Regulatory Filing Automation AI Agents

The Digital Swiss Army Knife for Compliance

Regulatory Filing Automation is the use of advanced technology to streamline and optimize the process of preparing, submitting, and managing regulatory filings. It's like having a digital Swiss Army knife for compliance - a tool that can handle everything from data collection and form filling to risk assessment and deadline management. This technology aims to reduce the manual labor, human error, and time traditionally associated with regulatory compliance.

Key Features of Regulatory Filing Automation

The standout features of Regulatory Filing Automation include:

- Intelligent data extraction and processing

- Automated form completion and validation

- Real-time regulatory updates and compliance checks

- Risk analysis and predictive insights

- Audit trail creation and management

- Integration with existing enterprise systems

- Machine learning capabilities for continuous improvement

These features combine to create a powerful tool that's not just about automation, but about augmenting human capabilities in the complex world of regulatory compliance.

Benefits of AI Agents for Regulatory Filing Automation

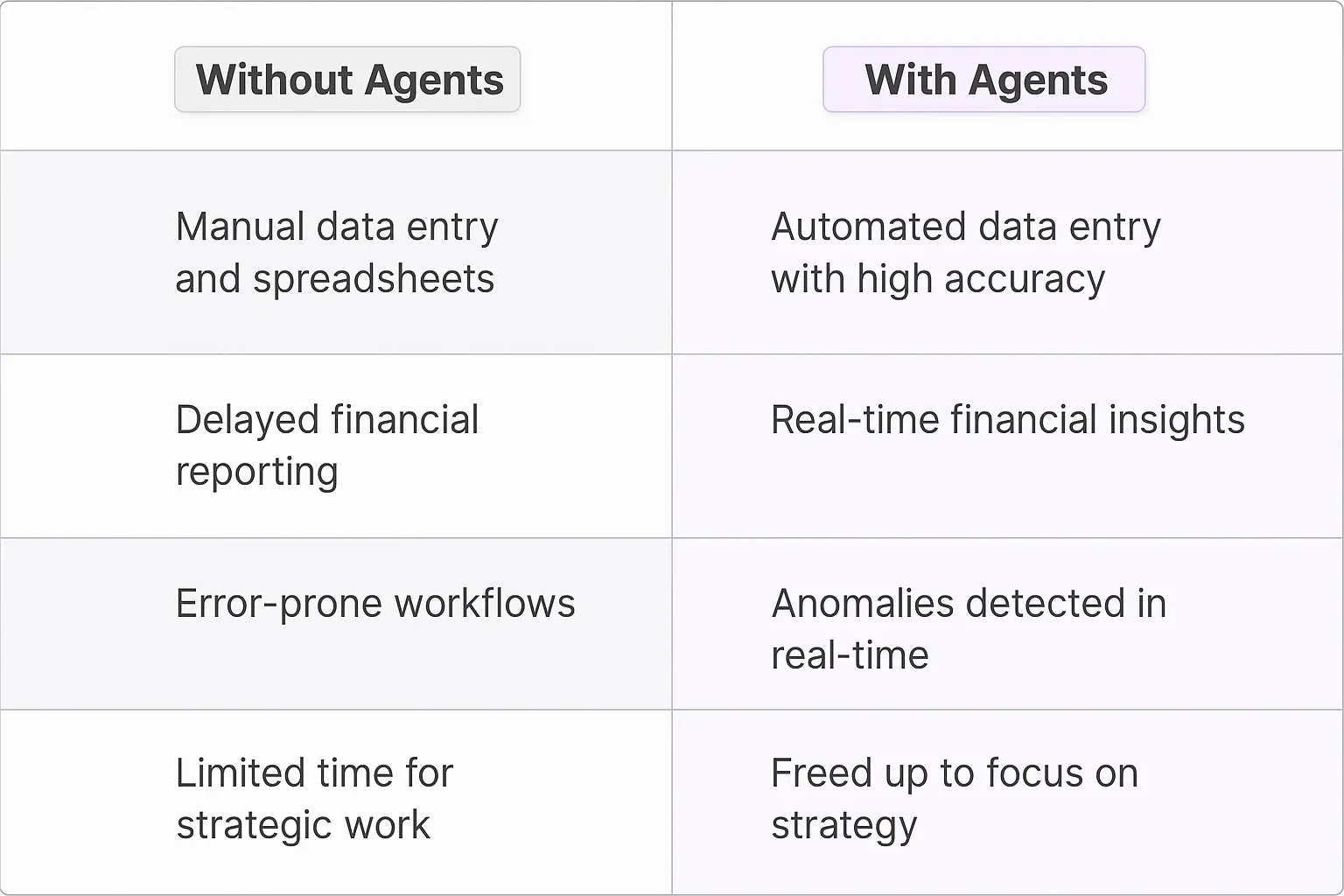

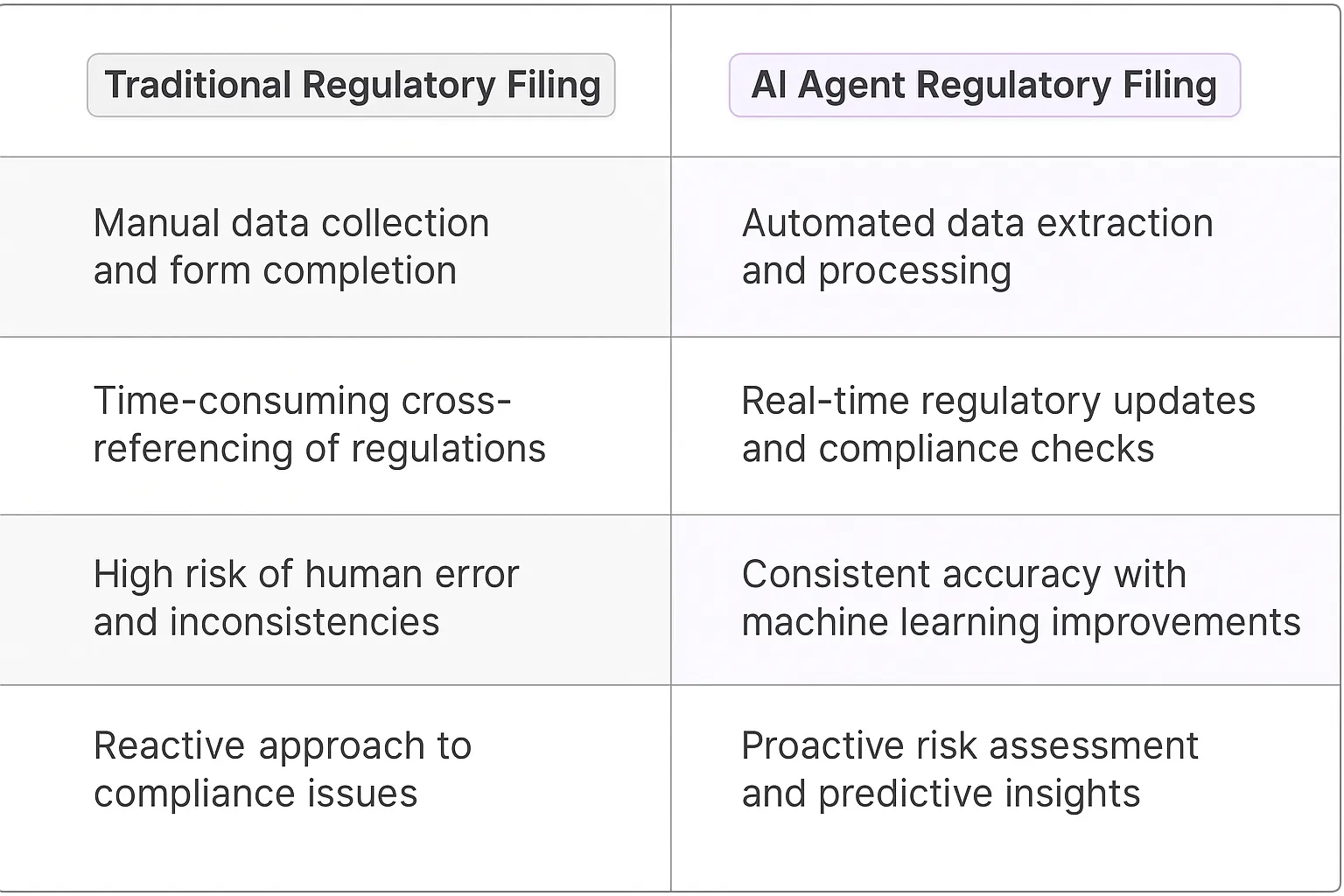

What would have been used before AI Agents?

Before AI agents entered the scene, regulatory filing was a nightmare of manual labor and endless spreadsheets. Teams of lawyers and compliance officers would burn the midnight oil, poring over dense regulatory texts and cross-referencing them with company data. It was like trying to solve a Rubik's cube blindfolded while riding a unicycle.

Companies relied on a patchwork of legacy software, custom-built tools, and good old-fashioned elbow grease. The process was slow, error-prone, and about as exciting as watching paint dry. Worse, it was a massive time-sink for some of the most valuable (and expensive) talent in any organization.

What are the benefits of AI Agents?

Enter AI agents for regulatory filing automation. These digital teammates are like having a team of tireless, hyper-intelligent interns who never sleep, never complain, and never ask for a raise. They're transforming the regulatory landscape faster than you can say "compliance."

First off, speed. AI agents can process regulatory documents at a pace that makes human readers look like they're moving in slow motion. They can ingest, analyze, and extract relevant information from thousands of pages of regulatory text in the time it takes a human to brew their morning coffee.

Accuracy is another game-changer. While humans might miss crucial details after hours of mind-numbing document review, AI agents maintain laser-like focus. They catch nuances and inconsistencies that even the most eagle-eyed lawyer might overlook. It's like having a proofreader with photographic memory and encyclopedic knowledge of regulatory frameworks.

But here's where it gets really interesting: AI agents don't just process information, they learn and adapt. They can identify patterns across multiple filings, predict potential compliance issues before they arise, and even suggest optimizations to your regulatory compliance strategy. It's like having a crystal ball for compliance.

Cost savings? Massive. By automating the grunt work of regulatory filing, companies can redirect their high-priced talent to more strategic tasks. It's like suddenly finding extra hours in the day and extra zeros in your budget.

Perhaps most importantly, AI agents reduce risk management. In a world where a single compliance misstep can lead to hefty fines and reputational damage, the consistency and thoroughness of AI-driven regulatory filing is invaluable. It's like having a safety net made of titanium.

The bottom line? AI agents are turning regulatory filing from a necessary evil into a strategic advantage. They're not just changing the game; they're rewriting the rulebook. And for companies willing to embrace this tech, the regulatory landscape is about to look a whole lot friendlier.

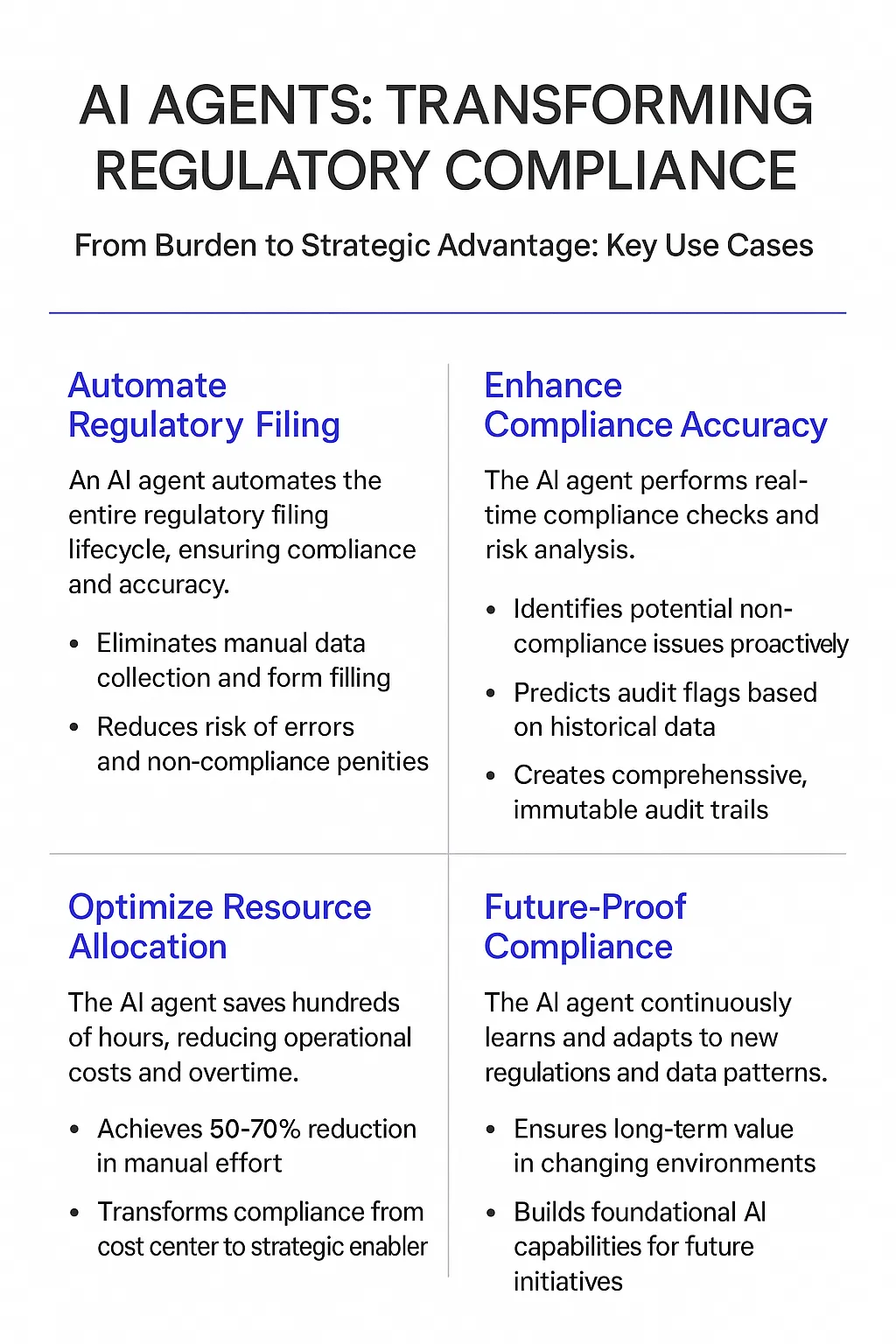

Potential Use Cases of AI Agents with Regulatory Filing Automation

Processes

Regulatory filing is a beast. It's complex, time-consuming, and fraught with potential pitfalls. But what if we could leverage AI to tame this beast? Enter the Regulatory Filing Automation AI Agent – a digital teammate that's about to change the game.

These AI agents can handle the heavy lifting of regulatory compliance, freeing up human experts to focus on strategy and high-level decision-making. They're not just glorified form-fillers; they're sophisticated systems that can interpret regulatory requirements, gather relevant data, and generate accurate filings.

Tasks

Let's break down some specific tasks where these AI agents shine:

- Data collection and validation: AI agents can scour internal databases, financial reports, and other relevant sources to gather the necessary information for filings. They can cross-check this data for consistency and flag any discrepancies.

- Form completion: With natural language processing capabilities, these agents can accurately fill out complex regulatory forms, ensuring all fields are properly populated and formatted.

- Regulatory updates tracking: AI agents can continuously monitor for changes in regulatory requirements across different jurisdictions, ensuring your filings are always up-to-date and compliant.

- Risk assessment: By analyzing historical data and current market conditions, AI agents can help identify potential compliance risks and suggest mitigation strategies.

- Deadline management: These digital teammates can keep track of filing deadlines, send reminders, and even prioritize tasks to ensure timely submissions.

- Audit trail creation: AI agents can automatically document the entire filing process, creating a comprehensive audit trail for internal review or regulatory inspections.

The potential impact of these AI agents is massive. They're not just incremental improvements; they're paradigm shifts in how we approach regulatory compliance. By automating the grunt work, they allow human experts to elevate their game, focusing on strategic decisions and complex interpretations that truly require human judgment.

But here's the kicker: as these AI agents learn and improve over time, they'll become increasingly sophisticated. They'll start to identify patterns and insights that humans might miss, potentially uncovering new strategies for regulatory compliance and workflow step automation.

The companies that embrace these AI agents early will have a significant competitive advantage. They'll be able to navigate the regulatory landscape with greater speed and accuracy, reducing compliance costs and minimizing the risk of costly errors or penalties.

In the world of regulatory filing, AI agents aren't just nice-to-haves – they're becoming must-haves for any organization serious about staying compliant and competitive in an increasingly complex regulatory environment.

Industry Use Cases: Regulatory Filing Automation AI Agents

The regulatory landscape is a complex maze that companies across industries must navigate. Enter AI agents for regulatory filing automation - these digital teammates are reshaping how businesses handle compliance. They're not just tools; they're game-changers that can parse through mountains of data, interpret regulatory requirements, and assist in preparing accurate filings.

What's fascinating is how these AI agents adapt to different sectors, each with its unique regulatory challenges. From finance to healthcare, energy to telecommunications, these digital helpers are proving their worth by reducing human error, speeding up processes, and ensuring consistency in regulatory submissions.

Let's dive into some industry-specific scenarios where regulatory filing automation AI agents are making waves. These examples will give you a taste of how AI is transforming compliance monitoring from a necessary evil into a strategic advantage. Whether it's through advanced document text extraction or intelligent data processing, these AI agents are revolutionizing how businesses approach regulatory requirements.

Financial Services: Automating SEC Filings with AI

The financial services industry is drowning in paperwork, and SEC filings are the Mount Everest of regulatory documentation. Enter the Regulatory Filing Automation AI Agent – the digital sherpa that's about to make this climb a whole lot easier.

Let's break it down. A typical public company spends countless hours and resources preparing quarterly and annual reports. It's a high-stakes game where a single mistake can lead to hefty fines or reputational damage. This is where our AI agent steps in, not just as a tool, but as a game-changer.

Picture a financial analyst at a Fortune 500 company. Instead of manually combing through thousands of data points, cross-referencing past filings, and triple-checking every footnote, they now have a digital teammate that can:

- Automatically gather and organize financial data from various sources

- Draft initial versions of complex forms like 10-Ks and 10-Qs

- Flag discrepancies or potential issues before they become problems

- Ensure consistency across multiple filings and time periods

- Keep track of evolving SEC regulations and adjust filing content accordingly

But here's where it gets really interesting. This AI isn't just about automation – it's about augmentation. It learns from each filing cycle, becoming more adept at understanding the nuances of the company's financial story. Over time, it can even suggest strategic improvements in financial statement preparation and risk disclosure.

The result? A dramatic reduction in the time and resources needed for SEC filings. But more importantly, it allows financial professionals to shift their focus from data entry and formatting to high-level analysis and strategic decision-making. It's not about replacing humans; it's about elevating their role.

This use case is a prime example of how AI can tackle the unsexy but crucial aspects of business operations. By taking on the heavy lifting of regulatory compliance, it frees up human capital for innovation and growth. And in an industry where time literally is money, that's a value proposition that's hard to ignore.

Pharmaceutical Industry: Accelerating Drug Approval Processes

The pharmaceutical industry is notorious for its lengthy and complex regulatory processes. Getting a new drug from the lab to the market is a marathon that can take over a decade and cost billions. But what if we could turn this marathon into a sprint? That's where Regulatory Filing Automation AI Agents come into play.

These AI agents are not just fancy document processors; they're the secret weapon in accelerating drug approvals. They're like having a team of regulatory experts working 24/7, but with superhuman speed and accuracy.

Let's zoom in on a typical scenario. A pharmaceutical company is preparing to submit a New Drug Application (NDA) to the FDA. Traditionally, this process involves:

- Compiling thousands of pages of clinical trial data

- Ensuring compliance with ever-changing FDA guidelines

- Cross-referencing data across multiple studies and years of research

- Preparing detailed safety and efficacy reports

- Addressing potential questions or concerns preemptively

Now, introduce an AI agent into this mix. It's not just automating tasks; it's fundamentally reshaping the workflow. The AI can:

- Aggregate and analyze vast amounts of clinical data in minutes, not months

- Generate initial drafts of key sections of the NDA, adhering to the latest FDA standards

- Identify potential red flags or inconsistencies that human reviewers might miss

- Suggest optimal ways to present data for maximum clarity and impact

- Continuously update the application as new data comes in, ensuring it's always current

But here's where it gets really interesting. These AI agents aren't just faster; they're smarter. They learn from every interaction with regulatory bodies, every approved drug, every rejected application. Over time, they develop an intuition for what works and what doesn't in regulatory filings.

The impact? We're talking about potentially shaving years off the drug approval process. This isn't just about efficiency; it's about getting life-saving treatments to patients faster. It's about reducing the astronomical costs of drug development, which could lead to more affordable medications.

And let's not forget the competitive advantage. In an industry where being first to market can mean billions in revenue, a company leveraging these AI agents could leave their competitors in the dust.

This use case exemplifies the transformative power of AI in highly regulated industries. It's not about replacing the expertise of regulatory professionals. Instead, it's about amplifying their capabilities, allowing them to focus on strategic decisions rather than drowning in paperwork.

As we look to the future, the companies that embrace these AI agents won't just be playing the game better – they'll be changing the rules entirely. And in an industry where innovation is everything, that's a game-changer we can't ignore. With advanced document version control and process mining and optimization, these AI agents are setting new standards for regulatory efficiency.

Considerations

Technical Challenges

Implementing a Regulatory Filing Automation AI Agent isn't a walk in the park. It's more like trying to teach a robot to dance salsa while juggling chainsaws. The first major hurdle? Data integration. These digital teammates need to pull information from a multitude of systems - ERPs, CRMs, document management platforms - you name it. It's like asking them to speak a dozen languages fluently, all at once.

Then there's the ever-evolving nature of regulatory requirements. It's not enough for these AI agents to know the rules; they need to stay ahead of the game. We're talking about building a system that can adapt to new regulations faster than a chameleon changes colors. This requires sophisticated natural language processing capabilities and continuous learning algorithms that make most machine learning models look like child's play.

Security and compliance are another can of worms. These AI agents are handling sensitive financial data, so they need Fort Knox-level security. We're not just talking about encryption and firewalls here. These systems need to be auditable, with every decision traceable. It's like asking them to leave breadcrumbs for every step they take, but in a way that would make even the most meticulous accountant nod in approval.

Operational Challenges

On the operational front, the challenges are just as daunting. First off, there's the human factor. Implementing these AI agents isn't just a tech upgrade; it's a cultural shift. You're essentially asking your team to trust a digital entity with tasks they've been doing for years. It's like asking a chef to let a robot cook their signature dish. The resistance can be real and intense.

Then there's the question of accountability. When an AI agent makes a mistake in regulatory filing (and let's face it, it will), who takes the fall? Is it the developer who built the system? The compliance officer who oversees it? Or does the buck stop with the C-suite? This isn't just a philosophical question; it has real legal and financial implications that need to be ironed out.

Lastly, there's the challenge of continuous improvement. These AI agents aren't set-it-and-forget-it solutions. They need constant fine-tuning, regular updates, and ongoing monitoring. It's like having a high-performance sports car; the maintenance never stops. This requires a dedicated team of AI specialists, compliance experts, and domain knowledge holders working in harmony. And let me tell you, getting all these experts to sing from the same hymn sheet is no small feat.

In the end, implementing a Regulatory Filing Automation AI Agent is a complex dance of technology, compliance, and change management. It's not for the faint of heart, but for those who pull it off, the rewards can be game-changing. Just remember, in this AI-driven world, the devil is always in the details - and there are a lot of details to manage. A skilled business systems analyst can help navigate these complexities and ensure successful implementation.

The Future of Compliance: AI Agents as Strategic Assets

Regulatory Filing Automation AI Agents are more than just a technological advancement - they're a paradigm shift in how we approach compliance. These digital teammates are turning what was once a necessary evil into a strategic advantage. They're not replacing human expertise, but amplifying it, allowing professionals to focus on high-level strategy rather than getting bogged down in paperwork.

The impact of these AI agents extends far beyond just saving time and reducing errors. They're enabling companies to navigate increasingly complex regulatory landscapes with greater agility and confidence. In industries where compliance can make or break a business, that's a game-changing proposition.

As these AI agents continue to evolve and learn, their potential only grows. We're looking at a future where regulatory compliance becomes a source of competitive advantage, rather than a burden. For companies willing to embrace this technology, the regulatory landscape is about to become a lot less daunting and a lot more navigable.

The regulatory filing automation revolution is here. The question isn't whether companies will adopt these AI agents, but how quickly they'll do so - and how they'll leverage this technology to stay ahead in an increasingly complex and regulated business world. With advanced business intelligence capabilities and strategic initiative tracking, these AI agents are becoming indispensable tools for forward-thinking organizations.