Customer Behavior Analysis AI Agents

Understanding Customer Behavior Analysis and AI Agents

What is Customer Behavior Analysis?

Customer Behavior Analysis is the process of examining how customers interact with a business, product, or service. It involves collecting and analyzing data from various touchpoints to understand patterns, preferences, and trends in customer behavior. This analysis helps businesses make data-driven decisions to improve customer experience, increase retention, and drive growth.

Key Features of Customer Behavior Analysis

1. Data Collection: Gathering information from multiple sources like website interactions, purchase history, and customer service logs.

2. Pattern Recognition: Identifying recurring behaviors and trends in customer data.

3. Predictive Analytics: Forecasting future customer actions based on historical data and current trends.

4. Segmentation: Grouping customers based on shared characteristics or behaviors.

5. Real-time Analysis: Processing and analyzing data as it's generated for immediate insights.

6. Personalization: Tailoring experiences and recommendations based on individual customer profiles.

7. Actionable Insights: Providing clear, data-driven recommendations for business strategies.

Benefits of AI Agents for Customer Behavior Analysis

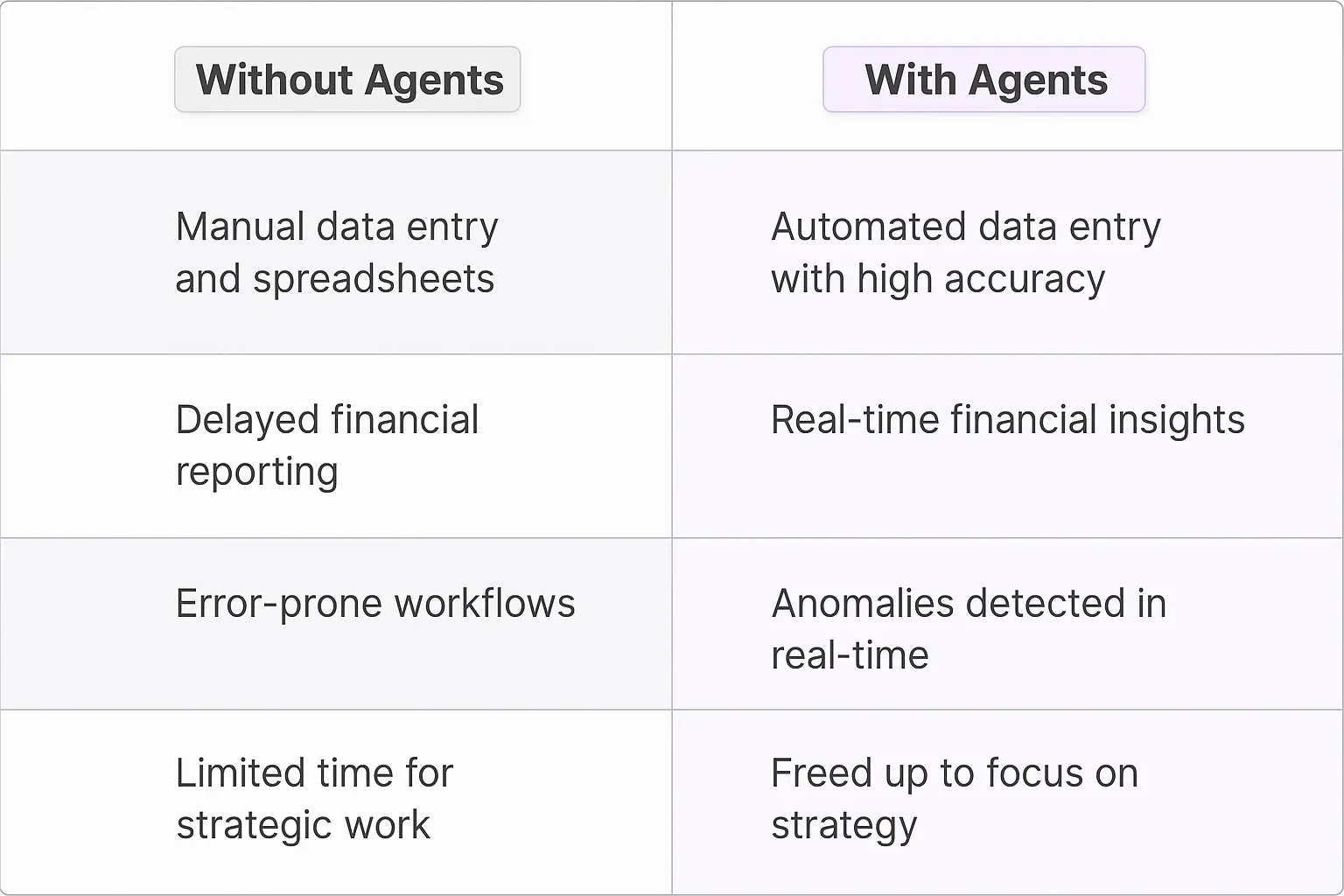

What would have been used before AI Agents?

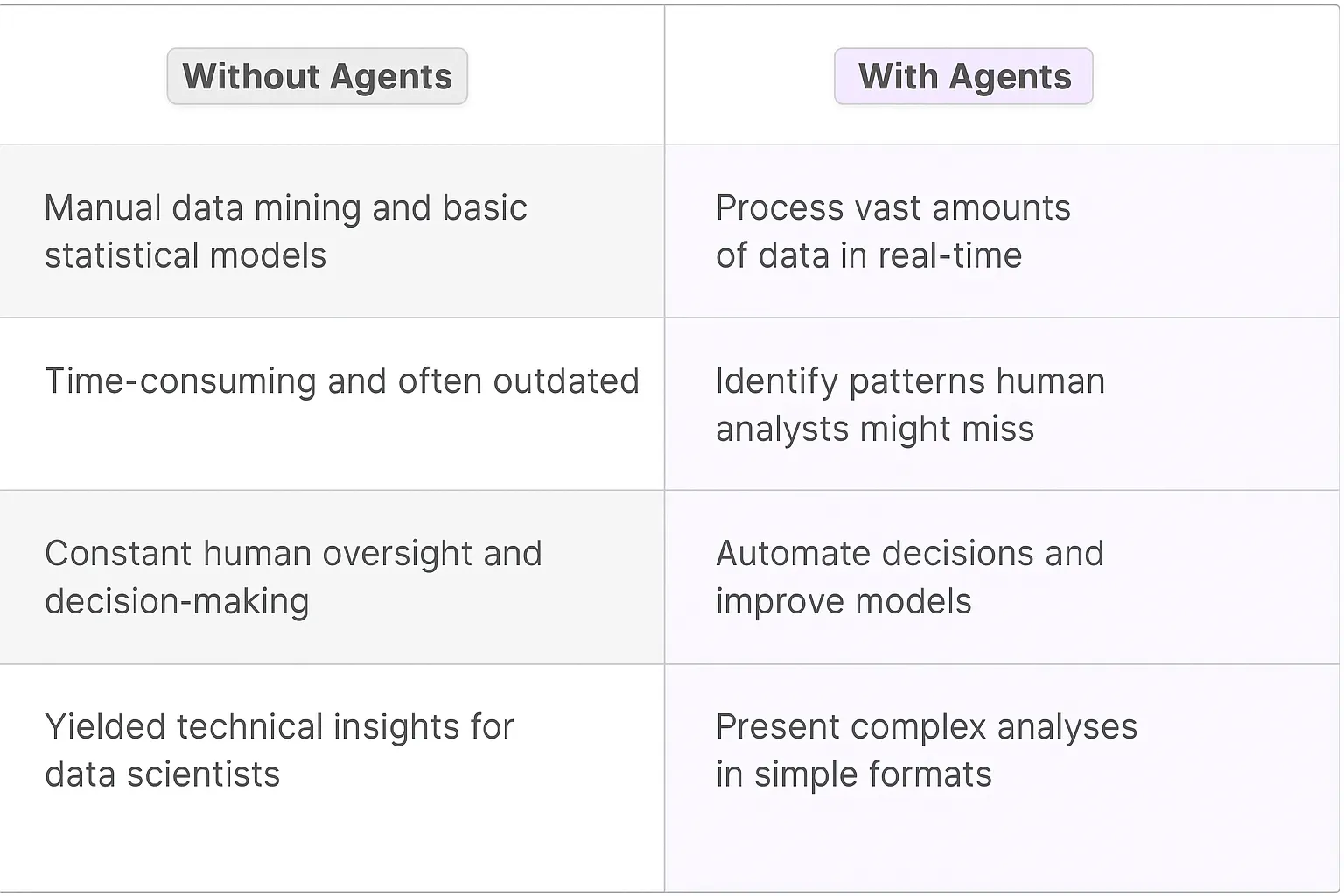

Before AI agents entered the scene, customer behavior analysis was a painstaking process. Companies relied on traditional data analytics tools, manual data mining, and human-led market research. These methods were time-consuming, often yielding insights that were already outdated by the time they reached decision-makers.

Businesses would hire teams of data scientists and analysts to sift through mountains of customer data, trying to extract meaningful patterns. They'd use basic statistical models and rudimentary machine learning algorithms that required constant human oversight and interpretation. The result? A slow, expensive process that often missed subtle trends and couldn't keep up with the rapid shifts in consumer behavior.

What are the benefits of AI Agents?

AI agents are game-changers for customer behavior analysis. They're like having a team of tireless, brilliant data scientists working 24/7, but at a fraction of the cost and with exponentially greater processing power.

First off, AI agents can process and analyze vast amounts of data in real-time. They're not just looking at historical data; they're constantly ingesting new information from multiple sources - social media, website interactions, purchase histories, customer service logs - you name it. This real-time analysis allows businesses to spot trends as they're emerging, not months after the fact.

But it's not just about speed. AI agents excel at identifying complex patterns and correlations that human analysts might miss. They can detect subtle shifts in customer preferences, predict future behaviors with uncanny accuracy, and even suggest personalized strategies for individual customers.

Moreover, AI agents are learning machines. They continuously improve their models based on new data and outcomes, becoming more accurate and insightful over time. This adaptive capability is crucial in today's rapidly changing market landscapes.

Another key benefit is the ability to automate decision-making processes. AI agents can trigger personalized marketing campaigns, adjust pricing strategies, or flag potential churn risks without human intervention. This level of automation frees up human resources to focus on high-level strategy and creative problem-solving.

Lastly, AI agents democratize data insights. They can present complex analyses in easily digestible formats, making data-driven decision-making accessible to non-technical team members across the organization. This widespread access to insights can foster a more agile, responsive business culture.

In essence, AI agents are transforming customer behavior analysis from a retrospective, labor-intensive process into a proactive, real-time strategic asset. They're not just tools; they're digital teammates that are reshaping how businesses understand and respond to their customers.

Potential Use Cases of AI Agents for Customer Behavior Analysis

Processes

Customer behavior analysis is a goldmine for businesses, but it's often buried under mountains of data. AI agents are the perfect excavators for this treasure trove. They can sift through vast amounts of customer data, identifying patterns and insights that human analysts might miss.

These digital teammates can continuously monitor customer interactions across multiple touchpoints - website visits, social media engagement, purchase history, and support tickets. They're not just collecting data; they're connecting dots in real-time, providing a holistic view of customer behavior that evolves with each interaction.

AI agents can also predict future behavior based on historical data and current trends. This isn't just about forecasting sales; it's about anticipating customer needs before they even arise. Imagine knowing what a customer wants before they do - that's the kind of prescience these AI agents can provide.

Tasks

On a more granular level, AI agents can tackle specific tasks that drive customer behavior analysis:

- Sentiment Analysis: AI agents can parse through customer reviews, social media posts, and support interactions to gauge overall sentiment. This isn't just about positive or negative; it's about understanding the nuances of customer emotions and how they correlate with specific products or services.

- Churn Prediction: By analyzing patterns in customer behavior, AI agents can flag accounts at risk of churning. This goes beyond simple metrics like login frequency; it involves understanding complex behavioral patterns that signal disengagement.

- Personalization Engine: AI agents can craft personalized experiences for each customer based on their behavior. This could involve tailoring product recommendations, customizing email content, or even adjusting website layouts in real-time.

- Anomaly Detection: These digital teammates can spot unusual behavior patterns that might indicate fraud, technical issues, or emerging trends. They're constantly on the lookout for anything out of the ordinary that could impact customer experience or business operations.

- Customer Segmentation: AI agents can dynamically segment customers based on behavior, not just demographics. These segments aren't static; they evolve as customer behavior changes, providing a always-current view of your customer base.

The beauty of AI agents in customer behavior analysis is their ability to operate at scale and in real-time. They're not replacing human insight; they're augmenting it, providing a level of depth and breadth in analysis that was previously unattainable. As these AI agents continue to learn and evolve, they'll become indispensable partners in understanding and predicting customer behavior.

Industry Use Cases: Customer Behavior Analysis AI Agents

The versatility of AI agents in customer behavior analysis makes them valuable across various industries. Let's dive into some meaty, industry-specific use cases that showcase how AI can transform workflows and processes.

These digital teammates aren't just fancy data crunchers. They're like having a team of expert analysts working 24/7, uncovering patterns and insights that would take humans weeks or months to discover. And the best part? They're constantly learning and improving, adapting to new trends and consumer behaviors in real-time.

From retail to finance, healthcare to entertainment, AI agents are reshaping how businesses understand and respond to their customers. They're not just providing data - they're offering actionable intelligence that can drive strategy, improve products, and ultimately boost the bottom line.

But here's the kicker: the real power of these AI agents lies in their ability to personalize at scale. They can analyze millions of data points to create individual customer profiles, predicting behaviors and preferences with uncanny accuracy. This level of granularity was simply impossible before, and it's opening up entirely new possibilities for businesses to connect with their customers.

So, let's roll up our sleeves and explore how different industries are leveraging these AI powerhouses to gain a competitive edge and deliver value to their customers.

Retail: Decoding the Digital Shopper's Journey

The retail landscape is undergoing a seismic shift, and Customer Behavior Analysis AI Agents are at the forefront of this transformation. These digital teammates are redefining how retailers understand and engage with their customers in the e-commerce space.

Take the case of a major online fashion retailer. They deployed a Customer Behavior Analysis AI Agent to dissect the intricate web of user interactions on their platform. This AI doesn't just crunch numbers; it unravels the story behind each click, hover, and purchase.

The AI agent dives deep into the data ocean, surfacing insights that human analysts might miss. It identifies micro-segments of customers based on browsing patterns, purchase history, and even the time spent on product pages. For instance, it might uncover a cohort of night owls who browse luxury items after midnight but only purchase during lunch breaks.

But here's where it gets interesting. The AI doesn't stop at identification; it predicts future behavior. It might notice that customers who view more than five items in a specific category are 70% more likely to make a purchase within the next 48 hours. This insight allows the retailer to time their marketing efforts with surgical precision.

The AI agent also acts as a real-time style consultant. By analyzing a customer's past purchases, current browsing behavior, and trends among similar customers, it can suggest personalized outfits or accessories. This level of customization creates a shopping experience that feels tailored and intimate, despite being powered by algorithms.

Moreover, the AI's analysis extends to inventory management. By predicting demand based on customer behavior, it helps the retailer optimize stock levels, reducing both overstocking and stockouts. This not only improves operational efficiency but also enhances customer satisfaction by ensuring product availability.

The impact? A dramatic increase in conversion rates, customer loyalty, and average order value. The retailer saw a 35% boost in repeat purchases and a 28% increase in customer lifetime value within six months of deployment.

This isn't just about selling more stuff. It's about creating a shopping experience that resonates on a personal level with each customer. In the age of digital retail, understanding customer behavior at this granular level isn't just an advantage—it's a necessity for survival and growth.

Financial Services: Decoding Investor Behavior in the Digital Age

The financial services industry is experiencing a seismic shift, and Customer Behavior Analysis AI Agents are leading the charge. These digital teammates are redefining how investment firms understand and cater to their clients in the digital wealth management space.

Let's zoom in on a cutting-edge robo-advisor platform. They've deployed a Customer Behavior Analysis AI Agent that's not just crunching numbers, but unraveling the complex tapestry of investor psychology and behavior.

This AI digs deep into the data goldmine, unearthing insights that even seasoned financial advisors might overlook. It segments investors based on their risk tolerance, investment patterns, and even their reactions to market volatility. For instance, it might identify a group of millennials who consistently increase their investments during market dips, showing a contrarian investment strategy.

But here's where it gets fascinating. The AI doesn't just categorize; it predicts future actions. It might notice that investors who check their portfolio more than three times a day during a market downturn are 60% more likely to make impulsive selling decisions. This insight allows the platform to proactively reach out with calming market analysis or educational content, potentially preventing panic selling.

The AI agent also acts as a personalized investment coach. By analyzing an investor's past behavior, current portfolio, and trends among similar investors, it can suggest tailored investment strategies or new asset classes to explore. This level of customization creates an investing experience that feels bespoke and informed, despite being driven by algorithms.

Moreover, the AI's analysis extends to product development. By predicting demand based on investor behavior and market trends, it helps the platform develop new investment products or tweak existing ones. This not only improves the platform's offerings but also enhances investor satisfaction by providing products that truly meet their needs.

The results? A significant boost in investor retention, increased assets under management, and improved investor outcomes. The platform saw a 40% reduction in churn during market volatility and a 25% increase in average account size within a year of deployment.

This isn't just about managing more money. It's about creating an investing experience that resonates on a personal level with each client. In the age of digital wealth management, understanding investor behavior at this granular level isn't just a nice-to-have—it's the key to building trust, driving growth, and ultimately, helping investors achieve their financial goals.

Considerations

Technical Challenges

Implementing a Customer Behavior Analysis AI Agent isn't a walk in the park. It's more like trying to solve a Rubik's cube blindfolded while riding a unicycle. The first hurdle? Data quality and integration. Your AI is only as good as the data it feeds on, and most companies have data spread across more systems than they have flavors of La Croix.

Then there's the machine learning model itself. It needs to be sophisticated enough to detect nuanced patterns in customer behavior, but not so complex that it becomes a black box even its creators can't understand. It's a delicate balance, like trying to explain TikTok to your grandparents without making them feel old.

And let's not forget about scalability. Your AI needs to handle millions of data points in real-time without breaking a sweat. It's like expecting a hamster to run a marathon - possible, but requires some serious engineering.

Operational Challenges

On the operational side, things get even trickier. First up: the human factor. Your team needs to trust the AI's insights, which is about as easy as convincing a cat to take a bath. You'll need to invest in training and change management, or your fancy new AI will be about as useful as a chocolate teapot.

Then there's the ethical minefield of customer privacy. Your AI might be able to predict a customer's next move better than they can themselves, but that doesn't mean you should. It's a fine line between helpful and creepy, like the difference between a friendly neighbor and a stalker.

Lastly, there's the challenge of actionability. Great, your AI can tell you that Customer X is likely to churn in the next 30 days. But what are you going to do about it? Without a solid strategy to act on these insights, your AI is just an expensive fortune teller. You need to build workflows and processes that can turn these predictions into tangible actions, or you're just collecting digital dust.

Implementing a Customer Behavior Analysis AI Agent is no small feat. It's a complex dance of technology, strategy, and human psychology. But get it right, and you'll have a digital teammate that can transform your customer relationships. Just remember, like any good relationship, it takes work, patience, and a healthy dose of humility.

The Future of Customer Engagement: AI-Driven Insights

Customer Behavior Analysis AI Agents are not just a technological advancement; they're a paradigm shift in how businesses understand and engage with their customers. These digital teammates offer unprecedented insights, enabling companies to move from reactive to proactive strategies. However, implementing these AI agents comes with technical and operational challenges that businesses must navigate carefully.

The future of customer analysis lies in the symbiosis between human creativity and AI-driven insights. As these AI agents continue to evolve, they'll become increasingly integral to business strategy, customer experience, and innovation. Companies that successfully harness this technology will find themselves with a significant competitive edge, able to anticipate and meet customer needs with unprecedented precision and speed.

The key takeaway? Customer Behavior Analysis AI Agents aren't just tools; they're transformative forces that are reshaping the business landscape. As we move forward, the question won't be whether to adopt this technology, but how to leverage it most effectively to create value for both the business and its customers.