Financial Statement Preparation AI Agents

The Evolution of Financial Reporting with AI

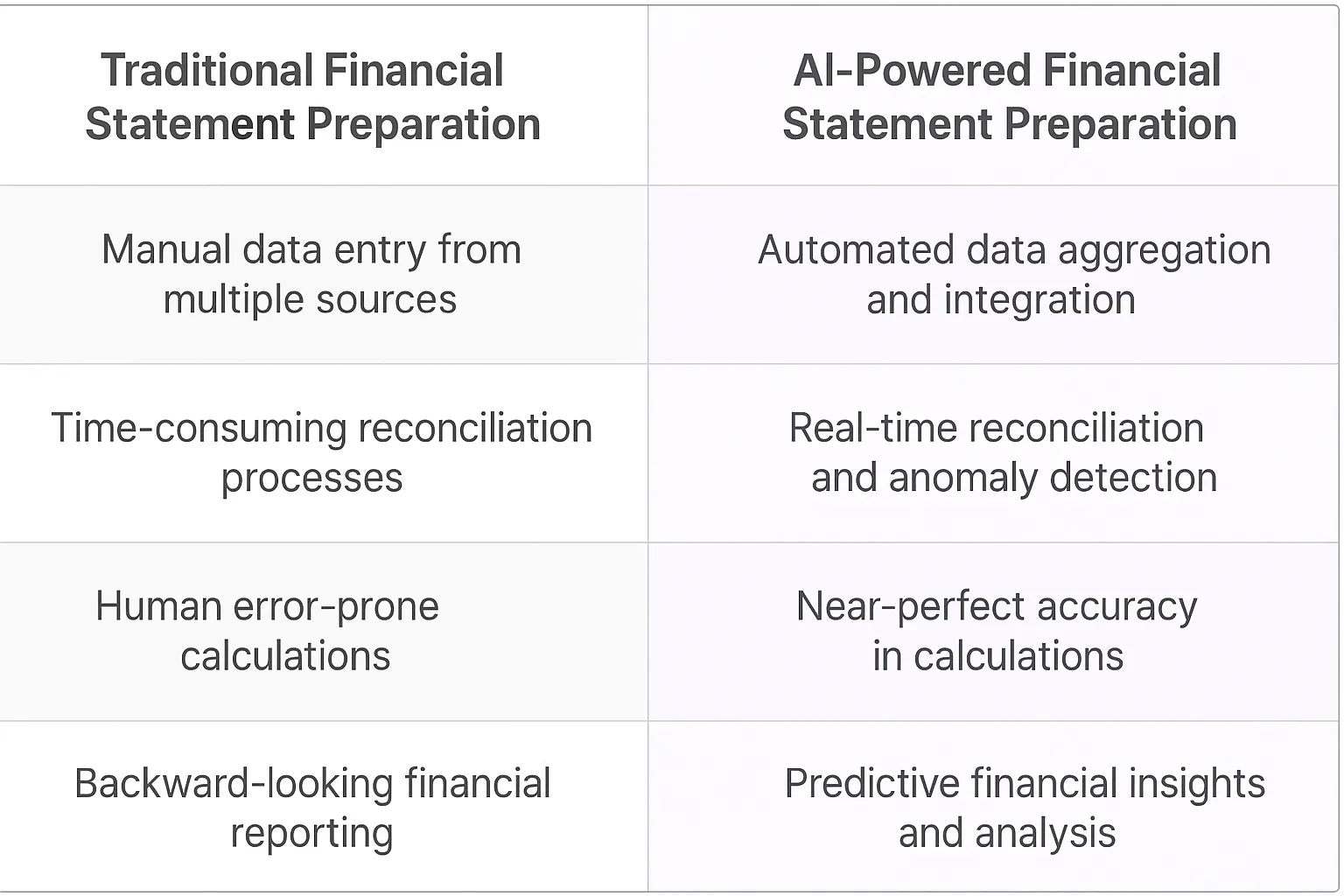

Financial statement preparation is the process of compiling, analyzing, and presenting a company's financial data in standardized formats. It's the backbone of financial reporting, providing a snapshot of a company's financial health through documents like balance sheets, income statements, and cash flow statements. Traditionally, this process has been labor-intensive, requiring meticulous attention to detail and a deep understanding of accounting principles.

The key features of financial statement preparation include data aggregation from various sources, reconciliation of accounts, application of accounting standards, and creation of standardized reports. It also involves ensuring compliance with regulatory requirements, performing financial analysis, and providing insights for decision-making. With the introduction of AI agents, these features are being enhanced and automated, leading to faster, more accurate, and more insightful financial reporting.

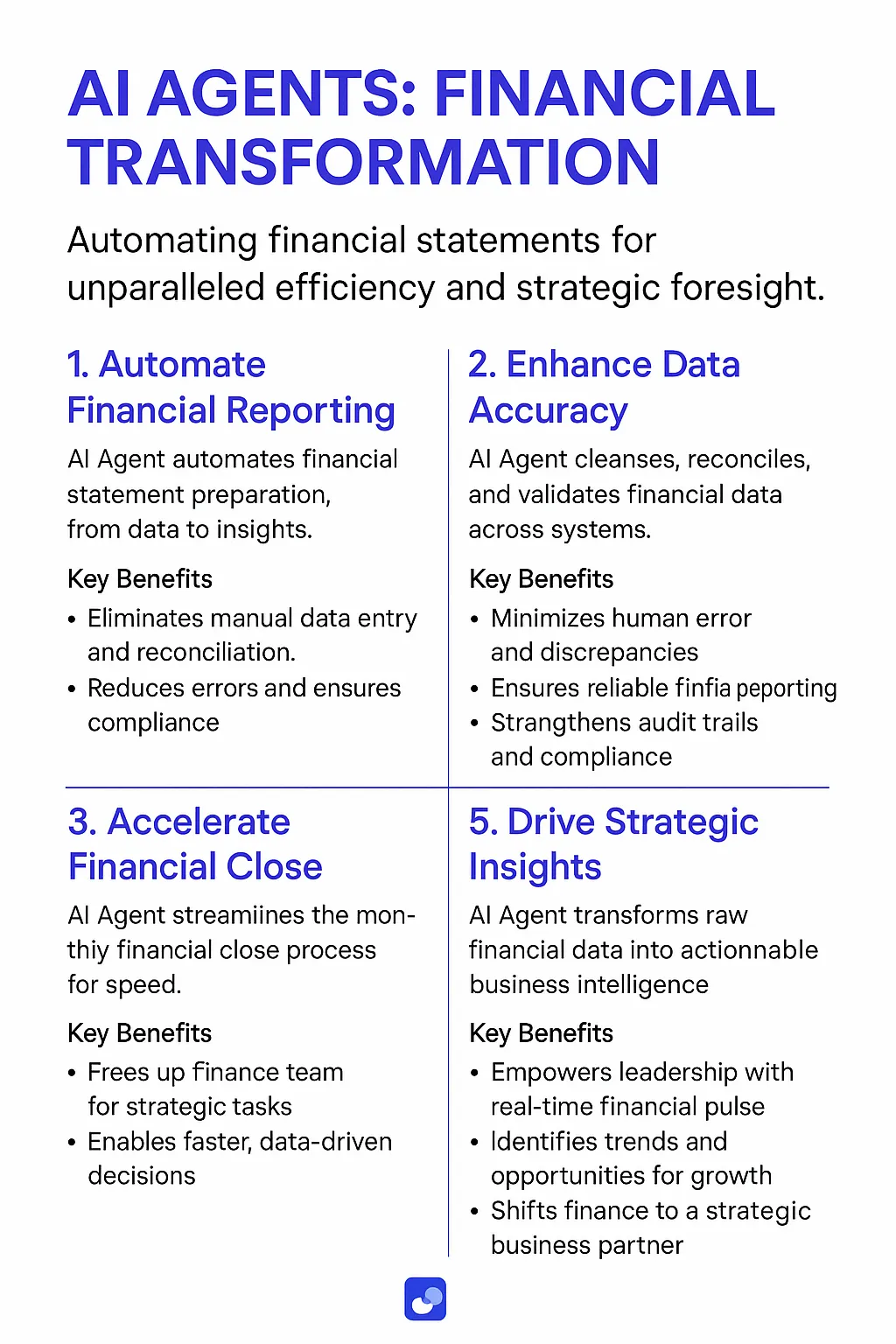

Benefits of AI Agents for Financial Statement Preparation

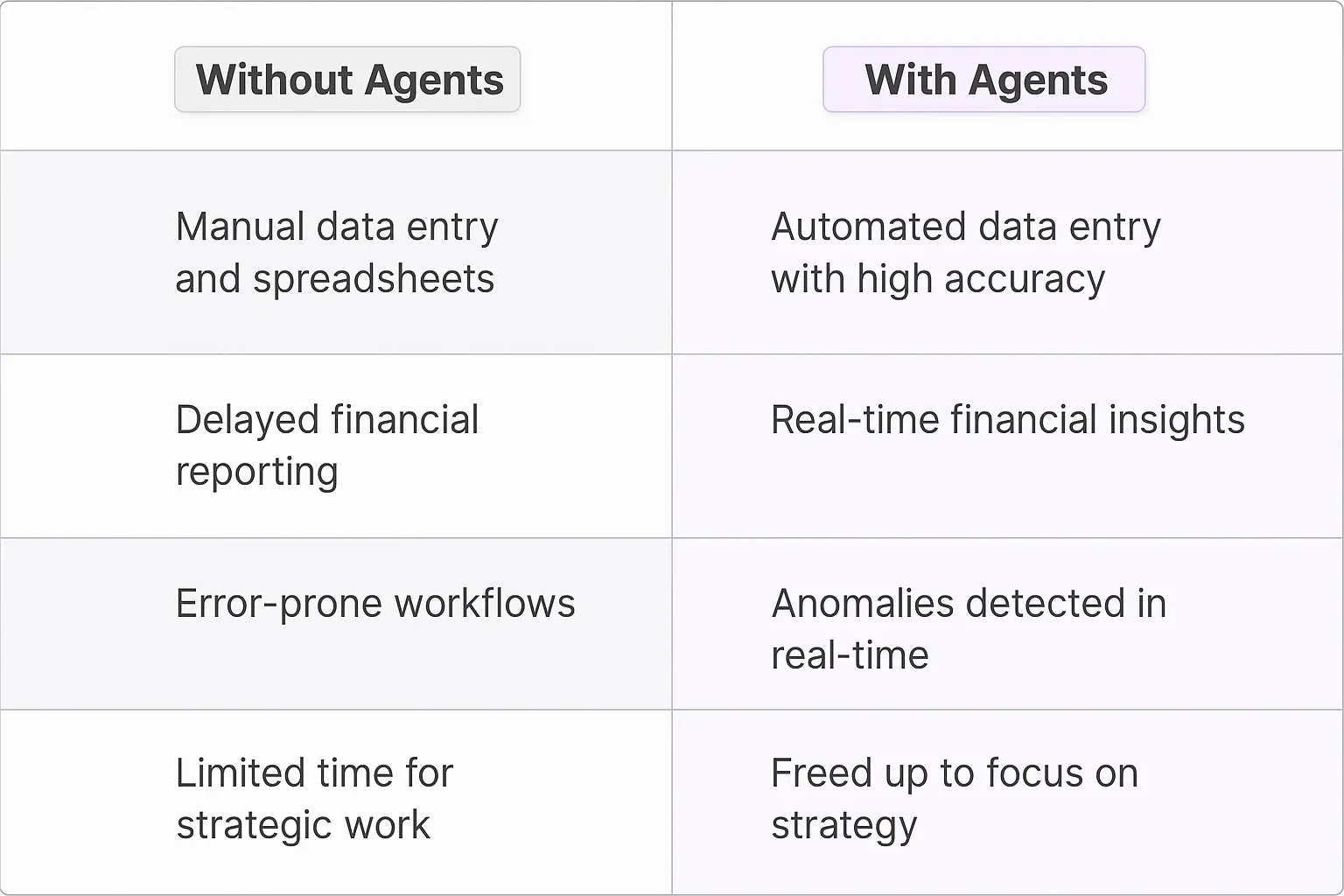

What would have been used before AI Agents?

Before AI agents entered the scene, financial statement preparation was a grueling process. Finance teams relied on a mix of spreadsheets, legacy accounting software, and manual data entry. It was like trying to build a skyscraper with a hammer and nails – possible, but painfully slow and error-prone.

Accountants spent countless hours reconciling accounts, hunting down discrepancies, and triple-checking figures. The process was not only time-consuming but also left ample room for human error. It was a world where the month-end close felt like an endless uphill battle, leaving little time for strategic financial analysis.

What are the benefits of AI Agents?

Enter AI agents for financial statement preparation – they're like having a team of tireless, hyper-accurate financial wizards at your fingertips. These digital teammates are transforming the landscape of financial reporting in ways that would make even the most seasoned CFO's jaw drop.

First off, AI agents slash the time required for statement preparation. They can process vast amounts of financial data in seconds, performing reconciliations and identifying anomalies faster than you can say "balance sheet." This speed isn't just about efficiency; it's about freeing up your finance team to focus on what really matters – strategic financial planning and analysis.

Accuracy is where these AI agents really flex their muscles. They're not just fast; they're practically infallible when it comes to calculations and data consistency. Say goodbye to those heart-stopping moments when you discover a formula error in your spreadsheet the night before a board meeting.

But here's where it gets really interesting: AI agents are learning machines. They don't just follow rules; they identify patterns and trends in your financial data that might take humans years to spot. This predictive capability is like having a financial crystal ball, offering insights that can drive better business decisions.

Moreover, these digital teammates adapt to your company's unique financial DNA. They learn your specific accounting practices, industry standards, and reporting preferences. It's like having a seasoned accountant who's been with your company for decades, but one who never sleeps, never takes a vacation, and never misses a beat.

The compliance angle is huge too. AI agents stay up-to-date with the latest financial regulations and reporting standards. They ensure your statements are always in line with GAAP, IFRS, or whatever alphabet soup of standards you need to adhere to. It's like having a regulatory expert on call 24/7.

Lastly, let's talk about scalability. As your business grows, your AI agents grow with you. They can handle increasing complexity and volume without breaking a sweat. Whether you're a startup or a multinational corporation, these digital teammates flex to meet your needs.

In essence, AI agents for financial statement preparation aren't just tools; they're game-changers. They're rewriting the rules of financial reporting, giving companies of all sizes access to capabilities that were once the domain of only the biggest players. It's not just about doing things faster or more accurately – it's about elevating the entire finance function to new heights of strategic value.

Potential Use Cases of AI Agents for Financial Statement Preparation

Processes

Financial statement preparation is a critical yet often time-consuming process for businesses. AI agents are poised to transform this landscape, offering a blend of efficiency and accuracy that human accountants can leverage to elevate their strategic value. Let's dive into some game-changing use cases:

- Data aggregation and reconciliation: AI agents can pull financial data from various sources, reconcile discrepancies, and organize information in a structured format, reducing manual data entry errors and saving countless hours.

- Automated journal entries: These digital teammates can analyze transactions and suggest or even create appropriate journal entries, ensuring consistency and adherence to accounting standards.

- Financial ratio analysis: AI agents can calculate and interpret key financial ratios, providing instant insights into a company's financial health and performance trends.

- Compliance checks: They can review financial statements against relevant accounting standards and regulations, flagging potential compliance issues for human review.

- Variance analysis: AI agents can compare actual financial results with budgets or forecasts, highlighting significant variances and suggesting potential explanations.

Tasks

Breaking down the financial statement preparation process, AI agents can tackle specific tasks with remarkable precision:

- Balance sheet reconciliation: Automatically cross-check account balances, identify discrepancies, and suggest adjusting entries.

- Income statement categorization: Classify revenue and expense items accurately, ensuring proper representation of the company's financial performance.

- Cash flow statement generation: Analyze cash inflows and outflows, categorizing them into operating, investing, and financing activities.

- Footnote drafting: Generate initial drafts of financial statement footnotes based on transaction data and company policies.

- Intercompany transaction elimination: For consolidated financial statements, AI agents can identify and propose eliminations for intercompany transactions.

- Audit trail documentation: Create detailed audit trails of all adjustments and decisions made during the financial statement preparation process.

The integration of AI agents in financial statement preparation isn't about replacing human expertise—it's about augmenting it. By offloading routine tasks to these digital teammates, financial professionals can focus on higher-value activities like strategic analysis and decision-making. This shift not only improves accuracy and efficiency but also transforms the role of finance teams from number crunchers to strategic partners in business growth.

As we move forward, the synergy between human insight and AI capabilities will redefine financial reporting, making it more dynamic, insightful, and aligned with the pace of modern business. The question isn't whether AI will impact financial statement preparation, but how quickly finance teams will adapt to harness its full potential.

Industry Use Cases

AI agents are reshaping financial statement preparation across diverse sectors, each with its unique challenges and opportunities. These digital teammates are not just number crunchers; they're becoming indispensable partners in financial reporting. Let's dive into some industry-specific scenarios where AI is making waves in financial statement prep:

From tech startups to multinational conglomerates, AI is transforming how financial data is processed, analyzed, and presented. These use cases demonstrate the tangible impact of AI on accuracy, efficiency, and strategic decision-making in financial reporting. As we explore each industry, you'll see how AI agents are becoming the secret weapon for finance teams looking to stay ahead in an increasingly complex financial landscape.

Retail's Financial Revolution: AI-Powered Statement Prep

The retail industry is ripe for a financial makeover, and AI-powered financial statement preparation is the game-changer we've been waiting for. Think about it: retailers deal with a tsunami of transactions daily, from in-store purchases to online orders, returns, and supplier payments. It's a financial data deluge that would make even the most seasoned accountant's head spin.

Enter the Financial Statement Preparation AI Agent. This digital teammate isn't just crunching numbers; it's rewriting the retail financial playbook. Here's the kicker: it can ingest raw transaction data from multiple sources - point-of-sale systems, e-commerce platforms, inventory management tools - and synthesize it into coherent financial statements in real-time.

But that's just the beginning. The AI doesn't stop at statement preparation. It's constantly learning, identifying patterns, and flagging anomalies. Sudden spike in returns from a particular product line? The AI spots it before it becomes a financial drain. Unexpected surge in sales from a new marketing campaign? The AI quantifies its impact on the bottom line instantly.

For retail CFOs, this is like having a financial crystal ball. They're no longer reacting to last quarter's numbers; they're steering the ship with up-to-the-minute financial insights. Inventory decisions, pricing strategies, and expansion plans are now backed by razor-sharp financial intelligence.

The ripple effects are massive. Smaller retailers can now compete with the big boys, leveraging AI to manage their finances with Fortune 500-level sophistication. Larger chains can optimize operations across hundreds of locations, each with its unique financial fingerprint.

This isn't just about saving time or reducing errors. It's about unlocking a new level of financial agility in an industry where margins are tight and competition is fierce. The retailers who embrace this AI-driven financial revolution won't just survive; they'll thrive, armed with financial insights that were once the stuff of retail fantasy.

Construction's Financial Blueprint: AI Reshapes the Books

The construction industry is about to experience a seismic shift in financial management, and AI-powered statement prep is the wrecking ball that's going to demolish old practices. Let's face it: construction finance is a beast. You've got long-term projects, progress billings, retainage, change orders, and a labyrinth of subcontractor payments. It's a financial Rubik's cube that's been giving CFOs migraines for decades.

Now, picture a Financial Statement Preparation AI Agent that's tailor-made for the hard hat crowd. This isn't your run-of-the-mill number cruncher. It's a digital foreman for your finances, capable of wrangling data from project management software, time-tracking systems, and supplier invoices into a cohesive financial narrative.

The real magic happens when this AI starts to connect the dots. It can track cost overruns in real-time, linking them to specific project phases or subcontractors. Suddenly, those profit-eating inefficiencies have nowhere to hide. The AI doesn't just prepare statements; it's constantly building a predictive model of your financial future, factoring in everything from weather delays to material price fluctuations.

For construction execs, this is like trading in their financial shovel for an excavator. They're not just digging through last quarter's numbers; they're unearthing actionable insights that can make or break projects. Bid pricing becomes more precise, resource allocation more efficient, and cash flow management smoother than freshly poured concrete.

The implications are massive. Smaller contractors can now punch above their weight, using AI-driven financial insights to compete for bigger projects. Large construction firms can optimize operations across multiple job sites, each with its own financial DNA.

This isn't just about balancing the books faster. It's about constructing a new financial reality in an industry where margins are as thin as drywall and the stakes are sky-high. The builders who embrace this AI-powered financial revolution won't just be erecting structures; they'll be building empires on a foundation of unparalleled financial intelligence.

Considerations

Technical Challenges

Implementing a Financial Statement Preparation AI Agent isn't just about slapping some machine learning on top of Excel sheets. It's a complex dance of data, algorithms, and financial acumen.

First off, data integration is a beast. You're dealing with a mishmash of sources - ERP systems, bank feeds, invoicing platforms, and probably some legacy systems held together with duct tape and prayers. Getting all this data integration to play nice is like herding cats, if the cats were also trying to solve differential equations.

Then there's the AI model itself. Financial statements aren't just about crunching numbers; they're about understanding context, applying accounting principles, and making judgment calls. Training an AI to do this is like teaching a robot to appreciate fine art. It's possible, but it's going to take a lot of work and a ton of high-quality, annotated training data.

Let's not forget about accuracy and auditability. In the world of finance, a small error can snowball into a big problem. Your AI needs to be more accurate than a Swiss watch, and every decision it makes needs to be traceable and explainable. This isn't just a nice-to-have; it's a regulatory requirement.

Operational Challenges

On the operational side, you're looking at a paradigm shift that would make Kuhn proud. You're not just introducing a new tool; you're fundamentally changing how financial teams work.

First up: the human factor. Your finance team has been doing things their way for years. Now you're asking them to trust an AI with tasks they've spent careers mastering. It's like telling a master chef to let a robot cook their signature dish. You need a change management strategy that's part education, part reassurance, and part showing them how this AI can make their jobs more interesting, not obsolete.

Then there's the workflow integration. Your AI isn't operating in a vacuum; it needs to slot into existing processes seamlessly. This means rethinking approval workflows, review processes, and how the AI's output feeds into downstream activities like audits and board reports.

Security and compliance are another can of worms. You're dealing with highly sensitive financial data. Your AI needs to be locked down tighter than Fort Knox, with robust access controls, encryption, and audit trails. And let's not forget about compliance with accounting standards and regulations, which can vary by jurisdiction and industry.

Lastly, there's the question of continuous improvement. Financial regulations and standards evolve, business models change, and your AI needs to keep up. You need a strategy for ongoing training and refinement that doesn't disrupt day-to-day operations.

Implementing a Financial Statement Preparation AI Agent is a journey, not a destination. It's complex, challenging, and not for the faint of heart. But for those who get it right, the potential to transform financial operations is enormous. Just be prepared for a wild ride.

Embracing the AI-Powered Financial Revolution

AI agents are not just tools; they're catalysts for a financial revolution. They're transforming financial statement preparation from a backward-looking chore into a real-time strategic asset. The benefits are clear: lightning-fast processing, near-perfect accuracy, and predictive insights that were once the stuff of CFO dreams.

But let's not kid ourselves - implementing these AI agents is no walk in the park. It's a complex undertaking that requires rethinking processes, retraining teams, and navigating a minefield of technical and operational challenges. Yet, for those who can pull it off, the rewards are game-changing.

As we've seen in retail and construction, AI agents are already reshaping industries, giving businesses of all sizes access to financial superpowers. They're not replacing human expertise; they're amplifying it, freeing up finance teams to focus on strategy and value creation.

The future of financial statement preparation is here, and it's powered by AI. The question isn't whether to adopt these technologies, but how quickly you can get on board. Because in this new financial landscape, those who embrace AI won't just be keeping up - they'll be leading the pack.