Financial Analysis AI Agents

The Evolution of Financial Analysis with AI Agents

What is Financial Analysis?

Financial analysis is the process of evaluating businesses, projects, budgets, and other finance-related entities to determine their performance and suitability. It's the backbone of informed decision-making in finance, involving the examination of historical data, current market conditions, and future projections. Traditionally, this has been a human-intensive process, requiring expertise in accounting, economics, and market dynamics.

Key Features of Financial Analysis

Financial analysis typically includes several key components:1. Data collection and organization from various sources2. Ratio analysis to assess financial health3. Trend analysis to identify patterns over time4. Comparative analysis against industry benchmarks5. Forecasting and modeling to predict future performance6. Risk assessment to evaluate potential threats and opportunities7. Report generation to communicate findings and recommendations

Benefits of AI Agents for Financial Analysis

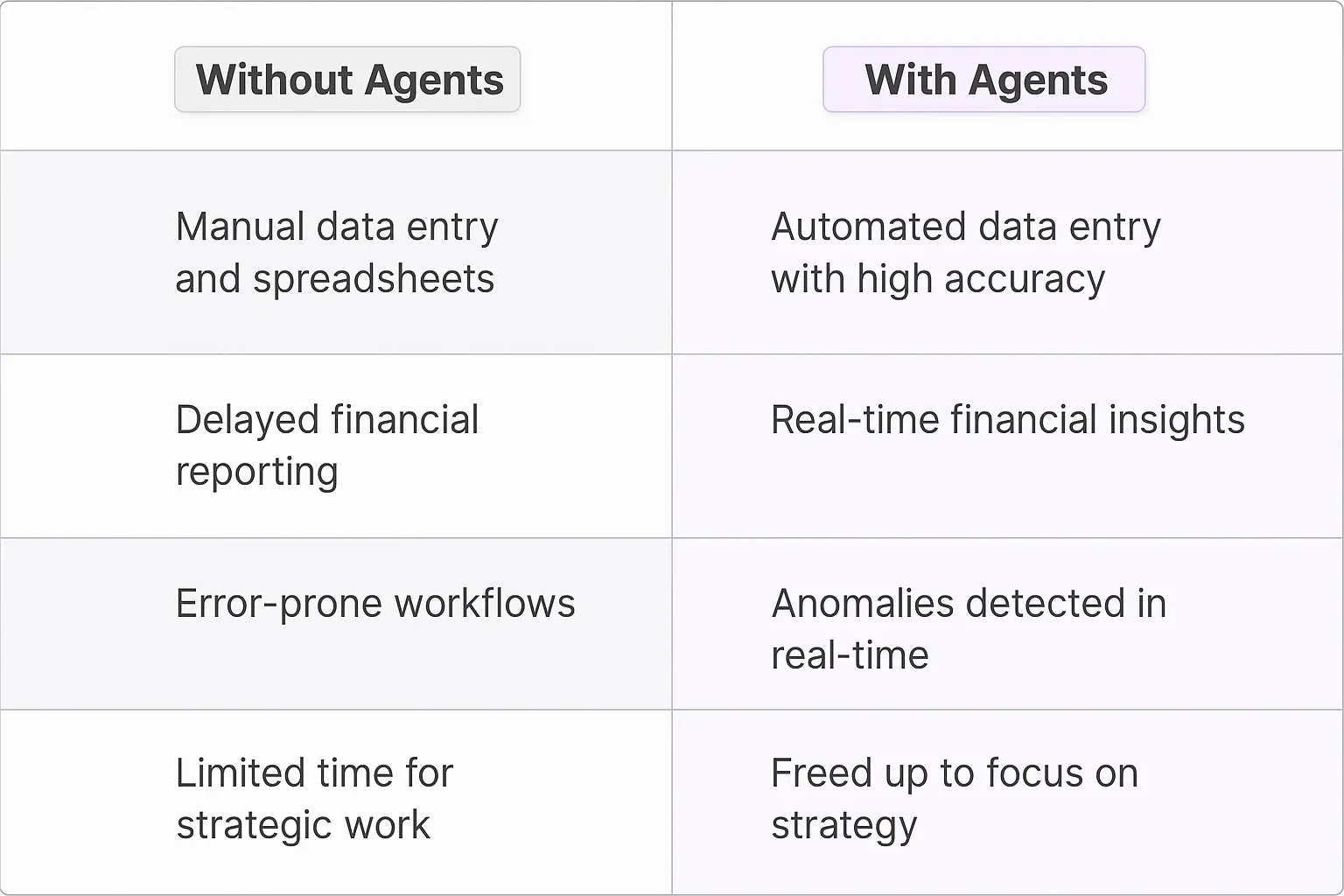

What would have been used before AI Agents?

Before AI agents entered the financial analysis scene, we were stuck in a world of spreadsheets, manual data entry, and endless hours of number crunching. Analysts would spend days, sometimes weeks, poring over financial statements, market reports, and economic indicators. It was a tedious process prone to human error and limited by the sheer volume of data one person could process.

Traditional software tools helped, but they were often rigid, requiring specific inputs and offering limited flexibility. They couldn't adapt to new data sources or evolving market conditions without significant reprogramming. The result? Slower decision-making, missed opportunities, and a constant game of catch-up with the rapidly changing financial landscape.

What are the benefits of AI Agents?

Enter AI agents for financial analysis. These digital teammates are game-changers, bringing a level of speed, accuracy, and insight that's transforming how we approach financial data. Here's the real deal:

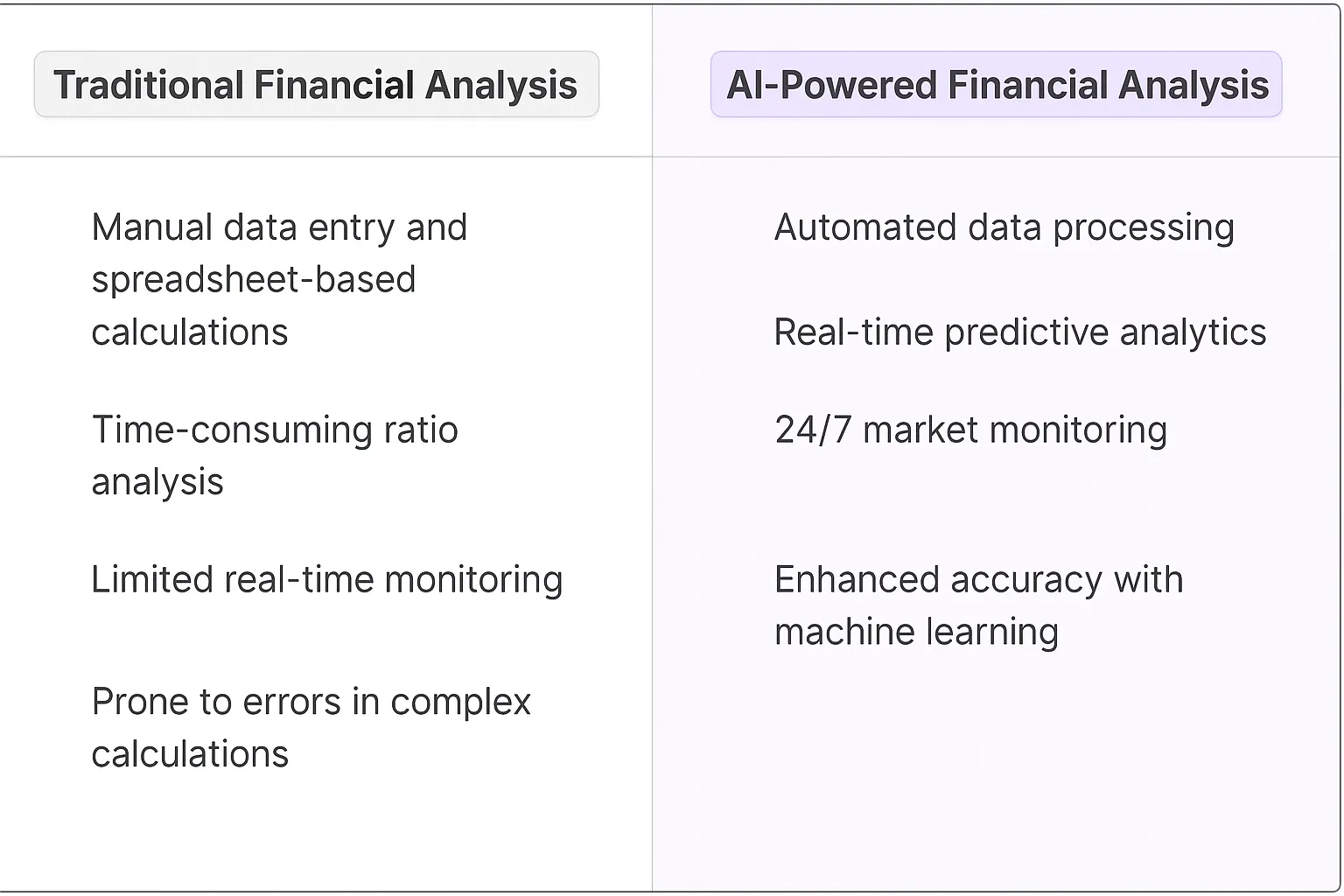

1. Data Processing on Steroids: AI agents can ingest and analyze vast amounts of financial data in seconds. We're talking about processing entire market histories, company financials, and global economic indicators faster than you can say "bull market." This isn't just about speed; it's about uncovering patterns and correlations that human analysts might miss.

2. Predictive Analytics That Actually Work: These AI agents aren't just looking at historical data; they're using it to make frighteningly accurate predictions. By analyzing trends and factoring in countless variables, they can forecast market movements, company performance, and economic shifts with a level of precision that makes traditional models look like guesswork.

3. Real-time Analysis and Alerts: Markets move fast, and AI agents move faster. They can monitor financial data streams 24/7, alerting analysts to significant changes or anomalies as they happen. This real-time insight can be the difference between capitalizing on an opportunity and missing it entirely.

4. Customization and Adaptability: Unlike traditional software, AI agents can be trained and fine-tuned to focus on specific sectors, companies, or financial strategies. They learn from new data and user feedback, constantly improving their analysis and adapting to changing market conditions.

5. Natural Language Processing for Sentiment Analysis: AI agents can scrape and analyze news articles, social media posts, and financial reports, gauging market sentiment in real-time. This adds a crucial qualitative layer to financial analysis, helping predict how human emotions and reactions might influence market movements.

6. Automated Report Generation: Say goodbye to spending hours compiling reports. AI agents can generate comprehensive, insightful financial reports in minutes, freeing up analysts to focus on strategy and decision-making rather than data compilation.

7. Risk Assessment on Another Level: By simulating thousands of scenarios and stress-testing portfolios, AI agents provide a depth of risk analysis that was previously unimaginable. They can identify potential vulnerabilities and suggest hedging strategies with a level of sophistication that goes beyond traditional risk models.

The bottom line? AI agents in financial analysis aren't just tools; they're digital teammates that are redefining what's possible in the world of finance. They're not replacing human analysts; they're augmenting them, allowing for deeper insights, faster decisions, and a level of financial intelligence that's pushing the boundaries of what we thought was possible. Welcome to the new era of financial analysis – it's smarter, faster, and infinitely more exciting.

Potential Use Cases of AI Agents for Financial Analysis

Processes

Financial analysis AI agents are poised to transform how we crunch numbers and extract insights from complex financial data. These digital teammates can tackle intricate processes that traditionally required hours of human effort, freeing up analysts to focus on high-level strategy and decision-making.

One key process where AI agents excel is in financial modeling. They can rapidly build and iterate on sophisticated models, incorporating vast amounts of historical data and real-time market information. This allows for more accurate forecasting and scenario analysis, giving businesses a competitive edge in volatile markets.

Another critical process is risk assessment. AI agents can continuously monitor financial indicators, market trends, and company-specific data to identify potential risks before they become critical issues. This proactive approach to risk management can save companies millions and prevent catastrophic financial missteps.

Tasks

When it comes to specific tasks, financial analysis AI agents are true workhorses. They can effortlessly handle data cleaning and normalization, ensuring that the information feeding into analysis is accurate and consistent. This tedious but crucial task often consumes a significant portion of analysts' time, but AI agents can perform it in seconds.

Ratio analysis becomes a breeze with AI agents. They can calculate and interpret financial ratios across multiple companies and time periods, providing instant comparisons and highlighting trends that might escape human notice. This rapid analysis enables quicker decision-making and more agile financial strategies.

AI agents also shine in anomaly detection. By analyzing patterns in financial data, they can flag unusual transactions or discrepancies that warrant further investigation. This capability is invaluable for fraud detection and ensuring financial compliance.

In the realm of investment analysis, these digital teammates can perform rapid valuation calculations using multiple methods simultaneously. They can adjust assumptions on the fly, allowing analysts to explore various scenarios and make more informed investment decisions.

The power of AI agents in financial analysis isn't just about speed - it's about uncovering insights that humans might miss. By processing vast amounts of data and identifying subtle correlations, these agents can reveal hidden opportunities and risks that traditional analysis might overlook.

As we continue to push the boundaries of what's possible with AI in finance, we're likely to see even more innovative use cases emerge. The future of financial analysis is one where human expertise is augmented and amplified by AI agents, leading to smarter, faster, and more accurate financial decision-making across the board.

Industry Use Cases: Financial Analysis AI Agents

AI agents are reshaping the landscape of financial analysis, offering a potent blend of speed, accuracy, and insight that's transforming how we crunch numbers and make decisions. These digital teammates aren't just tools; they're becoming indispensable partners in the financial sector. Let's dive into some real-world applications that showcase how AI is elevating financial analysis across different industries.

From hedge funds to Main Street banks, AI agents are proving their worth by tackling complex data sets, spotting trends humans might miss, and providing actionable intelligence in real-time. They're not replacing analysts but rather amplifying their capabilities, allowing for deeper dives into financial data and more nuanced strategy formulation.

The following use cases illustrate how AI agents are becoming the secret weapon for financial professionals, enabling them to stay ahead in a world where milliseconds can mean millions. Whether it's risk assessment, portfolio management, or fraud detection, these AI-powered allies are changing the game in ways that were once the stuff of science fiction.

Fintech Disruption: AI-Powered Risk Assessment

The fintech industry is ripe for a shake-up, and Financial Analysis AI Agents are leading the charge. Take the case of lending platforms – traditionally, risk assessment has been a time-consuming process, relying heavily on credit scores and manual review. But what if we could analyze a borrower's entire financial footprint in seconds?

Enter AI-powered risk assessment. These digital teammates can crunch through vast amounts of data – transaction history, spending patterns, income stability – and provide a nuanced risk profile that goes far beyond a simple credit score. They're not just looking at the numbers; they're understanding the story behind them.

For example, a gig economy worker might have an inconsistent income stream that would raise red flags in traditional models. But an AI agent could recognize the pattern of multiple income sources, seasonal fluctuations, and overall stability over time. It might even factor in industry trends and economic indicators to predict future earning potential.

This isn't just faster – it's smarter. By reducing false negatives, fintech companies can approve loans to creditworthy borrowers who might have been overlooked by traditional methods. And by catching subtle risk factors, they can better protect themselves against defaults.

The result? A more inclusive financial system, lower operating costs for lenders, and potentially lower interest rates for borrowers. It's a win-win-win that could fundamentally alter the lending landscape.

But here's the kicker: this is just the beginning. As these AI agents learn and evolve, they'll start to identify patterns and opportunities that humans might miss. We could be looking at a future where financial products are tailored not just to broad demographics, but to individual financial behaviors and goals.

The fintech companies that embrace this technology won't just be playing a different game – they'll be changing the rules entirely. And in the high-stakes world of finance, that's how you create unicorns.

Real Estate Revolution: AI-Driven Market Analysis

The real estate industry is notoriously slow to change, but AI-powered financial analysis is about to flip the script. We're not talking about simple property valuation tools here - we're looking at AI agents that can predict market trends with uncanny accuracy.

These digital teammates are ingesting massive amounts of data - everything from historical sales and rental rates to local economic indicators, demographic shifts, and even social media sentiment. They're not just crunching numbers; they're identifying complex patterns that human analysts might miss.

Consider a real estate investment firm eyeing a up-and-coming neighborhood. Traditionally, they'd rely on gut instinct and basic market reports. Now, an AI agent can provide a nuanced analysis that goes far deeper. It might notice a correlation between new coffee shop openings and property value increases, or identify a tipping point in the ratio of renters to owners that signals a neighborhood is about to boom.

But here's where it gets really interesting: these AI agents aren't just reactive - they're proactive. They can simulate countless "what-if" scenarios, helping investors and developers make smarter decisions. What happens to property values if a new transit line is approved? How might changing zoning laws affect commercial real estate in the area? The AI can model these scenarios in minutes, not weeks.

This level of analysis isn't just more accurate - it's opening up entirely new strategies. We're seeing the emergence of "micro-timing" in real estate, where investors can capitalize on short-term market inefficiencies that would be impossible to spot manually.

The implications are huge. For individual homebuyers, this could mean more accurate and personalized property recommendations. For large-scale developers, it could lead to smarter land acquisition strategies and more successful projects. And for the industry as a whole? We're looking at a fundamental shift in how risk is assessed and opportunities are identified.

The real estate firms that embrace this technology won't just have a competitive edge - they'll be playing an entirely different game. In an industry where information is everything, AI-driven financial analysis isn't just a tool - it's the key to unlocking billions in untapped value.

Considerations

Technical Challenges

Implementing a Financial Analysis AI Agent isn't just about slapping some machine learning models onto your existing systems. It's a complex dance of data, algorithms, and infrastructure that requires careful choreography.

First off, data quality is the bedrock of any AI system, but it's especially crucial in finance. You're dealing with high-stakes decisions where a single misplaced decimal can lead to million-dollar mistakes. Ensuring clean, consistent, and comprehensive data across various financial sources is a Herculean task. It's not just about having the data; it's about having the right data in the right format at the right time.

Then there's the challenge of model selection and training. Financial markets are notoriously complex and volatile. Your AI needs to be sophisticated enough to capture these intricacies without overfitting to historical patterns that may not repeat. It's a delicate balance between complexity and generalizability.

Real-time processing is another technical hurdle. In the world of finance, milliseconds matter. Your AI agent needs to ingest, process, and analyze vast amounts of data at breakneck speeds. This requires not just powerful hardware but also highly optimized algorithms and data pipelines.

Operational Challenges

On the operational side, integrating an AI Financial Analysis agent into existing workflows is like performing open-heart surgery on a marathon runner – it's complex, risky, and you can't afford to stop the system while you're doing it.

One of the biggest challenges is change management. You're not just introducing a new tool; you're potentially reshaping how financial analysis is done. This can lead to resistance from employees who fear being replaced or struggle to adapt to new ways of working. Overcoming this requires a mix of clear communication, comprehensive training, and a phased rollout approach.

Regulatory compliance is another operational minefield. Financial institutions are among the most heavily regulated, and for good reason. Your AI agent needs to not only produce accurate results but also be explainable and auditable. This often means sacrificing some performance for transparency, a trade-off that needs careful consideration.

Lastly, there's the ongoing challenge of maintenance and updates. Financial markets evolve rapidly, and your AI agent needs to keep pace. This requires continuous monitoring, regular retraining, and the ability to quickly deploy updates without disrupting operations. It's not just about launching an AI; it's about nurturing a living, learning system that grows with your organization.

Implementing a Financial Analysis AI Agent is not for the faint of heart. It's a journey that requires technical prowess, operational finesse, and a willingness to embrace change. But for those who get it right, the rewards can be transformative, offering insights and efficiencies that were previously unimaginable in the world of finance.

The AI-Powered Future of Financial Analysis

AI agents are not just enhancing financial analysis; they're redefining it. By automating complex processes, uncovering hidden patterns, and providing real-time insights, these digital teammates are giving financial professionals superpowers. The firms that successfully integrate AI into their financial analysis workflows will have a significant edge in decision-making, risk management, and opportunity identification.

However, the journey isn't without challenges. From ensuring data quality to navigating regulatory requirements, implementing AI in finance requires careful planning and execution. But for those who get it right, the potential rewards are enormous. We're entering an era where financial analysis is not just faster and more accurate, but also more predictive and personalized than ever before.

As AI technology continues to evolve, we can expect even more innovative applications in finance. The future of financial analysis is one where human expertise is augmented by AI capabilities, leading to smarter decisions, more efficient markets, and potentially, a more stable and inclusive financial system. The revolution is here, and it's powered by AI.