Due Diligence Process Automation AI Agents AI Agents

Unveiling the Power of AI-Driven Due Diligence

What is Due Diligence Process Automation?

Due diligence process automation is the use of advanced technologies, particularly AI agents, to streamline and enhance the comprehensive investigation of a business or investment opportunity. It's like giving your due diligence team a set of superpowers. These AI-powered tools can sift through mountains of data, spot patterns, and generate insights at superhuman speeds. They're not replacing human expertise, but rather augmenting it, allowing professionals to focus on strategic decision-making instead of drowning in spreadsheets.

Key Features of Due Diligence Process Automation

The secret sauce of due diligence process automation lies in its key features. First, there's the ability to process and analyze vast amounts of unstructured data - think contracts, financial statements, and market reports - in record time. Then there's the pattern recognition capability, which can flag potential risks or opportunities that might slip past human analysts. Add in machine learning algorithms that continuously improve their accuracy, and you've got a system that gets smarter with every deal it analyzes. Finally, there's the integration with existing workflows, allowing for seamless collaboration between AI agents and human experts. It's like having a tireless, hyper-intelligent intern who works 24/7 and never asks for a raise.

Benefits of AI Agents for Due Diligence Process Automation

What would have been used before AI Agents?

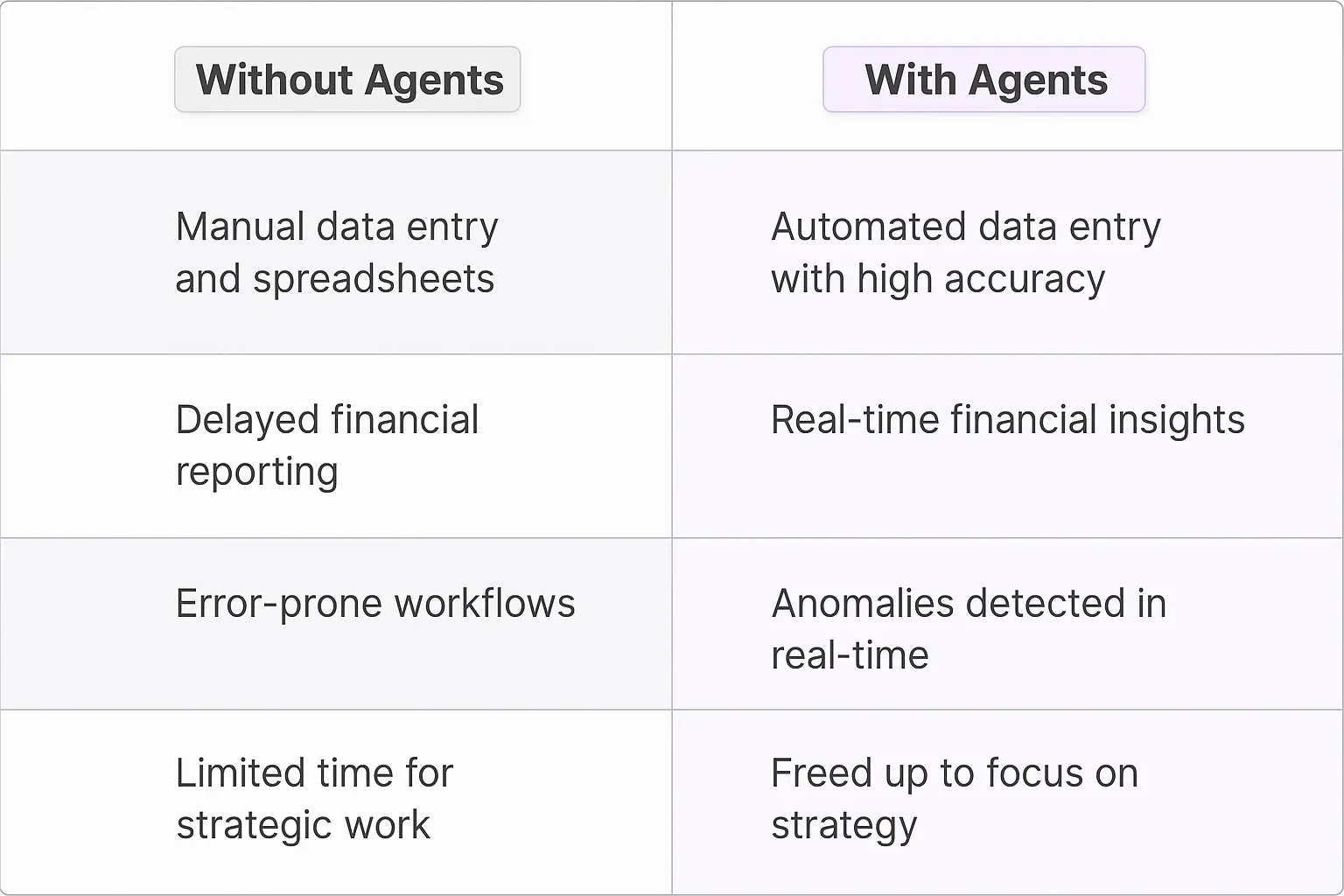

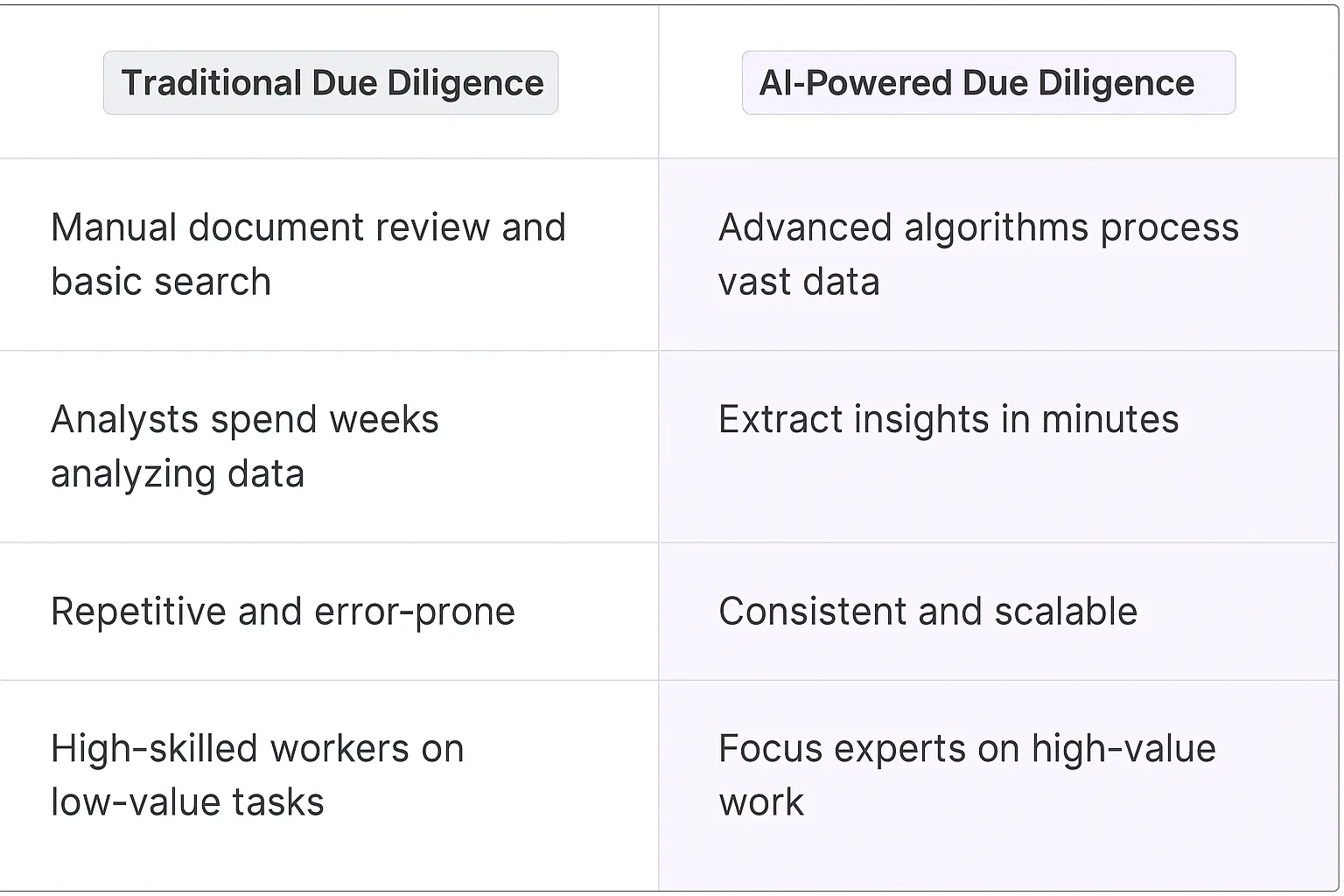

Before AI agents entered the scene, due diligence was a painstaking process that relied heavily on human labor and traditional software tools. Teams of analysts would spend countless hours poring over documents, spreadsheets, and databases. They'd use a combination of manual review, basic search functions, and rudimentary data analysis tools to extract and synthesize information.

This approach was not only time-consuming but also prone to human error. Analysts could easily miss critical details buried in mountains of data. The process was also highly repetitive, with teams often reinventing the wheel for each new due diligence project. It was a classic case of high-skilled knowledge workers spending too much time on low-value tasks.

What are the benefits of AI Agents?

AI agents are game-changers for due diligence. They're like having a team of tireless, hyper-intelligent interns who never sleep and can process information at superhuman speeds. But that's just scratching the surface.

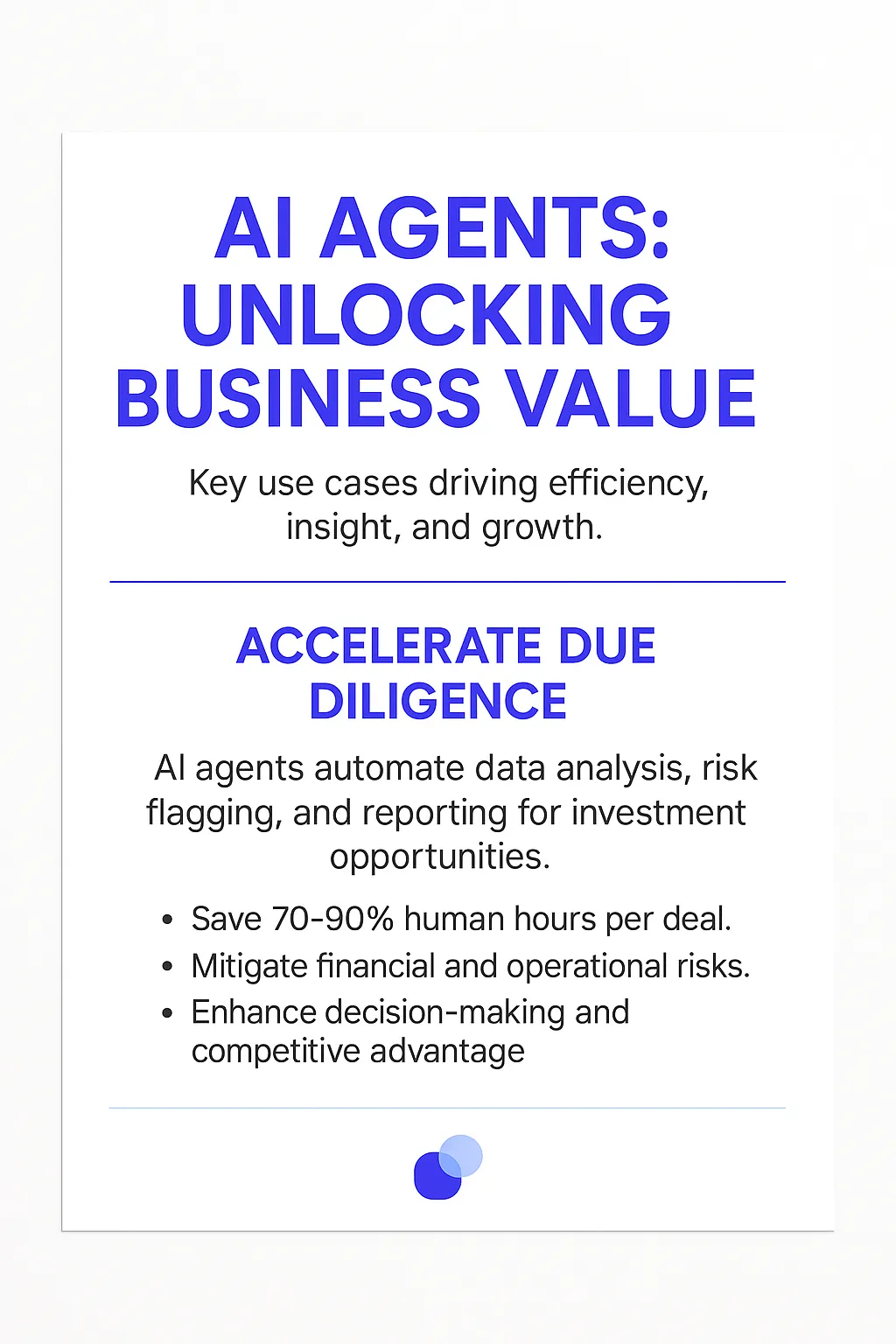

First, AI agents dramatically accelerate the due diligence process. They can sift through vast amounts of data in minutes, not weeks. This speed allows dealmakers to move faster and potentially close more deals in less time. It's not just about speed though - it's about depth. AI agents can uncover patterns and insights that humans might miss, potentially flagging risks or opportunities that could make or break a deal.

Second, AI agents bring consistency and scalability to due diligence. They apply the same rigorous analysis to every document, every time. This consistency reduces the risk of oversight and ensures that no stone is left unturned. As deal volumes increase, AI agents can scale effortlessly, unlike human teams that might struggle with increased workload.

Third, AI agents free up human experts to focus on high-value tasks. Instead of spending hours on data gathering and initial analysis, analysts can devote more time to strategic thinking, relationship building, and complex decision-making. This shift in focus can lead to better deals and more satisfied clients.

Finally, AI agents can learn and improve over time. As they process more deals, they become smarter and more efficient. They can start to recognize industry-specific patterns and nuances, making their analysis increasingly sophisticated. This continuous improvement means that the value of AI agents in due diligence will only grow over time.

In essence, AI agents are transforming due diligence from a necessary evil into a strategic advantage. They're not just tools; they're digital teammates that augment human capabilities in ways we're only beginning to fully appreciate. As these agents continue to evolve, they'll likely become as indispensable to dealmakers as spreadsheets and data rooms are today.

Potential Use Cases of AI Agents with Due Diligence Process Automation

Processes

Due diligence is a beast of a process, often involving mountains of data, complex financial models, and countless hours of human analysis. Enter AI agents - these digital teammates are poised to transform how we approach due diligence, making it faster, more accurate, and dare I say it, less soul-crushing for the analysts involved.

One key process where AI agents shine is in document analysis. They can plow through thousands of pages of contracts, financial statements, and legal documents in a fraction of the time it would take a human team. But it's not just about speed - these AI agents can spot patterns, inconsistencies, and red flags that might slip past even the most eagle-eyed analyst at 2 AM on their fourth cup of coffee.

Another process ripe for AI intervention is risk assessment. By analyzing historical data and market trends, AI agents can provide a more nuanced and comprehensive risk profile. They're not replacing human judgment, but rather augmenting it with data-driven insights that might not be immediately apparent to the naked eye.

Tasks

When it comes to specific tasks, AI agents are like Swiss Army knives for due diligence. They can tackle everything from financial modeling to competitor analysis with impressive dexterity.

Take financial statement analysis, for instance. AI agents can crunch numbers faster than you can say "EBITDA," identifying trends, anomalies, and potential areas of concern. They can even generate preliminary valuation models, giving analysts a solid starting point for their own assessments.

Another task where AI agents excel is in market research and competitive intelligence. They can scrape and analyze vast amounts of public data, from social media sentiment to patent filings, providing a comprehensive view of the competitive landscape. This isn't just about gathering information - it's about synthesizing it into actionable insights that can inform strategic decisions.

Compliance checking is another area where AI agents can save countless hours and headaches. They can cross-reference company practices against relevant regulations, flagging potential issues and ensuring nothing falls through the cracks. In an era of increasing regulatory scrutiny, this capability is worth its weight in gold (or bitcoin, if that's more your speed).

Lastly, AI agents can be invaluable in scenario modeling. By running countless simulations based on different variables, they can help teams anticipate potential outcomes and prepare for a range of scenarios. It's like having a crystal ball, except it's powered by algorithms instead of mystical energy.

The bottom line? AI agents are not just tools - they're game-changers in the due diligence process. They're enabling teams to work smarter, faster, and with greater confidence. And in a world where time is money and information is power, that's a competitive advantage you can't afford to ignore.

Industry Use Cases: AI Agents in Due Diligence

The due diligence process is ripe for disruption, and AI agents are the perfect catalysts. These digital teammates aren't just fancy chatbots; they're sophisticated tools that can sift through mountains of data, spot patterns, and provide insights that even seasoned professionals might miss. Let's dive into some industry-specific scenarios where AI agents are transforming due diligence from a necessary evil into a strategic advantage.

From finance to real estate, and from mergers and acquisitions to regulatory compliance, AI agents are proving their worth by automating tedious tasks, reducing human error, and uncovering hidden risks and opportunities. They're not replacing human expertise, but rather augmenting it, allowing professionals to focus on high-level strategy and decision-making.

In the following examples, we'll explore how AI agents are reshaping due diligence across various sectors, demonstrating their ability to handle complex, data-intensive tasks with speed and precision that was previously unimaginable. These use cases aren't just theoretical - they're happening right now, and they're changing the game for businesses that are bold enough to embrace the future of due diligence.

Fintech: Automating Due Diligence for Venture Capital Firms

Let's dive into how AI agents are reshaping due diligence in venture capital. These digital teammates are becoming indispensable for VCs drowning in deal flow and struggling to separate signal from noise.

Picture a VC firm evaluating 1,000+ startups annually. Traditionally, associates would spend countless hours scouring financial statements, market reports, and founder backgrounds. Now, AI agents can digest this information in minutes, flagging potential red flags and highlighting promising metrics.

But it goes deeper. These AI agents aren't just processing data; they're learning patterns. They can identify subtle indicators of future unicorns based on historical data of successful exits. They're spotting market trends before they become obvious, giving VCs a crucial edge in competitive deals.

The real game-changer? These AI agents are augmenting human decision-making, not replacing it. They're freeing up partners to focus on what truly matters: building relationships with founders and adding strategic value to portfolio companies.

This shift is creating a new breed of VC firms - ones that blend the best of human intuition with AI-powered insights. The firms that master this integration will likely see outsized returns in the coming years, as they're able to move faster, make more informed decisions, and support a larger portfolio of companies.

The ripple effects are significant. As VCs become more efficient, we might see an acceleration in the pace of innovation across the tech ecosystem. Founders could potentially access capital faster, and investors might be able to take more calculated risks on moonshot ideas.

Of course, there are challenges. VCs will need to ensure their AI agents don't introduce bias or overlook the human elements that often make or break a startup. But for firms willing to embrace this technology, the potential upside is enormous.

Real Estate: Transforming Property Acquisition Due Diligence

The real estate industry is ripe for disruption, and AI agents are leading the charge in revolutionizing due diligence for property acquisitions. This shift is particularly impactful for large-scale investors and REITs dealing with complex, multi-million dollar transactions.

Traditional due diligence in real estate is a nightmare of paperwork, site visits, and endless phone calls. It's slow, prone to human error, and often misses critical details. Enter AI agents, and suddenly we're playing a whole new ballgame.

These digital teammates can plow through thousands of pages of property documents, zoning laws, and financial records in minutes. They're cross-referencing data from multiple sources, spotting discrepancies that human eyes might miss. Think about the implications: no more nasty surprises after closing, no more deals falling through at the eleventh hour due to overlooked details.

But here's where it gets really interesting. These AI agents aren't just processing information - they're learning and predicting. They can analyze historical property data, local market trends, and even social media sentiment to forecast potential property value appreciation. They're essentially giving investors a crystal ball, helping them spot tomorrow's hot neighborhoods before they blow up.

The real power move? Combining AI insights with human expertise. Seasoned real estate pros can now focus on relationship building, creative deal structuring, and strategic decision-making. They're no longer bogged down by the grunt work of due diligence.

This shift is creating a new breed of real estate investors - tech-savvy, data-driven, and lightning-fast. They're able to evaluate more properties, move on deals quicker, and manage larger portfolios with smaller teams. It's a competitive advantage that's hard to overstate.

The ripple effects are huge. We might see more liquidity in real estate markets as transaction speeds increase. Smaller investors could gain access to institutional-grade due diligence tools, leveling the playing field. And as the process becomes more efficient, we could see downward pressure on transaction costs.

Of course, there are hurdles. The real estate industry is notoriously slow to adopt new tech. There's also the challenge of integrating AI insights with the "gut feel" that many successful real estate investors rely on. But for those who can navigate these challenges, the potential upside is massive.

We're looking at a future where AI-powered due diligence becomes the norm, not the exception. The winners in this new landscape will be those who can best harness the power of these digital teammates, blending AI insights with human judgment to make smarter, faster, and more profitable real estate decisions.

Considerations

Technical Challenges

Implementing a due diligence process automation AI agent isn't a walk in the park. It's more like trying to teach a robot to navigate a maze while blindfolded. The first hurdle? Data integration. We're talking about connecting disparate systems, each with its own quirks and data formats. It's like trying to get a group of cats to march in formation.

Then there's the issue of accuracy. AI models are only as good as the data they're trained on. If your training data is biased or incomplete, your AI agent might end up making decisions that are about as reliable as a weather forecast in San Francisco. And let's not forget about the constant need for model updates. The financial landscape is always shifting, and your AI needs to keep up or risk becoming as outdated as a flip phone.

Security is another beast altogether. We're dealing with sensitive financial data here, folks. One slip-up, and you might as well hand over your company's secrets to the highest bidder. Implementing robust encryption and access controls isn't just a nice-to-have, it's a must-have.

Operational Challenges

On the operational side, we're looking at a whole different set of headaches. First up: change management. Trying to get your team to adopt a new AI system can be like trying to convince a group of die-hard PC users to switch to Mac. There's going to be resistance, and you need a solid plan to overcome it.

Then there's the question of human oversight. Sure, AI can crunch numbers faster than a roomful of accountants, but it can't replace human judgment entirely. You need to strike a balance between automation and human intervention. It's like teaching a self-driving car when to hand over control to the human driver.

Let's not forget about regulatory compliance. The financial industry is more regulated than a nuclear power plant. Your AI agent needs to not only understand these regulations but also adapt as they change. It's like trying to hit a moving target while riding a unicycle.

Finally, there's the cost factor. Implementing an AI system isn't cheap. It's an investment that requires significant upfront capital and ongoing maintenance costs. You need to be prepared for a long-term commitment, not a quick fix. It's like adopting a high-maintenance pet - rewarding, but demanding.

In the end, implementing a due diligence process automation AI agent is a complex endeavor. But for those who can navigate these challenges, the potential rewards are substantial. It's not about replacing humans, but augmenting their capabilities, allowing them to focus on higher-value tasks. And in the cutthroat world of finance, that kind of edge can make all the difference.

The Future of Finance: Augmented Intelligence in Due Diligence

Due diligence process automation powered by AI agents is more than just a fancy tech upgrade - it's a game-changer for the financial industry. These digital teammates are redefining what's possible in terms of speed, accuracy, and depth of analysis. They're not just crunching numbers faster; they're uncovering insights and patterns that can make or break deals. But here's the kicker: the real power comes from combining AI capabilities with human expertise. It's this symbiosis that's creating a new breed of financial professionals - ones who can leverage AI to make smarter, faster decisions while focusing their human intelligence on strategy and relationship-building. As these technologies continue to evolve, we're likely to see a widening gap between firms that embrace AI-powered due diligence and those that don't. The future of finance isn't just automated - it's augmented. And those who can harness this augmentation effectively will be the ones writing the rules of the game.