Cash Flow Forecasting AI Agents

The Evolution of Financial Forecasting

What is Cash Flow Forecasting?

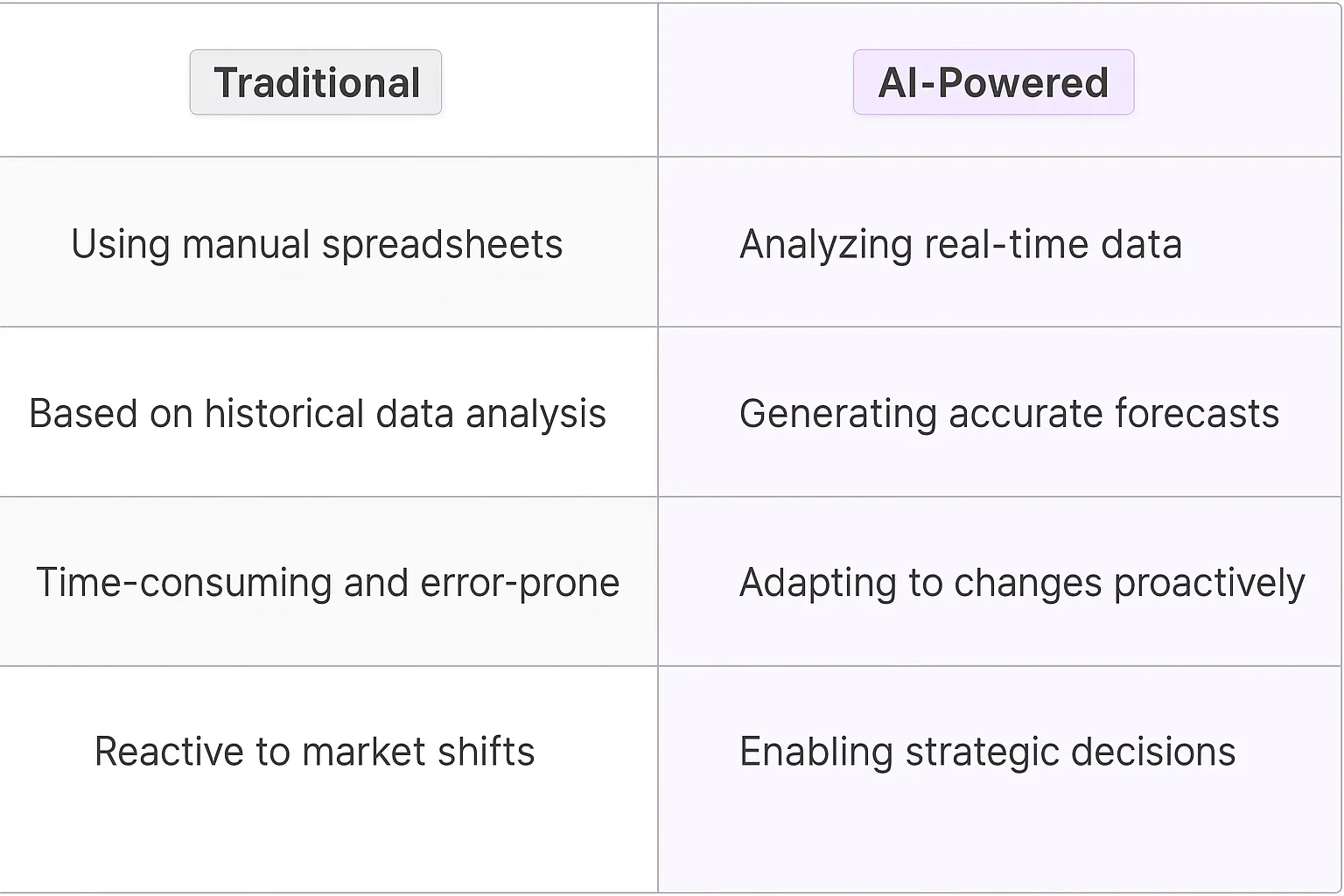

Cash flow forecasting is the process of predicting a company's future financial position. It's like having a financial crystal ball, allowing businesses to anticipate cash surpluses or shortfalls. Traditional methods relied on historical data, spreadsheets, and human analysis. But in today's fast-paced, data-rich environment, these methods often fall short. Enter AI agents - the game-changers in the world of financial forecasting.

Key Features of Cash Flow Forecasting

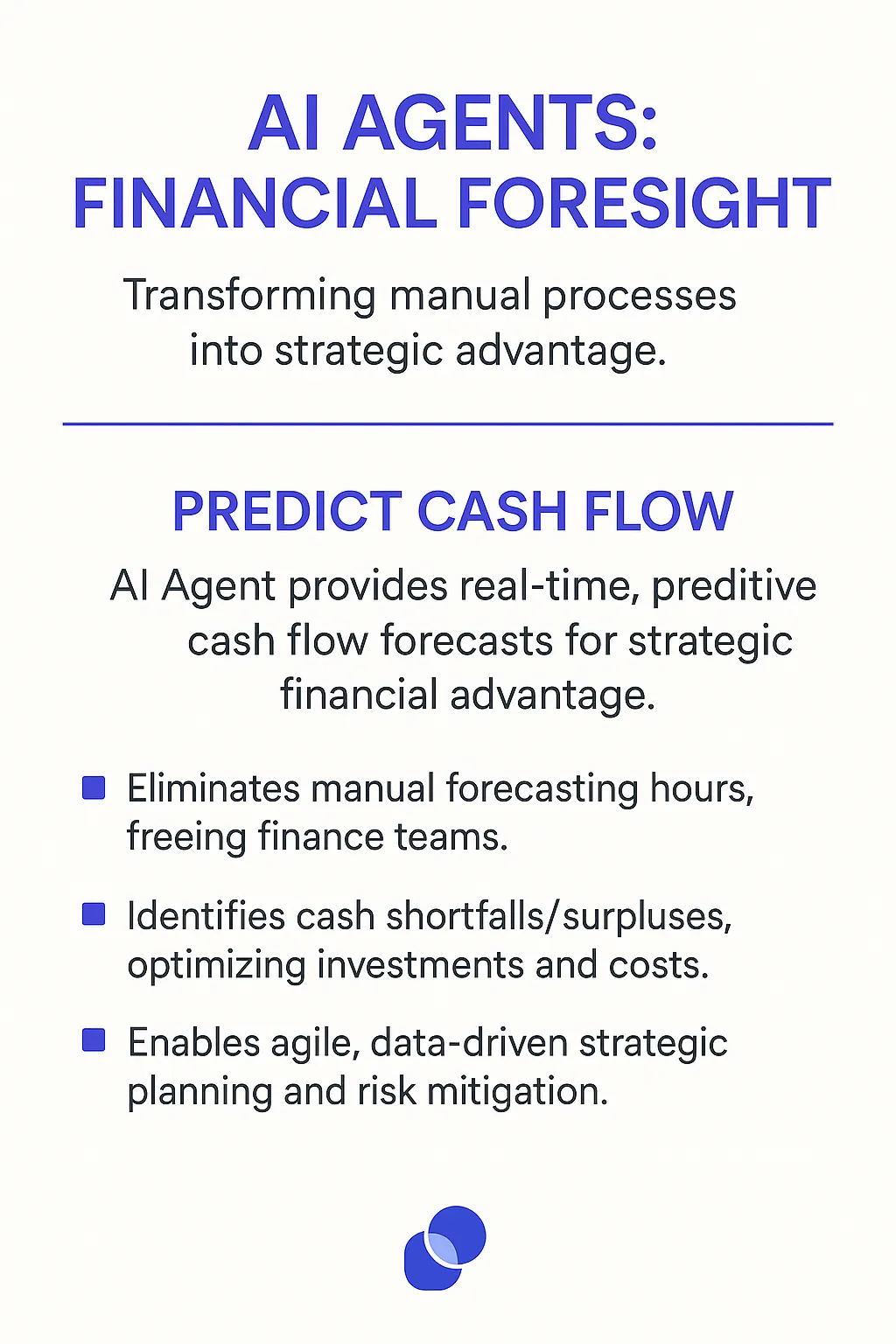

AI-powered cash flow forecasting brings a new level of sophistication to the table. These digital teammates can:1. Process massive amounts of data in real-time2. Learn and adapt from new information3. Identify complex patterns and correlations4. Run thousands of scenarios in seconds5. Integrate data from diverse sources6. Provide actionable insights, not just numbersThese features transform cash flow forecasting from a backward-looking chore into a powerful tool for strategic decision-making.

Benefits of AI Agents for Cash Flow Forecasting

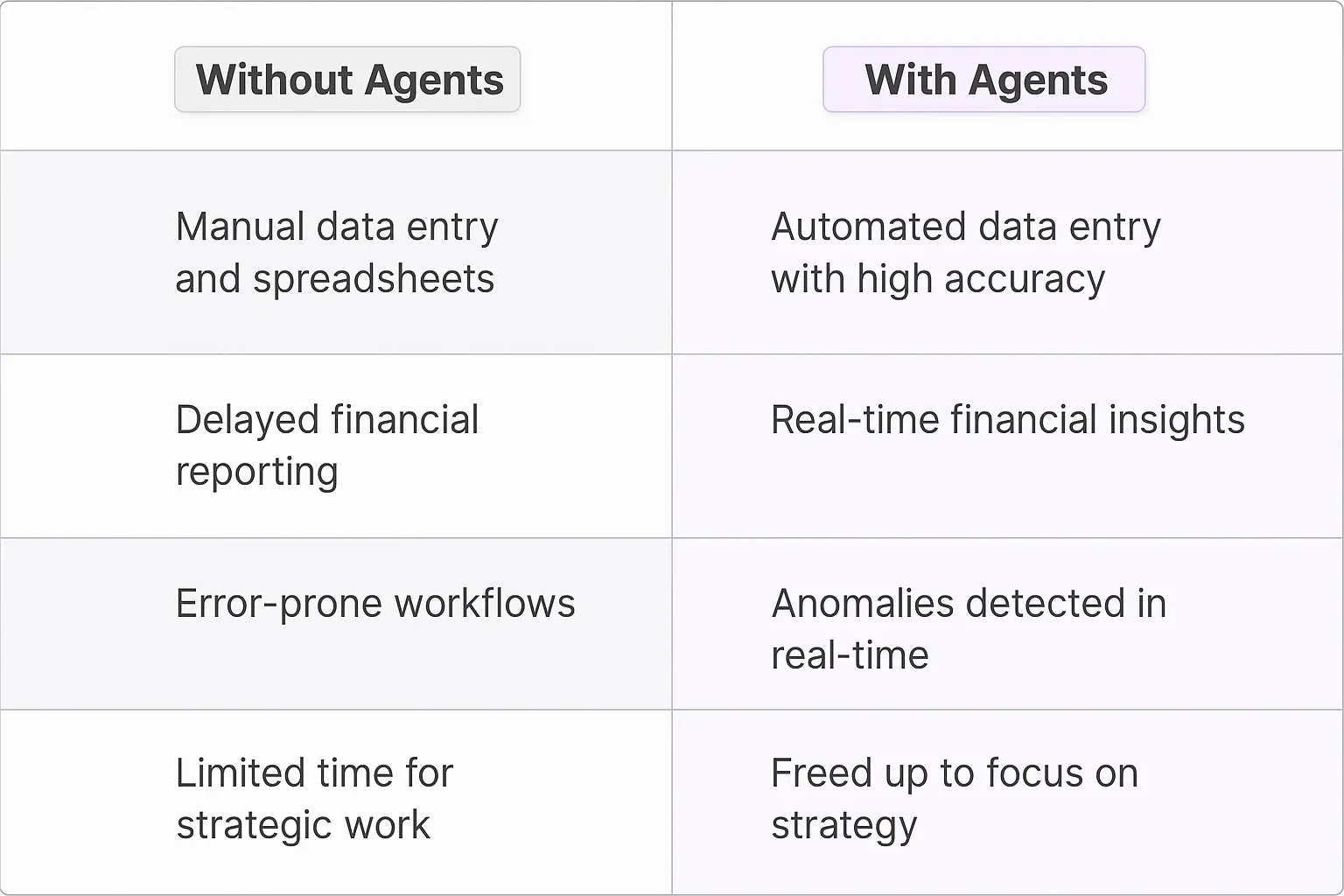

What would have been used before AI Agents?

Before AI agents entered the scene, cash flow forecasting was like trying to predict the weather with a stick and a wet finger. Finance teams relied on spreadsheets, historical data, and gut feelings. They'd spend hours poring over past transactions, seasonal trends, and market indicators, often ending up with forecasts that were about as reliable as a fortune cookie.

The process was manual, time-consuming, and prone to human error. It was like trying to solve a Rubik's cube blindfolded – possible, but painfully inefficient. Companies would hire armies of analysts to crunch numbers, yet still struggle to adapt quickly to market changes or unexpected events.

What are the benefits of AI Agents?

Enter AI agents for cash flow forecasting, and suddenly it's like we've upgraded from a bicycle to a Tesla. These digital teammates are changing the game in ways that would make even the most seasoned CFO's jaw drop.

First off, AI agents can process vast amounts of data at lightning speed. They're not just looking at your company's historical data; they're analyzing market trends, economic indicators, and even social media sentiment in real-time. It's like having a financial crystal ball that's constantly updating itself.

But here's where it gets really interesting: AI agents learn and adapt. They're not static tools; they're evolving partners. Every prediction, every data point, every market shift becomes a learning opportunity. Over time, these agents become eerily accurate, often spotting patterns and correlations that human analysts might miss.

The real kicker? AI agents free up your finance team to focus on strategy rather than number-crunching. Instead of spending hours updating spreadsheets, your team can be brainstorming ways to optimize cash flow or identifying new investment opportunities. It's like suddenly having a team of financial wizards who never sleep, never take vacations, and never ask for a raise.

And let's talk about risk management. AI agents can run thousands of scenarios in seconds, stress-testing your cash flow forecasts against a multitude of potential market conditions. It's like having a financial fire drill every day, ensuring you're prepared for whatever the market throws at you.

The bottom line? AI agents for cash flow forecasting aren't just improving the process – they're fundamentally transforming how businesses approach financial planning. They're turning what was once a reactive, rear-view mirror exercise into a proactive, forward-looking strategy. In the high-stakes world of finance, that's not just an advantage – it's a game-changer.

Potential Use Cases of AI Agents with Cash Flow Forecasting

Processes

Cash flow forecasting is a critical process for businesses of all sizes, but it's often time-consuming and prone to human error. AI agents are changing the game, bringing a level of precision and efficiency that's hard to match with traditional methods. These digital teammates can analyze vast amounts of financial data, identify patterns, and generate accurate predictions in a fraction of the time it would take a human analyst.

One of the most compelling use cases for AI in cash flow forecasting is its ability to continuously learn and adapt. As new financial data comes in, the AI agent can refine its models, improving accuracy over time. This dynamic approach to forecasting is particularly valuable in today's volatile economic environment, where historical trends may not always be reliable indicators of future performance.

Tasks

AI agents excel at handling specific tasks within the cash flow forecasting process. For instance, they can automatically categorize and analyze incoming and outgoing transactions, saving hours of manual data entry and classification. These digital teammates can also flag anomalies or unexpected patterns in cash flow, alerting finance teams to potential issues before they become critical problems.

Another key task for AI agents is scenario modeling. By rapidly running multiple "what-if" scenarios, these tools can help businesses prepare for various financial outcomes. This capability is particularly valuable for startups and high-growth companies, where cash flow can be unpredictable and managing runway is crucial.

AI agents can also integrate data from various sources - sales pipelines, accounts receivable, market trends - to create more comprehensive and accurate forecasts. This holistic approach to cash flow prediction gives businesses a clearer picture of their financial future, enabling more informed decision-making.

The real power of AI in cash flow forecasting lies in its ability to augment human expertise. While the AI handles the heavy lifting of data analysis and prediction, finance professionals can focus on strategic interpretation and action. This symbiosis between human insight and machine learning is where the true value of AI in financial planning really shines.

Industry Use Cases: Cash Flow Forecasting AI Agents

Cash flow forecasting AI agents are reshaping financial planning across sectors, offering a level of precision and adaptability that traditional methods can't match. These digital teammates aren't just number crunchers; they're strategic allies in the complex dance of financial management. Let's dive into some industry-specific scenarios where these AI agents are making waves, transforming how businesses predict and manage their cash flow.

From retail to manufacturing, these AI-powered tools are proving their worth by tackling industry-unique challenges head-on. They're not just streamlining processes; they're enabling a whole new level of financial agility. As we explore these use cases, you'll see how cash flow forecasting AI is becoming an indispensable part of modern business strategy, helping companies navigate financial uncertainties with unprecedented confidence.

Retail: Riding the Cash Flow Rollercoaster with AI

Let's talk about retail - an industry where cash flow is as unpredictable as fashion trends. Retailers are constantly juggling inventory, seasonal demands, and fickle consumer behavior. It's like trying to predict which TikTok dance will go viral next.

Enter cash flow forecasting AI agents. These digital teammates are like having a financial psychic on your team, but one that actually works. They crunch through mountains of data - past sales, market trends, weather patterns, social media sentiment - you name it. The AI doesn't just look at numbers; it understands the story behind them.

For a retailer, this means getting ahead of the game. Imagine knowing exactly when to stock up on ugly Christmas sweaters or when to slash prices on swimwear. The AI can predict cash crunches weeks in advance, giving you time to secure financing or adjust operations. It's like having a financial GPS, rerouting you away from cash flow traffic jams before you hit them.

But here's where it gets really interesting. These AI agents don't just forecast; they learn and adapt. They'll pick up on subtle patterns humans might miss. Maybe there's a correlation between Instagram influencer posts and sales spikes. Or perhaps political events in certain countries affect luxury goods purchases. The AI will find these needles in the haystack of data.

For retailers, this level of foresight is game-changing. It's not just about avoiding cash crunches; it's about seizing opportunities. When you can accurately predict cash surpluses, you can make bold moves - expanding into new markets, investing in game-changing tech, or outmaneuvering competitors.

The retail landscape is brutal. Margins are thin, competition is fierce, and consumer loyalty is as fleeting as the latest fashion trend. Cash flow forecasting AI agents give retailers the edge they need not just to survive, but to thrive in this cutthroat world. It's like having a financial crystal ball - one that actually works.

Construction: Building Financial Stability with AI Foresight

The construction industry is notorious for its cash flow challenges. It's a sector where massive projects can span years, with payments tied to milestones and subject to countless variables. Weather delays, material shortages, labor disputes - it's like trying to predict the outcome of a game of Jenga played by blindfolded giants.

Cash flow forecasting AI agents are changing this landscape dramatically. These digital teammates are like having a financial architect who can see through walls and predict the future. They don't just look at historical data; they integrate real-time information from multiple sources - weather forecasts, supplier databases, labor market trends, and even satellite imagery of construction sites.

For a construction firm, this means unprecedented visibility into future cash positions. The AI can predict potential delays or cost overruns weeks or even months in advance. It's like having a financial early warning system that alerts you to cash flow earthquakes before the ground even starts to shake.

But here's where it gets really interesting: these AI agents don't just forecast; they suggest solutions. They might recommend accelerating work on certain project phases to trigger earlier payments, or identify optimal times to negotiate better terms with suppliers. It's like having a master strategist constantly optimizing your financial game plan.

The AI's ability to learn and adapt is particularly crucial in construction. Every project is unique, with its own set of challenges and variables. The AI absorbs these lessons, becoming smarter with each completed project. It might discover that certain types of projects consistently underestimate labor costs, or that weather patterns in specific regions have a more significant impact than previously thought.

For construction firms, this level of financial intelligence is transformative. It's not just about avoiding bankruptcy (a real risk in this industry); it's about unlocking growth opportunities. When you can accurately predict and manage cash flow, you can take on larger projects, expand into new markets, or invest in cutting-edge construction technologies.

In an industry where margins are often razor-thin and competition is fierce, cash flow forecasting AI agents provide a critical edge. They're not just predicting the future; they're helping construction firms build a more stable, profitable future. It's like having X-ray vision for your finances - seeing through the concrete and steel to the cash flow patterns beneath.

Considerations

Technical Challenges

Implementing a cash flow forecasting AI agent isn't just about slapping some machine learning on your financial data and calling it a day. It's a complex beast that requires serious technical chops and a deep understanding of both finance and AI.

First off, data quality is a massive hurdle. Your AI is only as good as the data it's fed, and financial data is notoriously messy. You're dealing with inconsistent formats, missing entries, and sometimes straight-up errors. Cleaning this data is a Herculean task that often gets underestimated.

Then there's the challenge of feature engineering. What variables actually matter for predicting cash flow? It's not just about historical cash flow data. You need to factor in things like seasonality, economic indicators, and even social media sentiment. Figuring out these features and how to quantify them is a art and science in itself.

Let's not forget about model selection and tuning. Do you go with a traditional time series model or a more complex deep learning approach? Each has its pros and cons, and the right choice depends on your specific use case and data. And once you've chosen a model, you're in for a long ride of hyperparameter tuning to squeeze out every bit of performance.

Operational Challenges

On the operational side, integrating a cash flow forecasting AI agent into existing financial systems is like performing open-heart surgery while the patient is running a marathon. You can't just pause all financial operations to implement this new system.

There's also the human factor. Finance teams are often set in their ways, and introducing an AI agent can be met with skepticism or outright resistance. You need a solid change management strategy to get buy-in from the people who'll actually be using this tool.

Compliance and security are other big headaches. Financial data is sensitive stuff, and you need to ensure your AI agent doesn't become a liability. This means rigorous security measures, audit trails, and compliance with a alphabet soup of regulations like GDPR, CCPA, and industry-specific rules.

Lastly, there's the challenge of interpretability. AI models, especially complex ones, can be black boxes. But in finance, you can't just say "the AI said so." You need to be able to explain and justify the forecasts, which often requires additional tools and techniques for model interpretation.

Implementing a cash flow forecasting AI agent is no walk in the park. It's a journey filled with technical and operational landmines. But for those who can navigate these challenges, the potential rewards in terms of financial insights and competitive advantage are enormous. It's not about whether you should embark on this journey, but how you can do it right.

Shaping Financial Futures with AI

Cash flow forecasting AI agents are more than just a technological upgrade - they're a paradigm shift in financial management. They're turning what was once a laborious, error-prone process into a strategic advantage. By processing vast amounts of data, identifying subtle patterns, and adapting to new information, these digital teammates are giving businesses unprecedented insight into their financial future.

But implementing these AI agents isn't without challenges. From data quality issues to operational integration hurdles, businesses need to navigate a complex landscape to harness the full potential of AI in cash flow forecasting. Yet, for those who successfully implement these tools, the rewards are substantial. They gain the ability to anticipate financial trends, optimize cash management, and make data-driven decisions with confidence.

As we move further into the age of AI, it's clear that cash flow forecasting AI agents will become an indispensable tool for businesses across all sectors. They're not just predicting the future - they're helping businesses shape it. In the high-stakes world of finance, that's not just an advantage - it's the key to survival and success in an increasingly complex and competitive landscape.