Customer Lifetime Value Prediction AI Agents

Unveiling the Power of AI-Driven Customer Value Forecasting

Customer Lifetime Value Prediction is the art and science of forecasting the total worth of a customer to a business over the entire duration of their relationship. It's like having a crystal ball that shows you not just how much a customer is worth today, but how much they'll be worth tomorrow, next year, and five years from now. This isn't just about predicting future purchases; it's about understanding the full spectrum of value a customer brings, including their potential for referrals, brand advocacy, and even their impact on other customers.

The secret sauce of CLV Prediction lies in its ability to crunch massive amounts of data and extract meaningful patterns. Here are some key features that make it a game-changer:

- Predictive Analytics: Using historical data to forecast future behavior and value.

- Dynamic Segmentation: Grouping customers based on their predicted future value, not just their past actions.

- Real-time Updates: Continuously refining predictions as new data becomes available.

- Multi-channel Integration: Incorporating data from various touchpoints to create a holistic view of the customer.

- Actionable Insights: Providing clear, data-driven recommendations for marketing, sales, and customer service teams.

When you combine these features with AI agents, you get a powerhouse of customer intelligence. These digital teammates don't just crunch numbers; they uncover hidden patterns, adapt to changing behaviors, and provide insights that can reshape your entire customer strategy. It's like having a team of data scientists, psychologists, and fortune tellers working 24/7 to understand your customers at a level that was previously impossible. Predictive Analytics powered by AI agents transforms raw customer data into actionable intelligence that drives business growth.

Benefits of AI Agents for Customer Lifetime Value Prediction

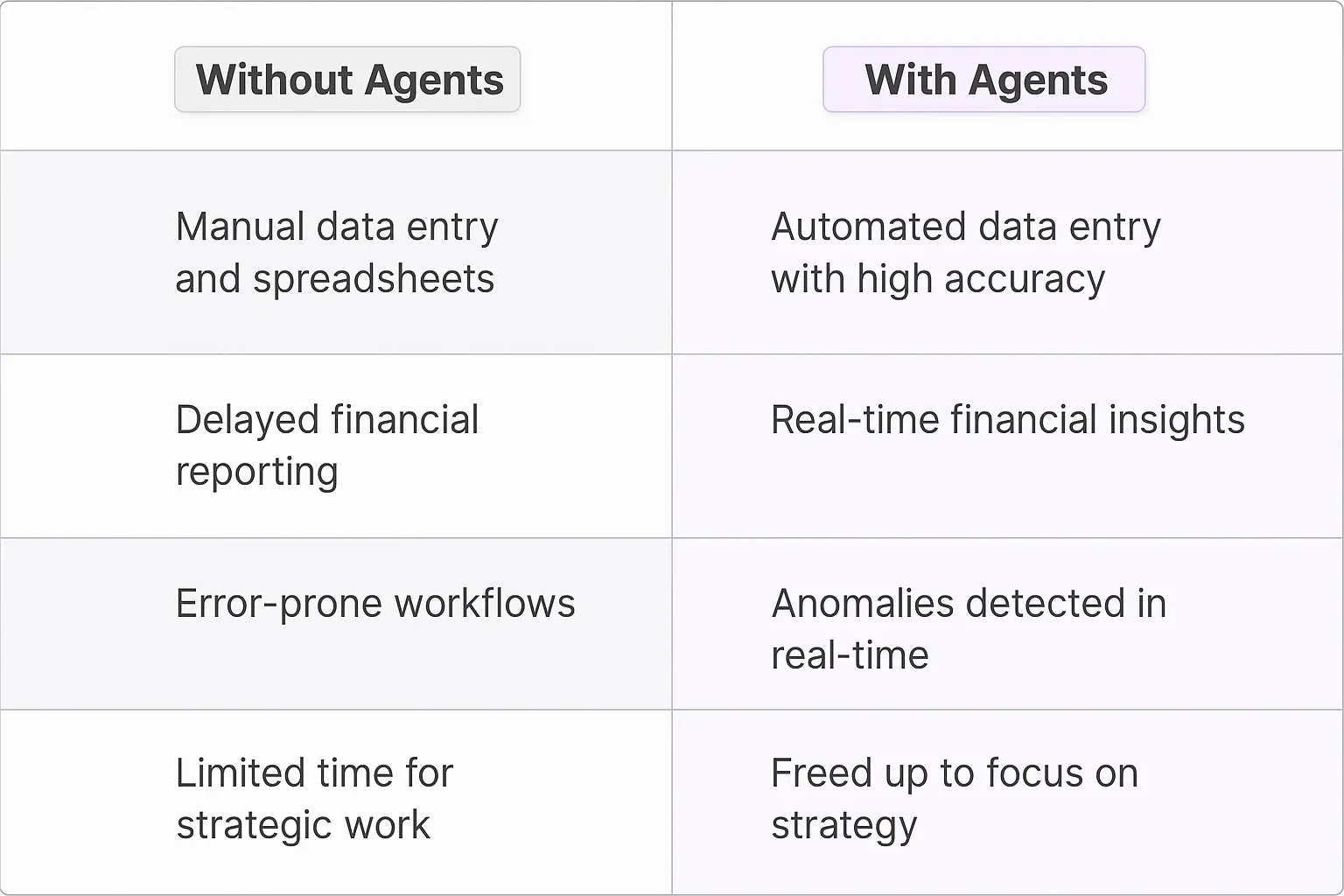

What would have been used before AI Agents?

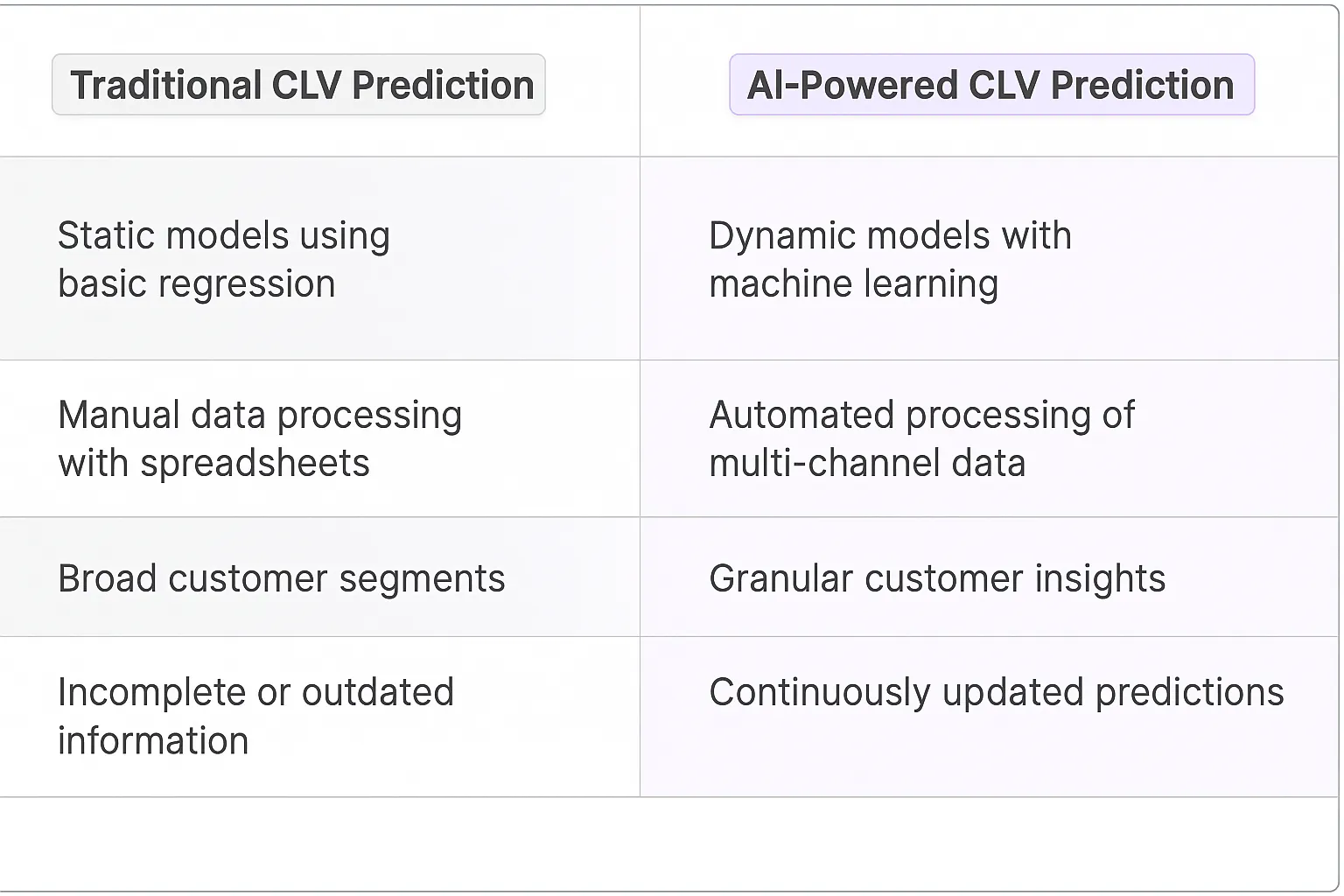

Before AI agents entered the scene, predicting customer lifetime value (CLV) was like trying to forecast the weather with a crystal ball and some educated guesses. Companies relied on static models, basic regression analysis, and a whole lot of Excel spreadsheets. Data scientists spent countless hours crunching numbers, often working with incomplete or outdated information. The result? CLV predictions that were about as reliable as a weather forecast for next month.

Marketing teams would segment customers based on broad categories, missing out on the nuanced behaviors that truly drive long-term value. Sales reps were left to rely on gut feelings and past experiences to prioritize their efforts. Analysts struggled with manual processes that couldn't keep pace with the dynamic nature of customer behavior. It was a world of missed opportunities and misallocated resources.

What are the benefits of AI Agents?

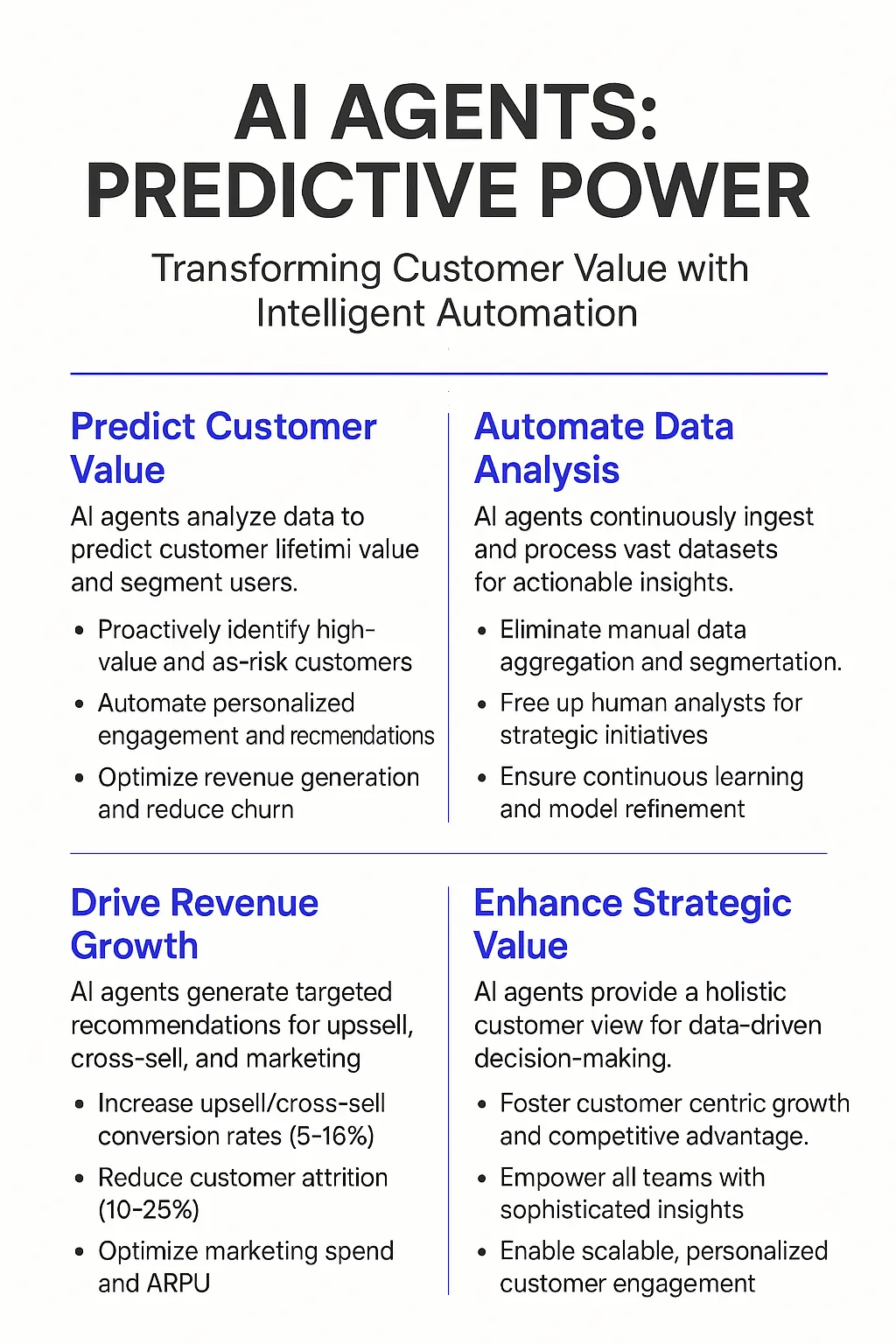

Enter AI agents for CLV prediction, and suddenly we're playing a whole new ballgame. These digital teammates are like having a team of data scientists, psychologists, and fortune tellers working 24/7 to understand your customers. They're not just crunching numbers; they're uncovering patterns and insights that human analysts might miss in a million years.

First off, AI agents can process vast amounts of data in real-time. They're not just looking at purchase history; they're analyzing web behavior, social media interactions, support tickets, and even external factors like economic trends. This holistic view allows for CLV predictions that are frighteningly accurate and constantly updated.

But here's where it gets really interesting: AI agents don't just predict CLV; they explain it. They can tell you why Customer A is likely to be worth 10x more than Customer B over the next five years. This insight is gold for marketers and product teams looking to replicate success and address churn risks.

Moreover, these AI agents are learning and improving with every interaction. They're not static models; they're evolving organisms that get smarter over time. This means your CLV predictions become more accurate and nuanced as you use them, creating a virtuous cycle of improvement.

Perhaps most importantly, AI agents democratize CLV prediction. You no longer need a team of data scientists to get actionable insights. Sales reps can access real-time CLV predictions for each lead, allowing them to focus their efforts where they'll have the biggest impact. Customer success teams can proactively reach out to high-value customers who might be at risk of churning.

In essence, AI agents for CLV prediction are turning what was once a guessing game into a precision sport. They're not just improving predictions; they're fundamentally changing how businesses understand and interact with their customers. And in a world where customer experience is the new battlefield, that's a game-changing advantage.

Potential Use Cases of AI Agents for Customer Lifetime Value Prediction

Processes

Customer Lifetime Value (CLV) prediction is a game-changer for businesses, and AI agents are taking it to the next level. These digital teammates can transform how companies understand and interact with their customers. Let's dive into some key processes where CLV prediction AI agents shine:

- Churn Prevention: AI agents can analyze customer behavior patterns and predict which customers are at risk of churning. They can then trigger personalized retention campaigns before it's too late.

- Upsell and Cross-sell Optimization: By understanding a customer's potential lifetime value, AI agents can identify the best candidates for upselling or cross-selling, maximizing revenue without wasting resources on low-potential customers.

- Customer Segmentation: AI agents can segment customers based on their predicted CLV, allowing businesses to tailor their marketing strategies and resource allocation for each group.

- Pricing Strategy: With accurate CLV predictions, AI agents can help businesses optimize their pricing models to maximize long-term profitability rather than short-term gains.

Tasks

Now, let's break down some specific tasks that CLV prediction AI agents can tackle:

- Data Integration: These digital teammates can pull data from various sources like CRM systems, transaction histories, and customer support logs to create a comprehensive customer profile.

- Predictive Modeling: AI agents can build and continuously refine predictive models using machine learning algorithms to forecast future customer behavior and value.

- Real-time Scoring: As new data comes in, AI agents can update CLV scores in real-time, allowing businesses to make dynamic decisions based on the most current information.

- Actionable Insights Generation: Beyond just crunching numbers, these AI agents can generate actionable insights and recommendations for marketing teams, sales reps, and customer service agents.

- Campaign Performance Analysis: By tracking the impact of marketing campaigns on CLV, AI agents can help businesses refine their strategies and allocate budgets more effectively.

The beauty of CLV prediction AI agents lies in their ability to process vast amounts of data and uncover patterns that humans might miss. They're not just number crunchers; they're strategic partners that can drive business growth by helping companies focus on the right customers at the right time.

As these AI agents become more sophisticated, we'll see them play an increasingly crucial role in shaping customer relationships and driving long-term business success. The companies that embrace this technology early and effectively will have a significant competitive advantage in the customer-centric economy of the future.

Industry Use Cases for Customer Lifetime Value Prediction AI Agents

The versatility of AI agents in Customer Lifetime Value Prediction makes them valuable across various industries. Let's dive into some meaty, industry-specific use cases that showcase how AI can transform workflows and processes.

These digital teammates aren't just fancy calculators - they're reshaping how businesses understand and interact with their customers. From e-commerce to SaaS, from finance to healthcare, CLV prediction AI is becoming the secret weapon for companies looking to play the long game.

But here's the kicker: it's not just about predicting numbers. These AI agents are uncovering hidden patterns, surfacing actionable insights, and fundamentally changing how businesses allocate resources and make strategic decisions. They're the data-driven crystal ball that every CEO wishes they had.

So buckle up. We're about to explore how these AI agents are turning customer data into gold across different sectors. And trust me, once you see what's possible, you'll wonder how businesses ever operated without them.

E-commerce: Predicting High-Value Customers with AI

The e-commerce industry is ripe for disruption with Customer Lifetime Value (CLV) prediction AI agents. These digital teammates are game-changers, offering a level of precision in customer analysis that human teams simply can't match.

Take an online fashion retailer like Stitch Fix. They're already using data science to personalize style recommendations, but imagine cranking that up to eleven with CLV prediction. An AI agent could sift through mountains of data - purchase history, browsing patterns, social media activity, and even macroeconomic trends - to identify which customers are likely to become long-term, high-value patrons.

This isn't just about finding big spenders. It's about uncovering hidden gems - those customers who might start small but have the potential to become brand evangelists and consistent buyers over time. The AI could flag these customers early, allowing the company to roll out the red carpet with personalized experiences, exclusive previews, or tailored loyalty programs.

But here's where it gets really interesting: the AI doesn't just predict, it learns and adapts. As customer behaviors shift (and they always do in fashion), the AI recalibrates its models in real-time. This dynamic approach ensures that Stitch Fix stays ahead of trends, not just in style, but in customer engagement strategies.

The impact? A seismic shift in customer acquisition and retention strategies. Instead of casting a wide net and hoping for the best, Stitch Fix could laser-focus its marketing spend on cultivating relationships with high-potential customers. This isn't just efficient - it's a whole new paradigm for growth in e-commerce.

CLV prediction AI in e-commerce isn't just a tool; it's like having a crystal ball that actually works. It's the difference between playing checkers and three-dimensional chess in the customer loyalty game. And in an industry where customer acquisition costs are skyrocketing, this could be the edge that separates the winners from the also-rans.

Fintech: Unlocking Hidden Value in Banking with CLV AI

Let's talk about how Customer Lifetime Value (CLV) prediction AI is about to flip the script in fintech. Traditional banks have been playing defense for years, watching as nimble startups eat their lunch. But CLV AI? It's the counterpunch they've been waiting for.

Consider a challenger bank like Monzo or Chime. They've got millions of users, but here's the million-dollar question: which ones are gold mines waiting to be tapped? Enter the CLV prediction AI.

This isn't your grandpa's risk assessment model. We're talking about an AI that's ingesting a firehose of data - transaction patterns, savings rates, investment behaviors, even the user's app interaction patterns. It's looking for signals that most humans would miss: the recent grad who's religiously saving 20% of her paycheck, or the side-hustler whose gig economy income is steadily climbing.

The AI isn't just crunching numbers; it's painting a picture of financial trajectories. It might flag a user who's just starting to dip their toes into stock trading. To a human, they might look like a small-time player. But the AI sees the potential for a future power user of investment products.

Here's where it gets spicy: the AI starts tailoring the entire banking experience. That budding investor? They start seeing more sophisticated investment content in their feed. The AI might trigger a "congrats on your first trade" notification with a link to a beginner's investment guide. It's not just reactive; it's proactive, nudging users towards behaviors that increase their lifetime value.

But the real magic happens at scale. The AI is constantly running scenarios, segmenting users into value tiers that go way beyond the traditional "private banking" cutoffs. It's creating a playbook for hyper-personalized banking that makes the old "one size fits all" approach look like banking in the Stone Age.

The implications? Massive. We're talking about a fundamental shift in how banks allocate resources. Instead of showering perks on high-net-worth individuals who might be on their way out, they're identifying and nurturing the next generation of valuable customers. It's like Moneyball for banking - finding undervalued assets and maximizing their potential.

This isn't just a nice-to-have. In a world where switching banks is as easy as a few taps on a smartphone, CLV prediction AI could be the difference between a bank that thrives and one that becomes a cautionary tale in fintech textbooks.

The banks that nail this will create a flywheel effect that's hard to beat. Better prediction leads to better service, which leads to higher customer value, which in turn improves the AI's predictive power. It's a virtuous cycle that could redefine what it means to be a successful bank in the digital age.

CLV prediction AI in fintech isn't just another tool in the toolbox. It's the blueprint for a new era of banking, where every customer interaction is an opportunity to build long-term value. The race is on, and the banks that get this right won't just be playing the game - they'll be changing it entirely.

Considerations

Technical Challenges

Implementing a Customer Lifetime Value (CLV) Prediction AI Agent isn't a walk in the park. It's more like trying to solve a Rubik's cube blindfolded while riding a unicycle. The first hurdle? Data quality and quantity. Your AI is only as good as the data it feeds on, and most companies are sitting on a data swamp rather than a data lake.

Then there's the model selection conundrum. Do you go for a simple regression model or dive into the deep end with neural networks? It's like choosing between a reliable Toyota or a flashy Tesla - both will get you there, but the ride will be very different. And let's not forget about feature engineering - it's the secret sauce that can make or break your CLV predictions.

Scalability is another beast altogether. Your CLV prediction engine needs to handle millions of customers without breaking a sweat. It's like building a bridge that can handle both pedestrians and jumbo jets - not an easy feat.

Operational Challenges

On the operational front, integrating a CLV Prediction AI Agent into existing systems is like performing open-heart surgery while the patient is running a marathon. You need to ensure seamless data flow between your CRM, marketing automation tools, and the AI agent without disrupting day-to-day operations.

Then there's the human factor. Getting your team to trust and act on AI-generated predictions is like convincing a cat to take a bath - possible, but not without some scratches. You'll need to invest in training and change management to ensure your team doesn't treat the AI agent like a magic 8-ball.

Privacy and compliance are the elephants in the room. With regulations like GDPR and CCPA, your CLV Prediction AI Agent needs to be a privacy ninja, handling sensitive customer data with the utmost care. One misstep, and you're looking at fines that could make your CFO faint.

Lastly, there's the ROI question. Implementing a CLV Prediction AI Agent is a significant investment, and proving its worth can be tricky. It's like justifying a gym membership - the benefits are there, but they're not always immediately visible on the balance sheet.

The Future of Customer-Centric Business: AI-Powered CLV Prediction

Customer Lifetime Value Prediction powered by AI agents isn't just another tech buzzword – it's a fundamental shift in how businesses understand and interact with their customers. This technology is turning what was once a guessing game into a precision sport, allowing companies to allocate resources more effectively, personalize experiences at scale, and make data-driven decisions that drive long-term growth.

The companies that embrace this technology early and effectively will have a significant edge in the customer-centric economy of the future. They'll be able to identify high-potential customers earlier, reduce churn more effectively, and create personalized experiences that foster loyalty and drive revenue.

But here's the kicker: this is just the beginning. As AI continues to evolve, we'll see even more sophisticated CLV prediction models that can factor in complex variables like market trends, competitive landscapes, and even global events. The businesses that stay ahead of this curve won't just be playing the game better – they'll be changing the rules entirely.

In the end, CLV Prediction with AI agents isn't just about predicting numbers; it's about understanding people. And in a world where customer experience is the new battlefield, that understanding is worth its weight in gold.