Fraud Detection AI Agents

Understanding Fraud Detection in the Digital Age

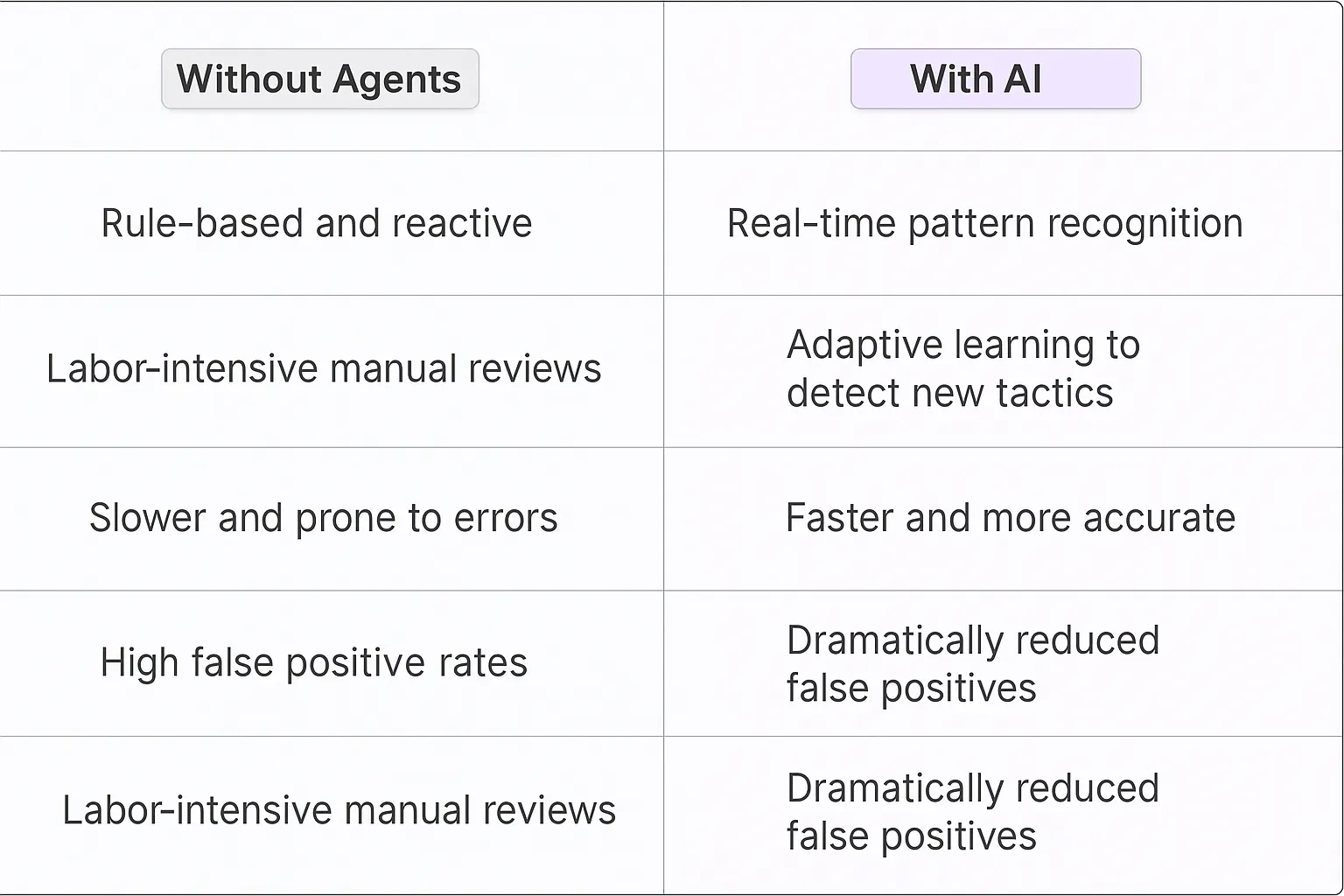

Fraud detection is the process of identifying and preventing unauthorized financial transactions or activities. In the digital age, it's become a critical component of financial security. Traditional methods relied on rule-based systems and manual reviews, but these approaches struggled to keep pace with increasingly sophisticated fraudsters. Enter AI agents - the game-changers in the world of fraud detection.

Key Features of Fraud Detection

Modern fraud detection powered by AI agents offers several key features:1. Real-time analysis of vast datasets2. Pattern recognition that goes beyond simple rules3. Adaptive learning to stay ahead of new fraud tactics4. Contextual understanding for more accurate risk assessment5. Predictive capabilities to anticipate potential vulnerabilities6. Significant reduction in false positivesThese features combine to create a robust, efficient, and highly effective fraud detection system that's transforming how financial institutions protect themselves and their customers.

Benefits of AI Agents for Fraud Detection

Let's dive into the world of fraud detection and how AI agents are changing the game. This isn't just another tech trend – it's a fundamental shift in how we approach financial security.

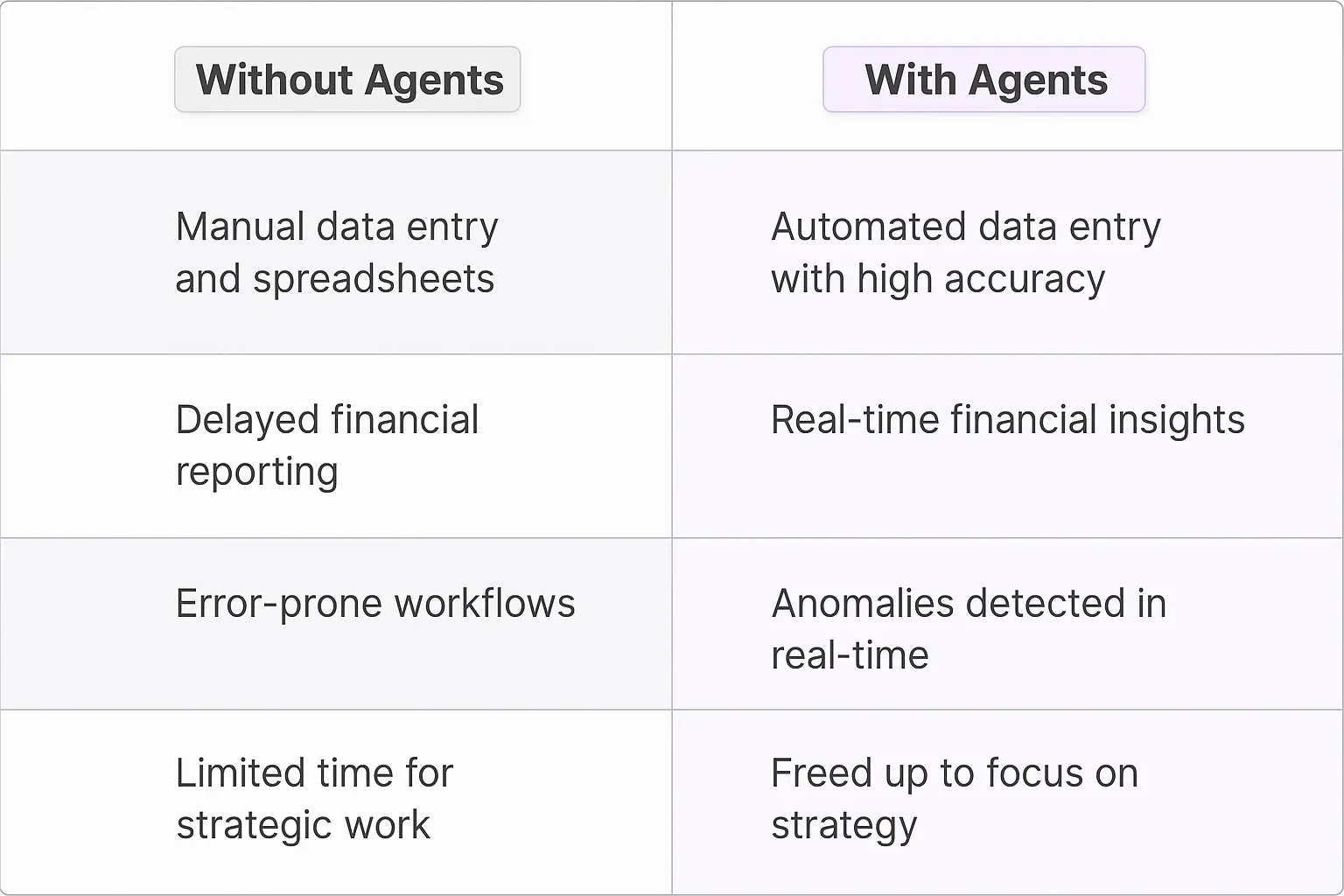

What would have been used before AI Agents?

Traditionally, fraud detection relied on rule-based systems and manual reviews. Think of it as a game of whack-a-mole: analysts would identify a fraud pattern, create a rule to catch it, and fraudsters would quickly adapt. It was reactive, labor-intensive, and always one step behind.

Banks and financial institutions employed large teams of analysts who'd spend hours poring over transaction data, looking for needles in a haystack. The process was slow, prone to human error, and struggled to keep pace with the increasing sophistication of fraudsters.

What are the benefits of AI Agents?

Enter AI agents – they're not just tools, they're digital teammates that are transforming fraud detection from a reactive game into a proactive strategy. Here's why they're game-changers:

- Pattern Recognition on Steroids: AI agents can analyze vast amounts of data in real-time, identifying subtle patterns that human analysts might miss. They're not just looking at individual transactions, but building complex models of user behavior, network connections, and temporal patterns.

- Adaptive Learning: Unlike static rule-based systems, AI agents continuously learn and adapt. They evolve their models based on new data, staying ahead of fraudsters' ever-changing tactics. It's like having a fraud analyst that never sleeps and gets smarter by the minute.

- Reduced False Positives: One of the biggest challenges in fraud detection is balancing security with user experience. AI agents excel at this, dramatically reducing false positives. This means fewer legitimate transactions get flagged, leading to happier customers and less time wasted on unnecessary reviews.

- Speed and Scale: AI agents operate at a speed and scale that's simply impossible for human teams. They can analyze millions of transactions in real-time, providing instant risk assessments and enabling immediate action on suspicious activities.

- Contextual Understanding: Modern AI agents don't just look at numbers – they understand context. They can analyze unstructured data like customer support interactions, social media activity, and even news events to build a more comprehensive risk profile.

- Predictive Capabilities: Perhaps most excitingly, AI agents are moving fraud detection from reactive to predictive. They can identify potential vulnerabilities and high-risk scenarios before they're exploited, allowing organizations to proactively strengthen their defenses.

The shift to AI-powered fraud detection isn't just an incremental improvement – it's a step change in capability. It's enabling financial institutions to stay ahead in the arms race against fraudsters, while simultaneously improving customer experience and operational efficiency. As these AI agents continue to evolve, we're moving towards a future where fraud becomes increasingly difficult and unprofitable for criminals.

For fintech startups and established financial institutions alike, integrating AI agents into fraud detection strategies isn't just an option – it's becoming a necessity to remain competitive and secure in the digital age.

Potential Use Cases of AI Agents for Fraud Detection

Processes

Fraud detection AI agents are game-changers in the financial security landscape. They're not just tools; they're digital teammates that work tirelessly to protect businesses and consumers. These agents excel at pattern recognition, sifting through vast amounts of data to spot anomalies that human analysts might miss.

One key process where these agents shine is in real-time transaction monitoring. They analyze each transaction as it occurs, comparing it against historical data and known fraud patterns. This isn't your grandpa's fraud detection system – it's a sophisticated neural network that learns and adapts with each passing second.

Another critical process is identity verification. Fraud detection AI agents can cross-reference multiple data points in milliseconds, verifying a user's identity across various platforms and databases. This multi-faceted approach creates a robust defense against identity theft and account takeovers.

Tasks

When it comes to specific tasks, fraud detection AI agents are versatile powerhouses. They can flag suspicious activities based on unusual spending patterns, geolocation discrepancies, or sudden changes in user behavior. It's like having a hyper-vigilant guardian that never sleeps, always on the lookout for potential threats.

These digital teammates excel at predictive analysis, forecasting potential fraud risks before they materialize. By analyzing historical data and current trends, they can anticipate new fraud tactics and help businesses stay one step ahead of cybercriminals.

Another crucial task is anomaly detection in large datasets. Fraud detection AI agents can sift through millions of transactions, pinpointing outliers that warrant further investigation. This needle-in-a-haystack capability is a game-changer for financial institutions dealing with massive volumes of daily transactions.

Let's not forget about their role in regulatory compliance. These agents can automatically generate detailed reports on suspicious activities, ensuring businesses meet their reporting obligations without drowning in paperwork. It's like having a compliance expert working 24/7, but without the need for coffee breaks or vacation time.

In the world of e-commerce, fraud detection AI agents are invaluable for preventing chargeback fraud. They can analyze purchase patterns, shipping addresses, and user behavior to flag potentially fraudulent orders before they're processed. This proactive approach not only saves money but also protects the merchant's reputation.

The beauty of these AI agents lies in their ability to learn and improve over time. As they encounter new fraud tactics, they adapt their algorithms, becoming increasingly sophisticated in their detection capabilities. It's a never-ending arms race against fraudsters, and these digital teammates are constantly evolving to stay ahead.

In essence, fraud detection AI agents are transforming the way we approach financial security. They're not replacing human expertise but augmenting it, creating a powerful synergy that's more effective than either could be alone. As we move further into the digital age, these AI agents will become an indispensable part of any robust fraud prevention strategy.

Industry Use Cases for Fraud Detection AI Agents

Fraud detection AI agents are reshaping how businesses combat financial crimes across sectors. These digital teammates bring a level of sophistication and speed that human analysts simply can't match. Let's dive into some industry-specific scenarios where these AI agents are making waves and saving millions.

From banking to e-commerce, insurance to telecommunications, fraud detection AI is becoming an indispensable tool. These agents don't just spot anomalies; they learn, adapt, and improve over time, staying one step ahead of increasingly sophisticated fraudsters. They're not replacing human expertise but amplifying it, allowing fraud teams to focus on complex cases while AI handles the heavy lifting of data analysis.

In the following examples, we'll explore how different sectors leverage these AI agents to protect their bottom line, maintain customer trust, and stay compliant with ever-evolving regulations. These aren't just hypothetical use cases – they're real-world applications that are transforming how businesses approach fraud prevention.

Fintech's New Fraud-Busting Sidekick: AI Agents

Let's talk fintech. It's a space where money moves at the speed of light, and fraudsters are always cooking up new schemes. Enter AI fraud detection agents - the digital teammates that never sleep and have an eagle eye for sketchy transactions.

Picture a neobank like Chime or Revolut. They're processing millions of transactions daily, each one a potential fraud risk. Traditional rule-based systems? They're like bringing a knife to a gunfight. But AI agents? They're the secret weapon that levels the playing field.

These AI agents are constantly learning, adapting to new fraud patterns faster than any human analyst could. They're not just looking at individual transactions; they're seeing the big picture, connecting dots across user behavior, device fingerprints, and transaction patterns.

Here's where it gets interesting: these AI agents can work in real-time, flagging suspicious activity before the transaction even completes. It's like having a hyper-vigilant bouncer at the door of every financial interaction.

But it's not just about stopping the bad guys. These AI agents are also reducing false positives - you know, those annoying times when your legit transaction gets flagged and you have to call the bank. By understanding context and user behavior at a deeper level, they're making the whole experience smoother for honest customers.

The result? Neobanks can scale faster, take on more customers, and offer more innovative services without proportionally increasing their fraud risk. It's a game-changer that allows these digital-first banks to compete with traditional giants while keeping fraud losses to a minimum.

In the high-stakes world of fintech, AI fraud detection agents aren't just nice to have - they're becoming table stakes. As the saying goes in Silicon Valley, software is eating the world. Well, in fintech, AI is eating fraud for breakfast.

E-commerce's Secret Weapon: AI Agents Outsmarting Fraudsters

The e-commerce world is a battlefield, and fraudsters are getting craftier by the minute. But here's the twist: AI fraud detection agents are turning the tables, giving online retailers an edge they've never had before.

Take a behemoth like Amazon or a rising star like Shopify. They're dealing with a tsunami of transactions every second, each one a potential Trojan horse for fraud. Old-school methods? They're about as effective as using a magnifying glass to spot a needle in a haystack. AI agents, though? They're like having an army of cyber-sleuths working 24/7.

These digital teammates are constantly evolving, learning from every transaction, every user interaction, every fraud attempt. They're not just looking at credit card numbers or shipping addresses. They're diving deep into user behavior patterns, device fingerprints, and even the subtle nuances of how someone types or moves their mouse.

What's really mind-blowing is how these AI agents operate in real-time. They're making split-second decisions, flagging potential fraud before the 'Place Order' button is even clicked. It's like having a psychic bouncer who knows who's trouble before they even reach the door.

But here's where it gets really interesting: these AI agents aren't just playing defense. They're actually improving the shopping experience for legitimate customers. By reducing false positives, they're ensuring that good customers aren't getting caught in the fraud net. No more frustrating declines when you're trying to buy that limited-edition sneaker drop.

The impact? E-commerce platforms can scale at warp speed, enter new markets, and roll out innovative features without exposing themselves to proportionally higher fraud risks. It's like having a growth hack and a security system rolled into one.

In the cutthroat world of online retail, where margins are tight and customer trust is everything, AI fraud detection agents aren't just a nice-to-have. They're becoming as essential as the 'Buy Now' button itself. As we say in the Valley, software is eating the world. In e-commerce, AI is eating fraud - and serving up growth for dessert.

Considerations

Technical Challenges

Implementing a fraud detection AI agent isn't just about slapping some machine learning models together and calling it a day. It's a complex beast that requires serious technical chops and a deep understanding of the fraud landscape.

First off, you're dealing with massive amounts of data. We're talking billions of transactions, each with hundreds of features. Your AI needs to crunch through this data in real-time, which means you need some serious computational firepower. You can't afford to have your fraud detection running slower than a sloth on vacation.

Then there's the ever-evolving nature of fraud. Fraudsters are like the ultimate hackers, constantly finding new ways to game the system. Your AI needs to be adaptable, capable of learning new patterns on the fly. This isn't your grandma's static rule-based system - we're talking about models that can self-update and stay ahead of the curve.

And let's not forget about the false positives. Nothing pisses off customers more than having their legitimate transactions flagged as fraud. Your AI needs to walk that fine line between catching the bad guys and not annoying the good ones. It's like trying to find a needle in a haystack, except the needle keeps changing shape and the haystack is on fire.

Operational Challenges

On the operational side, things get even trickier. You're essentially building a system that's going to make high-stakes decisions in milliseconds. Get it wrong, and you're either letting fraudsters run wild or turning away good business. No pressure, right?

You need a rock-solid infrastructure that can handle the load without breaking a sweat. We're talking about a system that needs to be up 24/7, because fraud doesn't sleep, and neither should your defenses. You'll need redundancies on top of redundancies, and a team that can jump on issues faster than a cat on a laser pointer.

Then there's the whole regulatory minefield. Depending on your industry, you might be dealing with a alphabet soup of compliance requirements - GDPR, PCI DSS, AML, KYC. Your AI needs to be a good citizen, following all the rules while still being effective. It's like trying to win a boxing match with one hand tied behind your back.

And let's talk about the human factor. Your fraud team needs to understand how this AI works, how to interpret its decisions, and when to override it. You can't just throw a black box at them and expect magic to happen. There's a whole change management aspect here that often gets overlooked. You're not just implementing a technology - you're changing how people work.

Implementing a fraud detection AI agent is like trying to solve a Rubik's cube while riding a unicycle on a tightrope. It's challenging, it's complex, but when you get it right, it's a game-changer. Just be prepared for a wild ride.

The Future of Financial Security: AI Agents Revolutionizing Fraud Prevention

The integration of AI agents into fraud detection isn't just a trend - it's a seismic shift in the financial security landscape. These digital teammates are redefining what's possible in fraud prevention, offering unprecedented speed, accuracy, and adaptability. They're not replacing human expertise, but augmenting it, creating a powerful synergy that's more effective than either could be alone. For fintech startups and established financial institutions alike, embracing this technology isn't just an option - it's becoming a necessity to remain competitive and secure in the digital age. As these AI agents continue to evolve, we're moving towards a future where fraud becomes increasingly difficult and unprofitable for criminals, ultimately leading to a safer, more trustworthy financial ecosystem for all.