Bad Debt Prediction AI Agents

Unveiling the Power of AI in Financial Risk Assessment

What is Bad Debt Prediction?

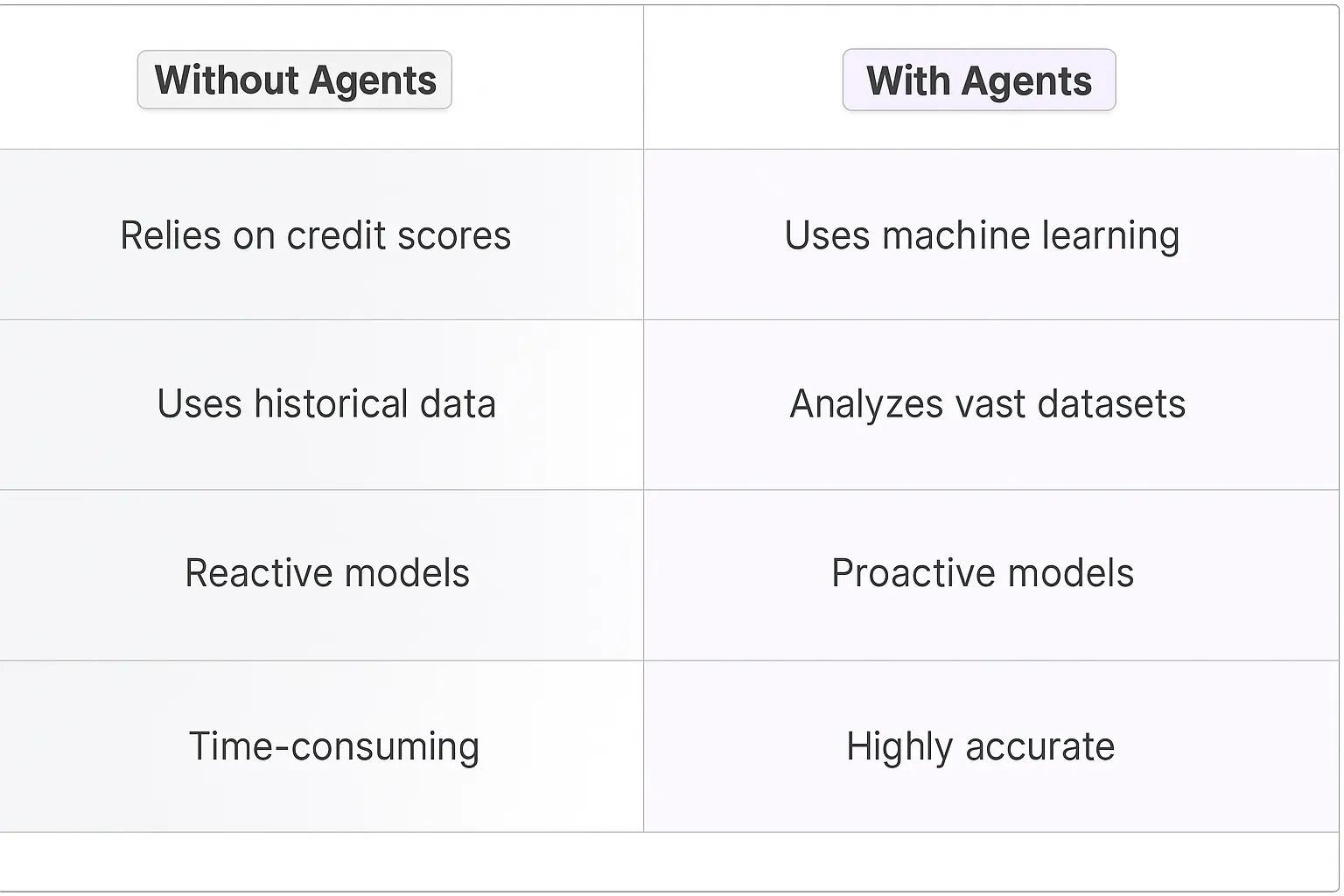

Bad Debt Prediction is the process of identifying which loans or accounts are likely to default before they actually do. It's like having a financial crystal ball, but instead of mystical powers, it uses data analysis and algorithms. Traditional methods relied on credit scores and historical data, but they were about as effective as using a weather vane to predict hurricanes. AI-powered Bad Debt Prediction, on the other hand, is like having a supercomputer crunching global weather patterns in real-time.

Key Features of Bad Debt Prediction

AI-powered Bad Debt Prediction is a game-changer. First, it's all about data - these systems can ingest and analyze massive amounts of information, from traditional credit reports to social media activity. Second, they're dynamic - constantly learning and adapting to new patterns. Third, they offer personalized risk assessment, creating individual profiles for each borrower or account. Finally, they provide real-time insights, allowing businesses to react quickly to changing conditions. It's like having a team of financial geniuses working 24/7, but without the need for coffee breaks or sleep.

Benefits of AI Agents for Bad Debt Prediction

What would have been used before AI Agents?

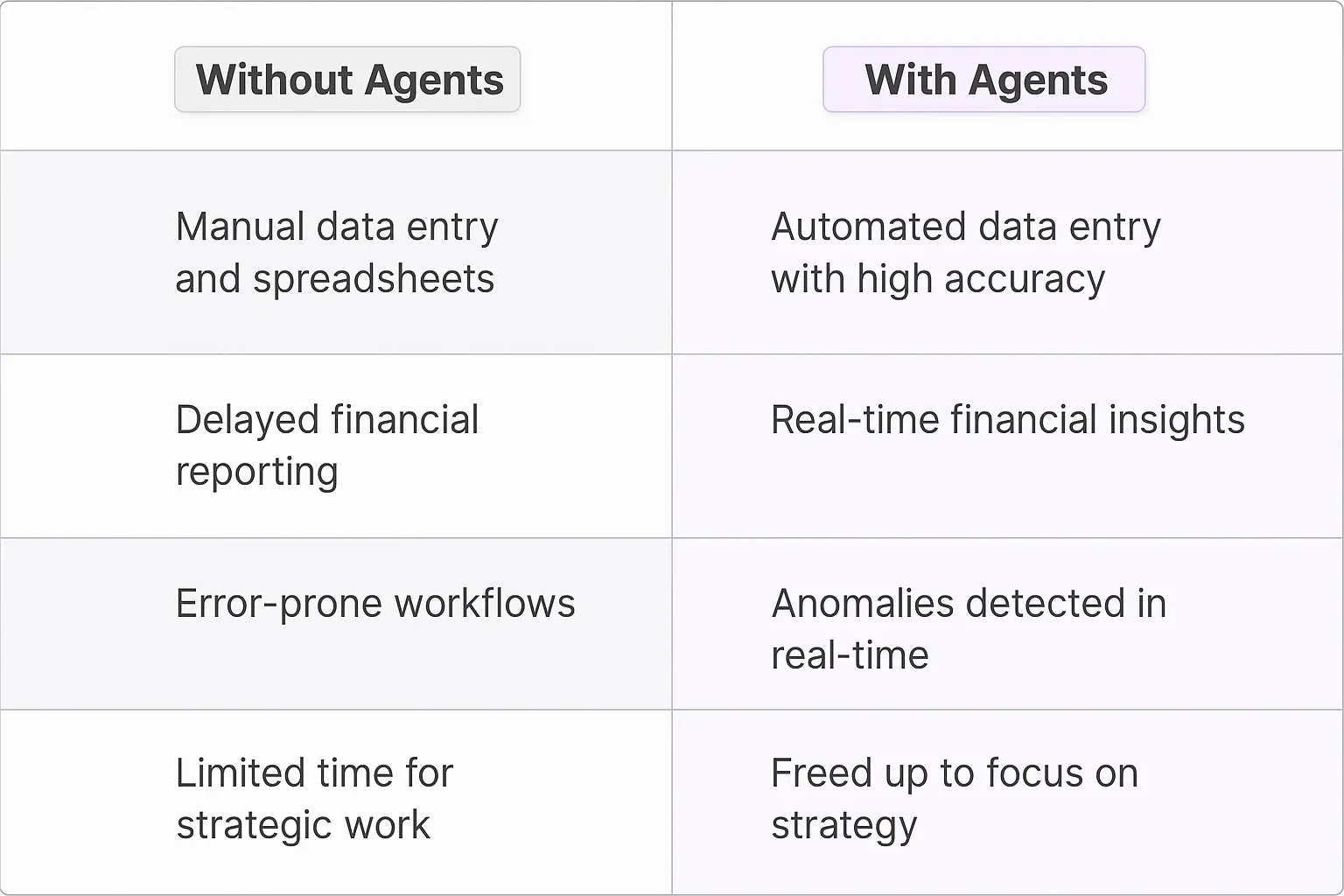

Before AI agents entered the scene, bad debt prediction was like trying to navigate a maze blindfolded. Companies relied on traditional statistical models, credit scores, and human judgment. These methods were about as effective as using a Magic 8-Ball to predict market trends.

Financial institutions would spend countless hours poring over spreadsheets, analyzing historical data, and making educated guesses. It was a time-consuming process that often led to suboptimal results. The worst part? By the time they finished their analysis, the market had already moved on, leaving them perpetually playing catch-up.

What are the benefits of AI Agents?

Enter AI agents for bad debt prediction, and suddenly we're playing a whole new ballgame. These digital teammates are like having a team of financial savants working 24/7, processing vast amounts of data at lightning speed.

First off, AI agents bring unprecedented accuracy to the table. They can spot patterns and correlations that would take humans years to uncover. It's like having a financial Sherlock Holmes on steroids, minus the pipe and deerstalker hat.

But here's where it gets really interesting: AI agents don't just look at historical data. They're constantly learning and adapting in real-time. This means they can factor in current market conditions, economic trends, and even social media sentiment to make predictions. It's like having a crystal ball that actually works.

Another game-changing benefit is the ability to personalize risk assessment. AI agents can create individual risk profiles for each customer, taking into account a myriad of factors that traditional methods simply couldn't handle. This level of granularity allows for more accurate pricing and better risk management.

But perhaps the most exciting aspect is how AI agents are democratizing access to sophisticated financial tools. Small businesses and startups can now leverage the same predictive power that was once the exclusive domain of big banks and hedge funds. It's leveling the playing field in a way we've never seen before.

The bottom line? AI agents for bad debt prediction aren't just improving an existing process - they're completely rewriting the rules of the game. And for businesses willing to embrace this technology, the potential for growth and risk mitigation is nothing short of mind-blowing.

Potential Use Cases of AI Agents for Bad Debt Prediction

Processes

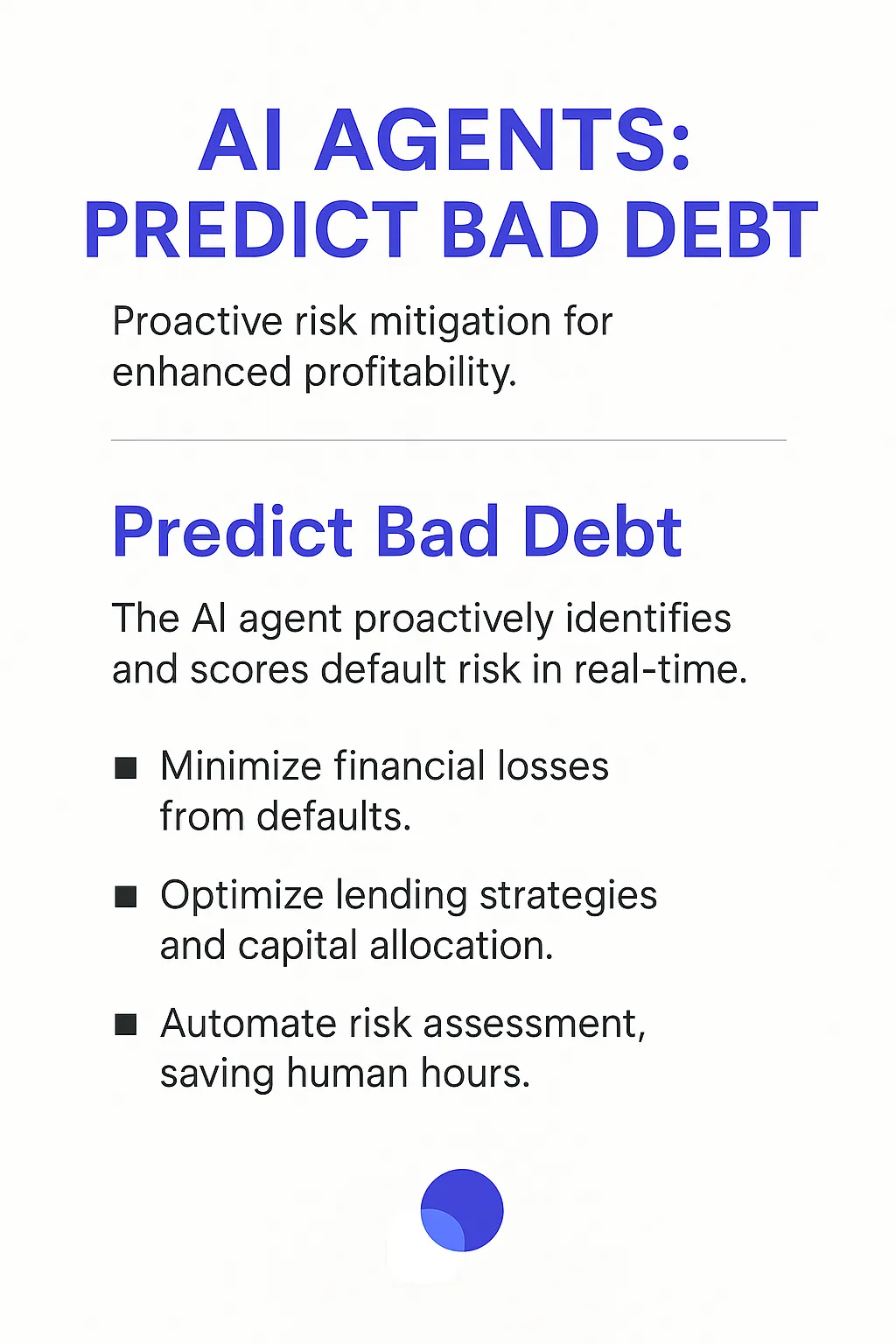

Bad debt prediction AI agents are game-changers for financial institutions and businesses dealing with credit risk. These digital teammates can revolutionize how companies approach risk assessment and debt management. Let's dive into some key processes where they shine:

- Credit Scoring Enhancement: AI agents can analyze vast datasets to refine traditional credit scoring models, incorporating non-traditional data points for a more holistic view of creditworthiness.

- Early Warning Systems: These agents can monitor customer accounts in real-time, flagging potential issues before they escalate into bad debt situations.

- Portfolio Risk Management: AI can continuously assess and rebalance loan portfolios, optimizing for risk and return based on current market conditions and individual loan performance.

- Fraud Detection: By identifying unusual patterns and behaviors, AI agents can help prevent fraudulent activities that often lead to bad debt.

- Customer Segmentation: AI can categorize customers into risk profiles, allowing for tailored debt collection strategies and personalized financial product offerings.

Tasks

Breaking it down further, here are specific tasks where bad debt prediction AI agents can make a significant impact:

- Predictive Analysis: Crunching numbers to forecast which accounts are likely to default in the next 30, 60, or 90 days.

- Document Processing: Automating the review of financial statements, tax returns, and other relevant documents to extract key information for risk assessment.

- Behavioral Analysis: Tracking and interpreting customer spending patterns, payment histories, and other financial behaviors to predict future actions.

- Scenario Modeling: Running multiple "what-if" scenarios to stress-test loan portfolios under various economic conditions.

- Compliance Checking: Ensuring that lending practices and debt collection efforts align with current regulations and best practices.

- Communication Optimization: Determining the most effective times and channels for reaching out to at-risk customers to prevent defaults.

- Data Enrichment: Continuously updating customer profiles with new data from various sources to improve prediction accuracy.

The beauty of these AI agents lies in their ability to learn and adapt. As they process more data and outcomes, their predictions become increasingly accurate. This creates a virtuous cycle where better predictions lead to better decisions, which in turn generate more valuable data for the AI to learn from.

For businesses, this means moving from reactive to proactive debt management. Instead of chasing bad debts after they occur, companies can take preventive measures, potentially saving millions in write-offs and collection costs. It's not just about avoiding losses; it's about optimizing the entire credit ecosystem for both lenders and borrowers.

The potential here is enormous. As these AI agents become more sophisticated, we could see a fundamental shift in how credit risk is assessed and managed across the financial industry. It's a prime example of how AI is not just augmenting human capabilities, but potentially redefining entire business processes.

Industry Use Cases for Bad Debt Prediction AI Agents

The versatility of AI agents in bad debt prediction makes them valuable across various industries. Let's dive into some meaty, industry-specific use cases that showcase how AI can transform workflows and processes in ways that'll make your head spin.

These digital teammates aren't just number crunchers; they're financial fortune tellers on steroids. They're reshaping how businesses approach risk, turning potential financial nightmares into manageable scenarios. From banking behemoths to scrappy startups, everyone's getting in on this AI-powered crystal ball action.

But here's the kicker: these use cases aren't just theoretical pipe dreams. They're real-world applications that are already making waves, saving companies millions, and turning CFOs into office heroes. So buckle up, because we're about to take a wild ride through the landscape of bad debt prediction, AI-style.

Fintech Disruption: Bad Debt Prediction AI in Peer-to-Peer Lending

The peer-to-peer lending industry is ripe for a shake-up, and bad debt prediction AI agents are the perfect disruptors. These digital teammates are poised to transform how P2P platforms assess risk and manage their loan portfolios.

Think about it: traditional credit scores barely scratch the surface of a borrower's financial reality. They're like using a flip phone in the age of smartphones. Bad debt prediction AI agents, on the other hand, are the iPhone 14 Pro of risk assessment.

These AI agents can crunch vast amounts of alternative data - social media activity, spending patterns, even how quickly someone fills out a loan application. They're not just looking at numbers; they're building a holistic financial profile of each borrower.

But here's where it gets really interesting: these AI agents don't just predict risk at the point of loan approval. They're constantly learning and updating their models based on real-time data. If a borrower's circumstances change, the AI can flag potential issues before they become actual defaults.

For P2P platforms, this means lower default rates, higher investor returns, and the ability to serve a broader range of borrowers. It's a win-win-win situation that could potentially double or triple the size of the P2P lending market.

The platforms that embrace these AI agents first will have a significant competitive advantage. They'll be able to offer more competitive rates to low-risk borrowers while still maintaining profitability on higher-risk loans. It's the kind of edge that could turn a scrappy startup into the next fintech unicorn.

But let's be real: implementing these AI agents isn't a walk in the park. It requires a massive shift in how P2P platforms operate. We're talking about overhauling risk assessment processes, retraining staff, and potentially redesigning entire user experiences. It's a big bet, but one with potentially exponential returns.

The P2P lending platforms that successfully integrate bad debt prediction AI agents won't just be participants in the fintech revolution - they'll be leading it. And that's the kind of disruption that gets VCs like me excited.

Real Estate Revolution: Bad Debt Prediction AI in Property Management

The real estate industry is about to experience a seismic shift, and bad debt prediction AI agents are the catalyst. These digital teammates are set to redefine how property management companies assess tenant risk and optimize their rental portfolios.

Traditional tenant screening methods are like using a compass in the age of GPS. They rely heavily on credit scores and income verification, which only tell part of the story. Bad debt prediction AI agents, however, are the Google Maps of tenant assessment - they provide a comprehensive, real-time view of a potential tenant's financial landscape.

These AI agents can analyze a wealth of alternative data points - rental history, utility payment patterns, employment stability, and even lifestyle factors that might impact ability to pay. They're not just looking at historical data; they're predicting future financial behavior with uncanny accuracy.

But the real game-changer is how these AI agents continue to work after a tenant moves in. They monitor ongoing payment patterns, local economic indicators, and even social media sentiment to predict potential payment issues before they occur. This allows property managers to intervene early, offering payment plans or other solutions to keep tenants in their homes and rental income flowing.

For property management companies, this translates to lower eviction rates, reduced vacancy periods, and more stable cash flows. It's a triple threat that could potentially increase net operating income by 15-20% across a portfolio.

The companies that adopt these AI agents first will have a massive competitive advantage. They'll be able to take on riskier tenants confidently, expanding their market while maintaining profitability. It's the kind of edge that could turn a regional player into a national powerhouse.

Implementing these AI agents isn't trivial. It requires a fundamental shift in how property management companies operate. We're talking about overhauling tenant screening processes, retraining leasing agents, and potentially redesigning entire property management systems. It's a significant investment, but one with the potential for outsized returns.

The property management firms that successfully integrate bad debt prediction AI agents won't just be participating in the real estate tech revolution - they'll be defining it. And that's the kind of disruption that makes tech investors sit up and take notice.

Considerations

Technical Challenges

Implementing a Bad Debt Prediction AI Agent isn't a walk in the park. It's more like trying to solve a Rubik's cube blindfolded while riding a unicycle. The first technical hurdle? Data quality. Your AI is only as good as the data it feeds on, and financial data can be messier than a toddler's art project.

You're dealing with a mix of structured and unstructured data from various sources - credit reports, transaction histories, social media activity. Cleaning and normalizing this data is crucial, but it's also a massive time sink. And let's not forget about data privacy. You're handling sensitive financial information, so you need Fort Knox-level security measures.

Then there's the challenge of feature engineering. Identifying the right predictors of bad debt is like finding a needle in a haystack... if the needle kept changing shape. You might think late payments are a dead giveaway, but what about subtle indicators like changes in spending patterns or frequency of bank logins?

Model selection and tuning is another beast. Do you go with a random forest, a neural network, or some fancy ensemble method? Each has its pros and cons, and finding the right balance between accuracy and interpretability is crucial, especially in the financial sector where regulators breathe down your neck.

Operational Challenges

On the operational side, integrating your shiny new AI agent into existing systems is like trying to fit a square peg in a round hole. Legacy systems in financial institutions are often older than the interns working there, and they don't play nice with newfangled AI tech.

Then there's the human factor. Your AI agent might be a whiz at crunching numbers, but it needs to work alongside human analysts. Building trust is key. If your team sees the AI as a threat rather than a digital teammate, you're in for a rough ride.

Model drift is another thorn in your side. Financial markets are as stable as a house of cards in a hurricane. Your model needs constant monitoring and retraining to stay relevant. This means setting up robust monitoring systems and having a team ready to jump in when things go sideways.

Lastly, there's the regulatory minefield. Financial regulations are tighter than a new pair of jeans, and they're constantly evolving. Your AI needs to be explainable and fair, or you'll have regulators knocking on your door faster than you can say "algorithmic bias."

Implementing a Bad Debt Prediction AI Agent is no small feat. It's a complex dance of technical prowess, operational finesse, and regulatory compliance. But get it right, and you've got a powerful tool that can transform risk assessment in the financial sector. Just remember, it's a marathon, not a sprint - and you better be ready for some hurdles along the way.

Embracing the Future of Financial Risk Assessment

Bad Debt Prediction AI Agents are not just another fintech fad - they're the future of risk assessment. These digital teammates are rewriting the rules of the game, offering unprecedented accuracy, real-time insights, and personalized risk profiles. They're democratizing access to sophisticated financial tools, leveling the playing field for businesses of all sizes.

But here's the kicker: we're just scratching the surface of what's possible. As these AI agents continue to evolve, we'll likely see even more innovative applications across various industries. From peer-to-peer lending platforms to property management firms, the potential for disruption is massive.

However, it's not all smooth sailing. Implementing these AI agents comes with significant technical and operational challenges. Data quality, model selection, regulatory compliance - these are just a few of the hurdles businesses will need to overcome.

But for those who can successfully navigate these challenges, the rewards are enormous. We're talking about the potential to dramatically reduce default rates, optimize pricing strategies, and unlock new market opportunities. It's the kind of innovation that separates the market leaders from the also-rans.

In the end, Bad Debt Prediction AI Agents aren't just changing how we assess risk - they're changing the very nature of lending and credit. And for businesses willing to embrace this technology, the future looks bright indeed. The question isn't whether you should adopt this technology, but how quickly you can get on board before your competitors do.