creating algorithms that can actually understand and interpret this data in context. It's not just about crunching numbers; it's about grasping nuanced financial regulations, market trends, and even geopolitical events. We're talking about building an AI that can read between the lines of a 10-K report and smell trouble before it hits the fan.

Let's not forget about the need for real-time processing. In the world of risk management, being a day late is like showing up to a gunfight with a butter knife. These AI agents need to process vast amounts of data and make decisions faster than a trader can say "sell." This requires some serious computational muscle and clever architecture design.

On the operational side, we're dealing with a whole different beast. First off, there's the integration issue. How do you seamlessly weave this AI agent into existing risk management processes without causing a corporate immune system response? It's like trying to introduce a new player to a championship team mid-season.

Then there's the human factor. Risk management professionals might view these AI agents as threats rather than teammates. You need to cultivate a culture where humans and AI can play nice together, leveraging each other's strengths. It's not about replacing humans; it's about augmenting their capabilities.

Compliance and accountability are other thorny issues. When your AI makes a call that leads to a significant financial decision, who's on the hook if things go south? You need robust governance frameworks and audit trails that can stand up to regulatory scrutiny.

Lastly, there's the ever-present challenge of keeping these AI agents up-to-date. The financial world moves at breakneck speed, with new regulations, market dynamics, and risk factors emerging constantly. Your AI needs to be as adaptable as a chameleon in a disco, continuously learning and evolving to stay relevant.

Implementing a Risk Management Specialist AI Agent is no small feat. But for those who can navigate these choppy waters, the potential rewards are enormous. It's not just about managing risk; it's about turning risk into opportunity.

Risk Management Specialist AI Agents are more than just a technological upgrade; they're a paradigm shift in how we approach risk. By combining the processing power of machines with human expertise, these digital teammates are enabling organizations to navigate uncertainty with unprecedented confidence and agility. As the technology continues to evolve, we can expect to see even more innovative applications across industries, from finance to healthcare to manufacturing. The future of risk management is here, and it's powered by AI. Companies that embrace this technology now will be better positioned to thrive in an increasingly complex and volatile business environment. The question isn't whether you can afford to implement AI in your risk management strategy - it's whether you can afford not to.