Financial Ratio Analysis AI Agents

The Fundamentals of Financial Ratio Analysis

What is Financial Ratio Analysis?

Financial ratio analysis is a critical tool used by investors, analysts, and business leaders to evaluate a company's financial health and performance. It involves calculating various ratios from financial statements to assess aspects like profitability, liquidity, efficiency, and solvency. These ratios provide a snapshot of a company's financial position and help in making informed decisions about investments, operations, and strategic planning.

Key Features of Financial Ratio Analysis

Financial ratio analysis offers several key features that make it indispensable in the financial world:1. Comparative Analysis: It allows for easy comparison between different companies or industries.2. Trend Identification: By analyzing ratios over time, it helps identify financial trends.3. Performance Evaluation: It provides metrics to assess a company's operational efficiency and financial health.4. Risk Assessment: Certain ratios help in evaluating a company's financial risk and stability.5. Decision Support: It aids in making informed decisions about investments, lending, and strategic planning.With AI agents now entering this domain, these features are being enhanced and expanded, offering deeper insights and more accurate predictions than ever before.

Benefits of AI Agents for Financial Ratio Analysis

What would have been used before AI Agents?

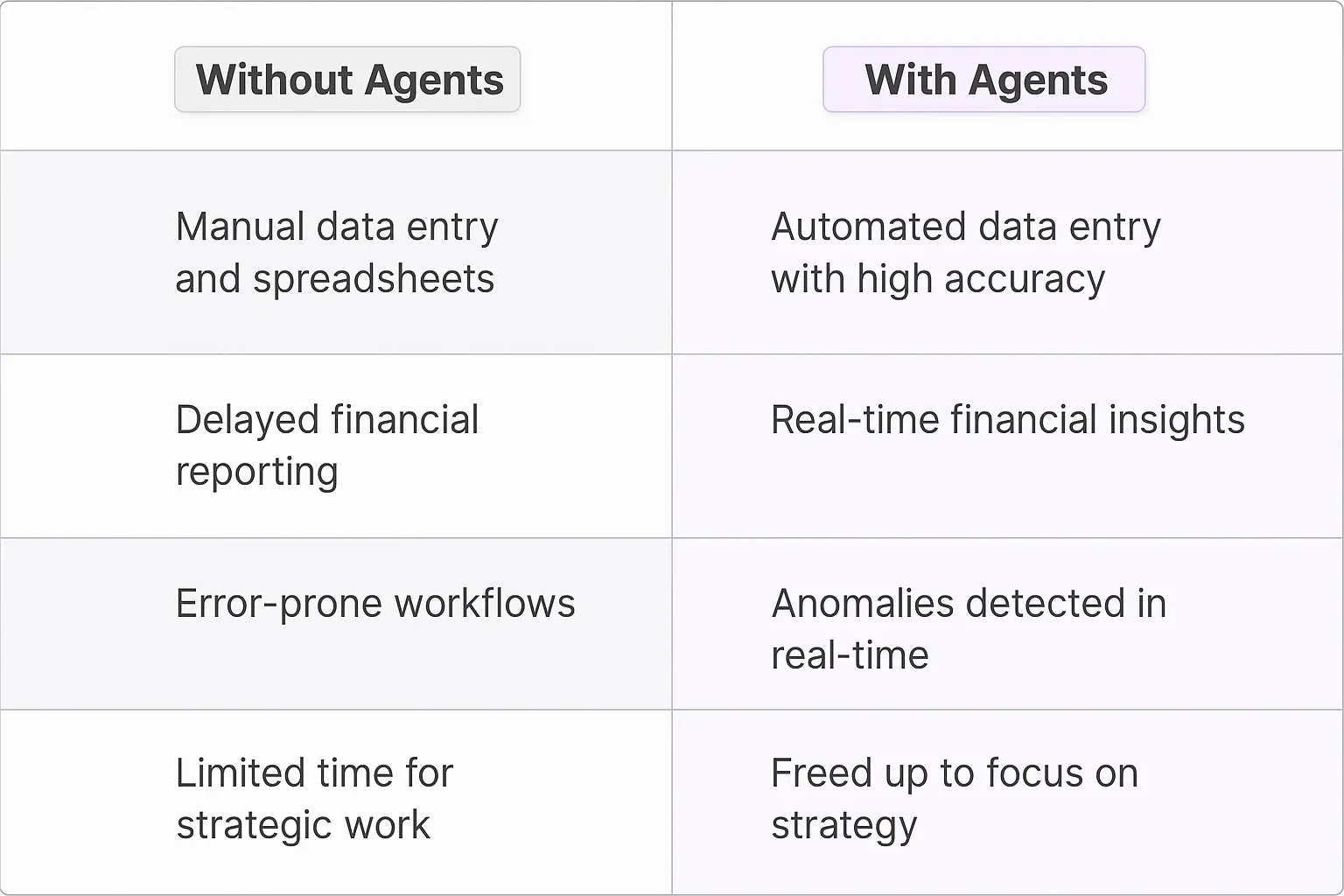

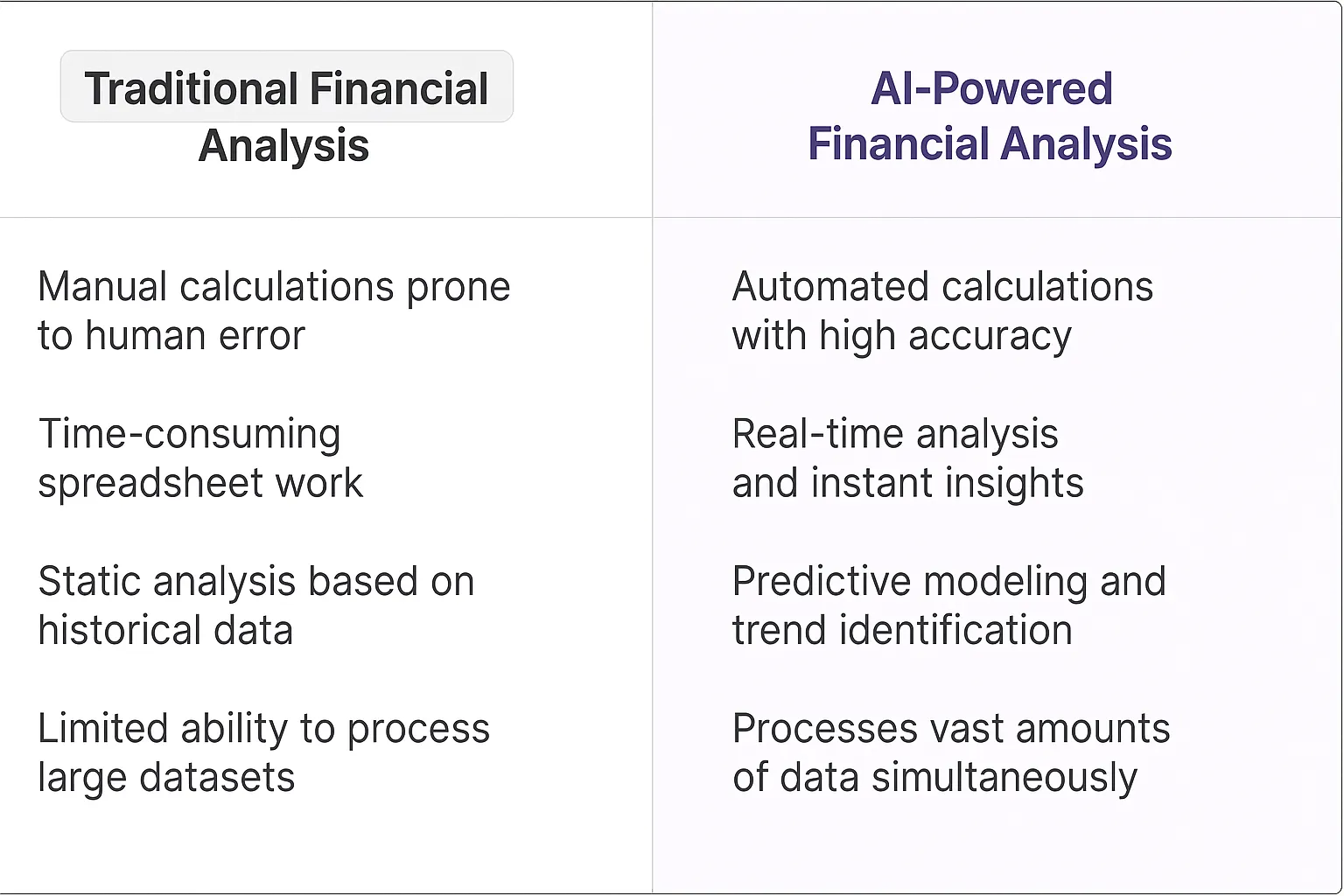

Before AI agents entered the scene, financial ratio analysis was a time-consuming, manual process. Financial analysts would spend hours poring over spreadsheets, crunching numbers, and cross-referencing data from multiple sources. They'd rely on static formulas and predefined models, often struggling to keep up with the sheer volume of financial data generated in today's markets.

This old-school approach had its limitations. It was prone to human error, lacked real-time insights, and couldn't easily adapt to new market conditions or company-specific nuances. Plus, it was a major bottleneck for decision-making in fast-moving financial environments.

What are the benefits of AI Agents?

AI agents are game-changers for financial ratio analysis. They're not just faster - they're smarter, more adaptable, and capable of processing vast amounts of data in ways humans simply can't match.

First off, AI agents can analyze financial ratios in real-time, continuously updating their insights as new data flows in. This means financial professionals can make decisions based on the most current information available, not last quarter's outdated reports.

But speed isn't everything. The real power of AI agents lies in their ability to uncover hidden patterns and correlations in financial data. They can identify subtle trends that human analysts might miss, providing a deeper, more nuanced understanding of a company's financial health.

AI agents also excel at contextualizing financial ratios. They can automatically factor in industry benchmarks, macroeconomic indicators, and company-specific variables to provide a more holistic analysis. This level of context-aware analysis was previously only possible with teams of experienced analysts and countless hours of work.

Another key benefit is the ability to generate predictive insights. AI agents can use historical data and current trends to forecast future financial ratios, helping companies anticipate potential issues or opportunities before they arise.

Lastly, AI agents democratize financial ratio analysis. They make sophisticated financial analysis accessible to a broader range of professionals, not just those with advanced degrees in finance. This democratization could lead to more informed decision-making across all levels of an organization.

In essence, AI agents are transforming financial ratio analysis from a backward-looking, time-intensive process into a forward-looking, strategic tool. They're not replacing human analysts, but rather augmenting their capabilities, allowing them to focus on higher-level strategy and decision-making. As these AI agents continue to evolve, we can expect even more profound impacts on how businesses understand and leverage their financial data.

Potential Use Cases of AI Agents for Financial Ratio Analysis

Processes

Financial ratio analysis is a critical process for investors, analysts, and business leaders. AI agents can transform this traditionally time-consuming task into a swift, insightful operation. These digital teammates excel at crunching numbers and spotting patterns, making them ideal for financial analysis.

An AI agent dedicated to financial ratio analysis could continuously monitor a company's financial statements, calculating key ratios in real-time. This ongoing process would provide up-to-the-minute insights, allowing for more agile decision-making. The AI could also compare these ratios against industry benchmarks, flagging any significant deviations that warrant human attention.

Another process where AI agents shine is in trend analysis. By examining historical financial data, these digital teammates can identify long-term trends in a company's financial health. They can spot subtle shifts in profitability, liquidity, or efficiency that might escape human notice, providing early warnings of potential issues or highlighting emerging strengths.

Tasks

When it comes to specific tasks, AI agents for financial ratio analysis are game-changers. They can swiftly calculate complex ratios like the Altman Z-score, which predicts the likelihood of bankruptcy, or the DuPont analysis, which breaks down return on equity into its component parts. These calculations, which might take a human analyst considerable time, can be performed by an AI agent in seconds.

Data visualization is another task where these digital teammates excel. They can generate clear, informative charts and graphs that illustrate financial ratios over time or compare them across different companies. This visual representation of data can make complex financial information more accessible to stakeholders who might not have a deep financial background.

AI agents can also automate the task of report generation. After analyzing financial ratios, they can compile comprehensive reports, highlighting key findings and potential areas of concern. These reports can be customized based on the specific needs of different stakeholders, whether it's a high-level summary for executives or a detailed analysis for the finance team.

In the world of financial ratio analysis, AI agents are not just number crunchers - they're insightful partners that can elevate the entire process. By handling the heavy lifting of calculations and data processing, they free up human analysts to focus on strategy and decision-making. This symbiosis between human expertise and AI capabilities is where the real magic happens in modern financial analysis.

Industry Use Cases: AI Agents in Financial Ratio Analysis

AI agents are reshaping how we approach financial ratio analysis, bringing a level of sophistication and speed that's transforming decision-making across sectors. These digital teammates aren't just crunching numbers; they're providing insights that can make or break investment strategies, M&A deals, and corporate financial health assessments.

Let's dive into some industry-specific scenarios where AI agents are proving their worth in financial ratio analysis. These examples aren't just theoretical - they're based on real-world applications that are already changing the game for financial professionals, investors, and business leaders.

From Wall Street to Silicon Valley, from Fortune 500 boardrooms to startup incubators, AI agents are becoming indispensable tools for anyone serious about understanding the financial DNA of a company or market. They're not replacing human expertise, but rather augmenting it, allowing professionals to focus on high-level strategy while the AI handles the heavy lifting of data analysis.

The following use cases demonstrate how AI agents are elevating financial ratio analysis from a time-consuming necessity to a strategic advantage. Whether you're a seasoned CFO or a budding entrepreneur, understanding these applications could give you a critical edge in your financial decision-making process.

Venture Capital: Turbocharging Deal Flow with Financial Ratio Analysis AI

In the high-stakes world of venture capital, time is money, and the ability to quickly assess a startup's financial health can make or break a deal. Enter Financial Ratio Analysis AI agents - the secret weapon that's quietly reshaping how VCs evaluate potential investments.

These digital teammates are like having a team of seasoned CFOs on speed dial, ready to crunch numbers 24/7. They're not just calculating ratios; they're uncovering patterns and insights that might take a human analyst days or weeks to spot.

Here's where it gets interesting: imagine a VC firm receiving hundreds of pitch decks daily. Traditionally, associates would spend hours poring over financial statements, often missing out on promising opportunities due to sheer volume. With Financial Ratio Analysis AI, they can instantly generate comprehensive reports on key metrics like burn rate, customer acquisition cost, and lifetime value.

But it's not just about speed. These AI agents are learning from every deal they analyze, developing an increasingly nuanced understanding of what financial profiles correlate with startup success in different sectors. They're becoming predictive powerhouses, flagging potential unicorns based on subtle financial indicators that human analysts might overlook.

The result? VCs can make faster, more informed decisions, potentially increasing their hit rate on successful investments. It's like having a financial crystal ball that gets clearer with every use.

This isn't just incremental improvement - it's a fundamental shift in how VCs operate. Firms leveraging these AI agents can evaluate a much larger deal flow, potentially uncovering hidden gems that competitors miss. In an industry where being first can mean the difference between a 10x and a 100x return, that's a game-changing advantage.

As these AI agents continue to evolve, they'll likely start incorporating more diverse data sources - social media sentiment, patent filings, team LinkedIn profiles - to provide an even more holistic view of a startup's potential. The future of VC might just be a perfect symbiosis of human intuition and AI-powered financial acumen.

Real Estate: Financial Ratio Analysis AI Redefines Property Investment

The real estate market is notoriously opaque, with deals often hinging on gut feelings and incomplete data. But that's changing fast, thanks to Financial Ratio Analysis AI agents that are bringing unprecedented clarity to property investments.

These digital teammates are like having a team of seasoned real estate analysts working around the clock, crunching numbers on everything from cap rates to debt service coverage ratios. They're not just spitting out basic metrics; they're uncovering hidden value and potential risks that even experienced investors might miss.

Think about a real estate investment firm evaluating dozens of properties across multiple markets. Traditionally, this would involve armies of analysts poring over spreadsheets, often leading to decision paralysis or missed opportunities. With Financial Ratio Analysis AI, they can instantly generate in-depth reports on key metrics like net operating income, return on investment, and occupancy rates across their entire portfolio.

But here's where it gets really interesting: these AI agents are learning from every property they analyze, developing an increasingly sophisticated understanding of what financial profiles correlate with successful investments in different markets and property types. They're becoming predictive powerhouses, flagging potential goldmines based on subtle financial indicators that human analysts might overlook.

The result? Real estate investors can make faster, more informed decisions, potentially increasing their ROI and reducing risk. It's like having a financial X-ray machine that gets more precise with every use.

This isn't just a minor upgrade - it's a fundamental shift in how real estate investment works. Firms leveraging these AI agents can evaluate a much larger number of properties, potentially uncovering hidden gems in overlooked markets. In an industry where information asymmetry has long been the norm, that's a massive competitive advantage.

As these AI agents evolve, they'll likely start incorporating more diverse data sources - local economic indicators, zoning changes, demographic shifts - to provide an even more comprehensive view of a property's potential. The future of real estate investment might just be a perfect blend of human intuition and AI-powered financial analysis.

Considerations

Technical Challenges

Building a Financial Ratio Analysis AI Agent isn't just about slapping some algorithms together and calling it a day. It's a complex beast that requires serious technical chops and a deep understanding of both finance and machine learning.

First off, data quality is a massive hurdle. Financial data is often messy, inconsistent, and spread across multiple sources. Your AI needs to be smart enough to clean, normalize, and make sense of this data jungle. It's like trying to build a skyscraper on quicksand – if your foundation (data) isn't solid, the whole thing comes crashing down.

Then there's the challenge of keeping up with the ever-changing financial landscape. Accounting standards evolve, new financial instruments emerge, and market conditions shift. Your AI needs to be flexible enough to adapt to these changes without breaking. It's not just about building a static model; it's about creating a living, breathing system that can learn and evolve.

Accuracy is another beast altogether. In the world of finance, even small errors can lead to catastrophic consequences. Your AI needs to be precise, consistent, and reliable. This means implementing robust error-checking mechanisms, continuous validation processes, and maybe even some form of explainable AI to help users understand how the system arrives at its conclusions.

Operational Challenges

On the operational side, integrating a Financial Ratio Analysis AI Agent into existing workflows is like trying to perform heart surgery while the patient is running a marathon. It's tricky, to say the least.

First, you've got the human factor. Financial analysts and decision-makers who've been doing things their way for years might view this AI as a threat rather than a tool. You need to focus on change management, providing training, and demonstrating clear value to overcome this resistance.

Then there's the issue of trust. Finance is all about confidence, and asking people to trust an AI with critical financial decisions is a tall order. You need to build in transparency, provide clear audit trails, and possibly implement a human-in-the-loop system for critical decisions.

Compliance and regulatory issues are another minefield. Different jurisdictions have different rules about automated financial analysis and decision-making. Your AI needs to be compliant across all relevant regulations, which is no small feat given the global nature of finance today.

Lastly, there's the challenge of continuous improvement. Finance doesn't stand still, and neither should your AI. You need systems in place to continuously monitor performance, gather feedback, and iterate on your models. It's not a "set it and forget it" situation – it's more like tending to a high-maintenance garden that's constantly trying to evolve into new species.

In the end, implementing a Financial Ratio Analysis AI Agent is a journey, not a destination. It requires a perfect blend of technical prowess, domain expertise, and operational finesse. But get it right, and you've got a powerful tool that can transform financial analysis as we know it.

The Future of Finance: AI Agents Revolutionizing Financial Ratio Analysis

The integration of AI agents into financial ratio analysis marks a pivotal shift in how we approach financial decision-making. These digital teammates are not just tools; they're game-changers that are reshaping the financial landscape. By automating complex calculations, uncovering hidden patterns, and providing real-time insights, AI agents are elevating financial analysis from a backward-looking process to a forward-thinking, strategic asset.

However, the journey isn't without its challenges. From technical hurdles like data quality and model accuracy to operational issues like user adoption and regulatory compliance, implementing AI agents in financial ratio analysis requires a delicate balance of innovation and pragmatism.

Despite these challenges, the potential benefits are too significant to ignore. AI agents are democratizing sophisticated financial analysis, making it accessible to a broader range of financial professionals and potentially leading to more informed decision-making across all levels of an organization.

As we look to the future, it's clear that AI agents will play an increasingly crucial role in financial ratio analysis. They won't replace human expertise, but rather augment it, allowing financial professionals to focus on high-level strategy while the AI handles the heavy lifting of data analysis. This symbiosis between human intuition and AI-powered insights is where the real magic happens, potentially unlocking new levels of financial acumen and market understanding.

In the end, those who successfully navigate the implementation of AI agents in financial ratio analysis will likely find themselves with a powerful competitive advantage. As these technologies continue to evolve, we can expect even more profound impacts on how businesses understand, leverage, and act upon their financial data. The future of finance is here, and it's powered by AI.