A Compliance Officer AI Agent is a sophisticated digital system designed to assist and enhance the capabilities of human compliance officers. It leverages artificial intelligence and machine learning to process and analyze vast amounts of regulatory data, interpret complex rules, and provide context-aware guidance on compliance issues. These AI agents act as tireless, always-on teammates that can predict potential compliance risks, automate routine tasks, and offer insights that help organizations stay ahead of regulatory changes.

Before AI agents entered the scene, compliance officers were drowning in a sea of manual processes and endless paperwork. They'd spend countless hours poring over regulatory documents, cross-referencing policies, and manually flagging potential violations. It was like trying to find a needle in a haystack, except the haystack was made of legal jargon and the needle was constantly moving.

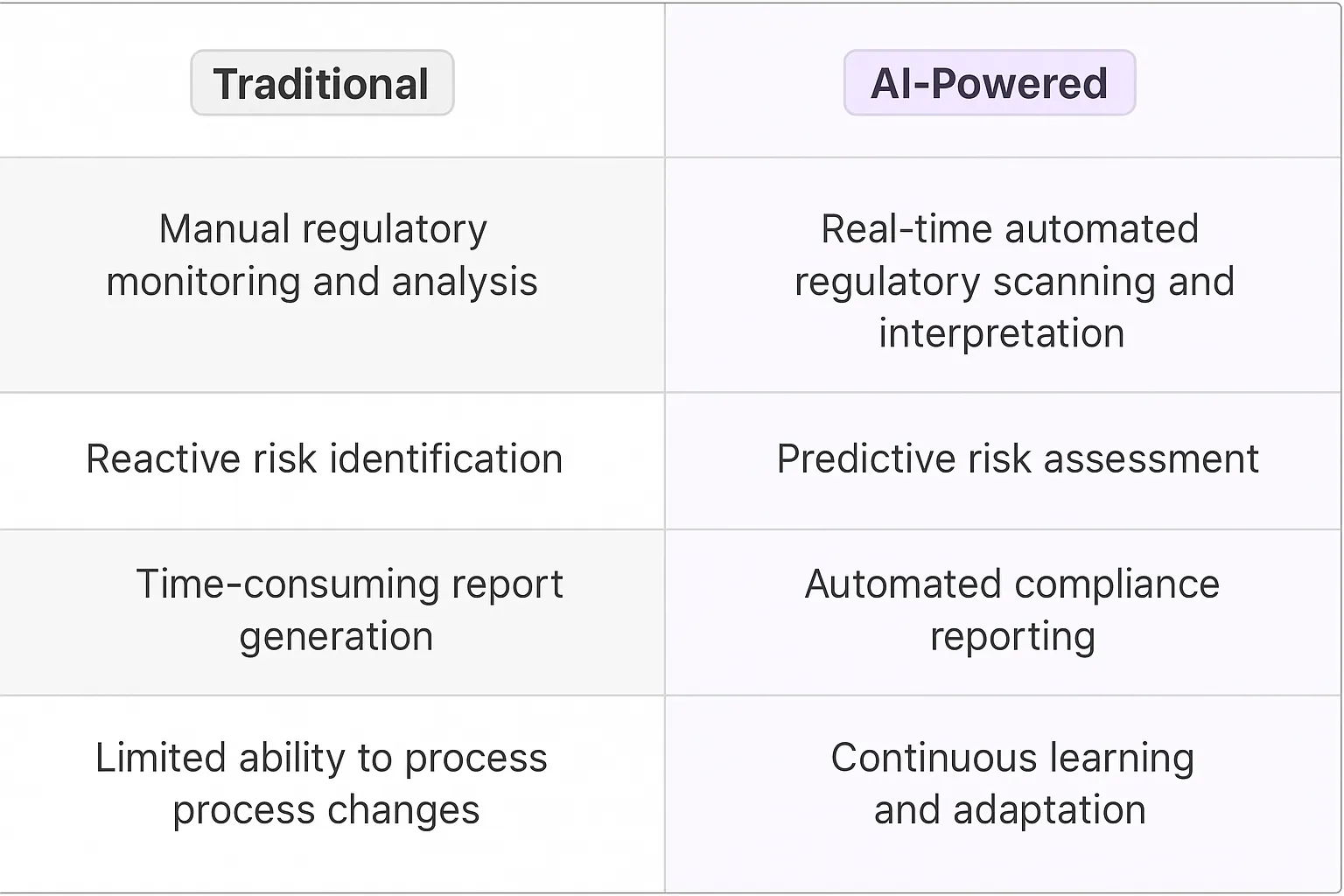

Traditional software tools offered some relief, but they were often clunky and required significant human oversight. These systems could flag obvious issues, but they lacked the nuance to understand context or adapt to rapidly changing regulations. Compliance teams were essentially playing a never-ending game of catch-up, always one step behind the latest regulatory changes or emerging risks.

Enter AI agents - the digital teammates that are transforming the compliance landscape. These aren't your run-of-the-mill chatbots; we're talking about sophisticated systems that can parse complex regulations, learn from historical data, and even predict future compliance issues.

First off, AI agents are absolute beasts when it comes to processing and analyzing vast amounts of data. They can sift through years of compliance records, internal policies, and regulatory updates in seconds, identifying patterns and potential risks that human eyes might miss. This isn't just about speed - it's about uncovering insights that can fundamentally reshape a company's compliance strategy.

But here's where it gets really interesting: AI agents don't just follow rules - they understand context. They can interpret the spirit of regulations, not just the letter, adapting their analysis based on the specific circumstances of each case. This level of nuance is crucial in the often gray areas of compliance.

Moreover, these digital teammates are constantly learning and evolving. As they interact with compliance officers and process more data, they become increasingly adept at identifying potential issues before they escalate. It's like having a compliance crystal ball, but one that's powered by machine learning algorithms instead of mystical energy.

Perhaps most importantly, AI agents free up compliance officers to focus on high-level strategy and complex decision-making. Instead of getting bogged down in routine tasks, they can leverage the insights provided by AI to make more informed decisions and proactively shape their organization's compliance posture.

In essence, AI agents are turning compliance from a reactive, box-ticking exercise into a proactive, strategic function. They're not replacing compliance officers - they're empowering them to operate at a higher level, driving real value for their organizations. And in a world where regulatory complexity is only increasing, that's not just an advantage - it's a necessity.

Compliance officers face a constant barrage of regulatory changes, internal policy updates, and potential violations. AI agents can transform how these professionals operate, turning a traditionally reactive role into a proactive powerhouse. Let's dive into some game-changing processes where AI can make a real difference:

Breaking down these processes, we see a myriad of tasks where AI agents can provide significant value. Here's where the rubber meets the road:

When we look at the compliance landscape, we're seeing a classic example of an industry ripe for disruption. Compliance officers are drowning in a sea of regulations, and the traditional tools just aren't cutting it anymore. This is where AI agents come in, not just as tools, but as digital teammates that can transform the entire compliance function.

Think about it - we're moving from a world where compliance was about ticking boxes and hoping for the best, to one where AI agents are proactively hunting down potential issues before they become problems. It's like giving every compliance officer a team of tireless, hyper-intelligent interns who never sleep and never miss a detail.

But here's the real kicker: AI agents in compliance aren't just about doing the same old things faster. They're about unlocking entirely new capabilities. Imagine being able to simulate the impact of a new regulation across your entire organization before it even goes into effect. Or having an AI that can predict where the next big compliance risk is likely to emerge based on patterns it's seeing across industries.

This isn't just an incremental improvement - it's a step change in how compliance works. And for companies that get this right, it's going to be a massive competitive advantage. We're talking about turning compliance from a cost center into a strategic asset that can help companies move faster and more confidently in complex regulatory environments.

The companies that embrace this shift early are going to be the ones writing the playbook for 21st-century compliance. And let's be real - in a world where regulations are only getting more complex, that's going to be a playbook every company needs.

The versatility of AI agents in Compliance Officer roles makes them valuable across various industries. Let's dive into some meaty, industry-specific use cases that showcase how AI can transform workflows and processes in ways that'll make your head spin.

These digital teammates aren't just glorified chatbots or rule-following robots. They're sophisticated systems capable of parsing complex regulatory landscapes, spotting patterns in vast datasets, and adapting to the ever-shifting sands of compliance requirements. Think of them as your compliance department's secret weapon, operating 24/7 with superhuman precision and tireless dedication.

From financial services to healthcare, manufacturing to tech startups, compliance officer AI agents are reshaping how organizations approach risk management and regulatory adherence. They're not replacing human expertise, but rather amplifying it, allowing compliance teams to focus on high-level strategy while the AI handles the grunt work.

So, buckle up as we explore how these AI agents are becoming indispensable allies in the compliance battlefield across different sectors. You'll see why forward-thinking companies are racing to integrate these digital compliance officers into their operations, and how they're gaining a serious edge in the process.

The financial services industry is drowning in regulations. Banks, investment firms, and insurance companies face a constant barrage of new rules, updates, and interpretations. It's a compliance nightmare that keeps executives up at night and costs billions annually.

Enter Compliance Officer AI Agents. These digital teammates are game-changers for financial institutions grappling with regulatory overload. They're not just glorified search engines – they're regulatory experts that never sleep, never take vacations, and never miss a beat.

Here's where it gets interesting: These AI agents can ingest and analyze vast amounts of regulatory text, from Dodd-Frank to GDPR, in seconds. They spot patterns and connections that human compliance officers might miss, flagging potential issues before they become costly violations.

But the real magic happens when these agents start interacting with employees across the organization. A trader about to execute a complex derivatives deal can instantly consult the AI agent about relevant regulations. The agent doesn't just regurgitate rules – it provides context-aware guidance, explaining how the specific transaction might be impacted by recent regulatory changes.

For compliance teams, these AI agents act as force multipliers. They can continuously monitor transactions, communications, and internal processes for compliance risks. When they detect a potential issue, they don't just raise an alert – they provide a detailed analysis of the problem and suggest remediation steps.

The impact? Dramatically reduced compliance costs, fewer regulatory fines, and a shift from reactive to proactive compliance management. It's not about replacing human compliance officers – it's about empowering them to focus on high-level strategy and complex decision-making while the AI handles the grunt work.

This isn't some far-off future. Forward-thinking financial institutions are already experimenting with these AI agents, and the early results are promising. As these systems become more sophisticated, we're likely to see a fundamental shift in how the financial services industry approaches regulatory compliance.

The compliance game is changing, and AI agents are holding the winning hand. Financial institutions that embrace this technology will have a significant competitive advantage in navigating the regulatory maze of the future.

The manufacturing industry is a minefield of regulations, standards, and safety protocols. From OSHA requirements to ISO certifications, the compliance landscape is complex and ever-changing. It's a world where a single oversight can lead to catastrophic accidents, massive recalls, or crippling fines.

This is where Compliance Officer AI Agents are making waves. These digital teammates are transforming how manufacturers approach safety and quality control. They're not just fancy checklists – they're vigilant overseers that never blink, never fatigue, and never compromise.

Let's dive into the nitty-gritty. These AI agents can process and interpret thousands of pages of safety regulations, industry standards, and company policies in real-time. They're constantly updating their knowledge base with the latest changes, ensuring that your factory floor is always in line with current requirements.

But here's where it gets really interesting: These agents don't just sit in a digital corner, waiting to be consulted. They're proactively involved in every aspect of the manufacturing process. Imagine a production line where each machine is monitored by an AI agent. The moment a process deviates from safety or quality standards, the agent flags it. Not just with a simple alert, but with a detailed analysis of the issue and recommended corrective actions.

For workers on the factory floor, these AI agents become indispensable safety partners. A worker about to handle a new chemical can quickly consult the AI for safety protocols. The agent doesn't just recite a manual – it provides contextual advice, taking into account the specific environment, the worker's experience level, and any recent incidents or updates.

The impact on quality control is equally profound. These AI agents can analyze production data in real-time, identifying subtle patterns that might indicate a looming quality issue. They can predict when a machine is likely to fail or when a batch might not meet specifications, allowing for preemptive action.

The result? A dramatic reduction in workplace accidents, a significant improvement in product quality, and a sharp decrease in compliance-related costs and penalties. It's not about replacing human safety officers or quality control specialists – it's about augmenting their capabilities, allowing them to focus on strategic improvements while the AI handles the constant vigilance.

This isn't science fiction. Progressive manufacturers are already experimenting with these AI agents, and the results are turning heads. As these systems evolve and learn, we're looking at a future where manufacturing compliance isn't just about meeting standards – it's about setting new benchmarks for safety and quality.

The manufacturing compliance landscape is being rewritten, and AI agents are holding the pen. Companies that embrace this technology won't just stay compliant – they'll redefine what excellence in manufacturing looks like.

Implementing a Compliance Officer AI Agent isn't just about slapping some code together and calling it a day. We're talking about building a digital teammate that can navigate the labyrinth of regulatory requirements without breaking a sweat. But here's the rub: compliance isn't a one-size-fits-all game.

First off, we need to tackle the data monster. Compliance rules are like a living, breathing entity - they're constantly evolving. Our AI needs to be a quick learner, capable of ingesting and interpreting new regulations faster than a startup burns through VC money. We're not just parsing text here; we're decoding the intent behind complex legal jargon.

Then there's the integration headache. Your Compliance Officer AI isn't operating in a vacuum. It needs to play nice with existing systems - CRMs, document management tools, financial software. It's like trying to fit a square peg into a round hole, except the peg is constantly shape-shifting.

And let's not forget about security. We're dealing with sensitive data here, folks. One slip-up, and you're looking at a PR nightmare that makes the Fyre Festival look like a minor hiccup. Encryption, access controls, audit trails - our AI needs to be Fort Knox levels of secure.

On the operational front, we're entering uncharted territory. Introducing an AI Compliance Officer is like adding a new species to an ecosystem - it's going to shake things up.

First, there's the human factor. Your flesh-and-blood compliance team might view this AI as a threat, like a robot coming for their jobs. We need to reframe the narrative. This isn't about replacement; it's about augmentation. It's giving your human compliance officers superpowers, not pink slips.

Then there's the trust issue. Can we really rely on an AI to make critical compliance decisions? It's one thing to have an AI suggest the best burrito joint in town, but quite another to have it interpret complex regulations. We need to build confidence in the system, which means transparency in decision-making processes and a clear audit trail.

Training is another beast altogether. Your AI Compliance Officer needs to be trained on your specific industry, company policies, and risk appetite. It's like teaching a newborn to run a marathon - it takes time, patience, and a lot of data.

Lastly, we can't ignore the regulatory landscape itself. How do regulators view AI in compliance roles? Are there additional reporting requirements? We might be creating a compliant AI only to find out we're non-compliant in using AI for compliance. It's a regulatory inception that would make Christopher Nolan's head spin.

Implementing a Compliance Officer AI Agent is no walk in the park. But for those who can navigate these challenges, the potential rewards are massive. We're talking about a future where compliance isn't just a box-ticking exercise, but a strategic advantage. Now that's a future worth building.

Compliance Officer AI Agents represent a paradigm shift in regulatory compliance. By automating routine tasks, providing deep insights, and predicting potential issues, these digital teammates enable human compliance officers to focus on strategic decision-making and complex problem-solving. As regulatory environments grow increasingly intricate, AI adoption in compliance is becoming essential for maintaining competitiveness and avoiding costly violations. The future of compliance is AI-powered, and organizations that embrace this technology now will be well-equipped to navigate tomorrow's regulatory challenges. This shift transforms compliance from a cost center into a strategic asset that drives business value, positioning early adopters at the forefront of regulatory management in an ever-evolving business landscape.