Invoice Processing Automation AI Agents

Revolutionizing Financial Operations with AI-Powered Invoice Processing

What is Invoice Processing Automation?

Invoice Processing Automation is the use of technology to streamline and digitize the handling of invoices from receipt to payment. It's the financial equivalent of upgrading from a horse-drawn carriage to a Tesla. This system takes the tedious, error-prone manual process of dealing with invoices and turns it into a smooth, largely hands-off operation. But when you add AI agents to the mix, you're not just automating - you're supercharging the entire process with machine learning capabilities that continuously improve over time.

Key Features of Invoice Processing Automation

- Intelligent Data Extraction: AI agents can pull relevant information from invoices with uncanny accuracy, regardless of format or layout.

- Automated Validation: The system cross-checks extracted data against purchase orders and other records, flagging discrepancies without human intervention.

- Smart Routing: Invoices are automatically sent to the right approvers based on predefined rules and learned patterns.

- Continuous Learning: The AI improves its performance over time, adapting to new invoice formats and company-specific quirks.

- Integration Capabilities: These systems seamlessly connect with existing ERP and accounting software, creating a unified financial ecosystem.

- Real-time Analytics: Provides instant insights into cash flow, spending patterns, and vendor relationships.

Benefits of AI Agents for Invoice Processing Automation

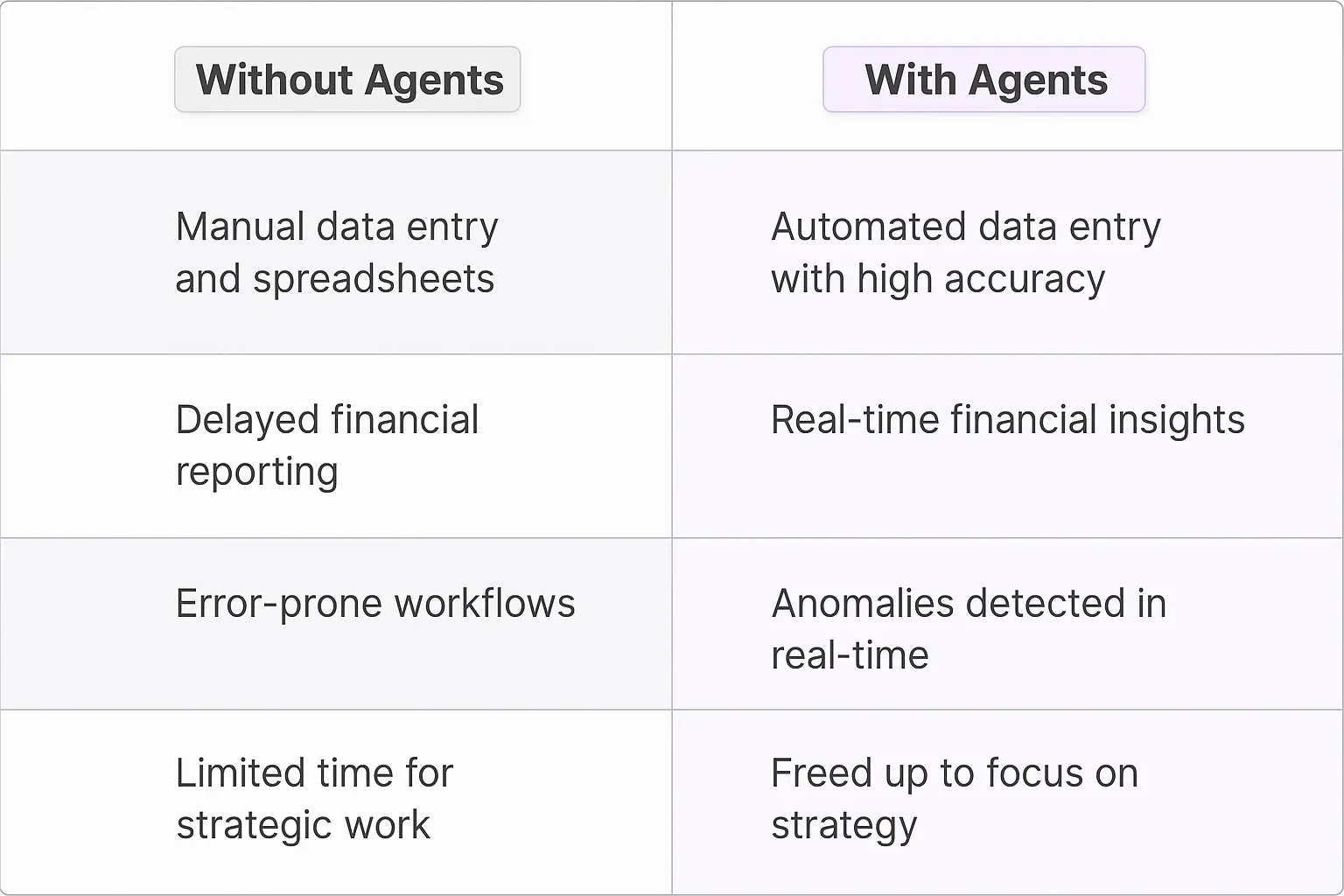

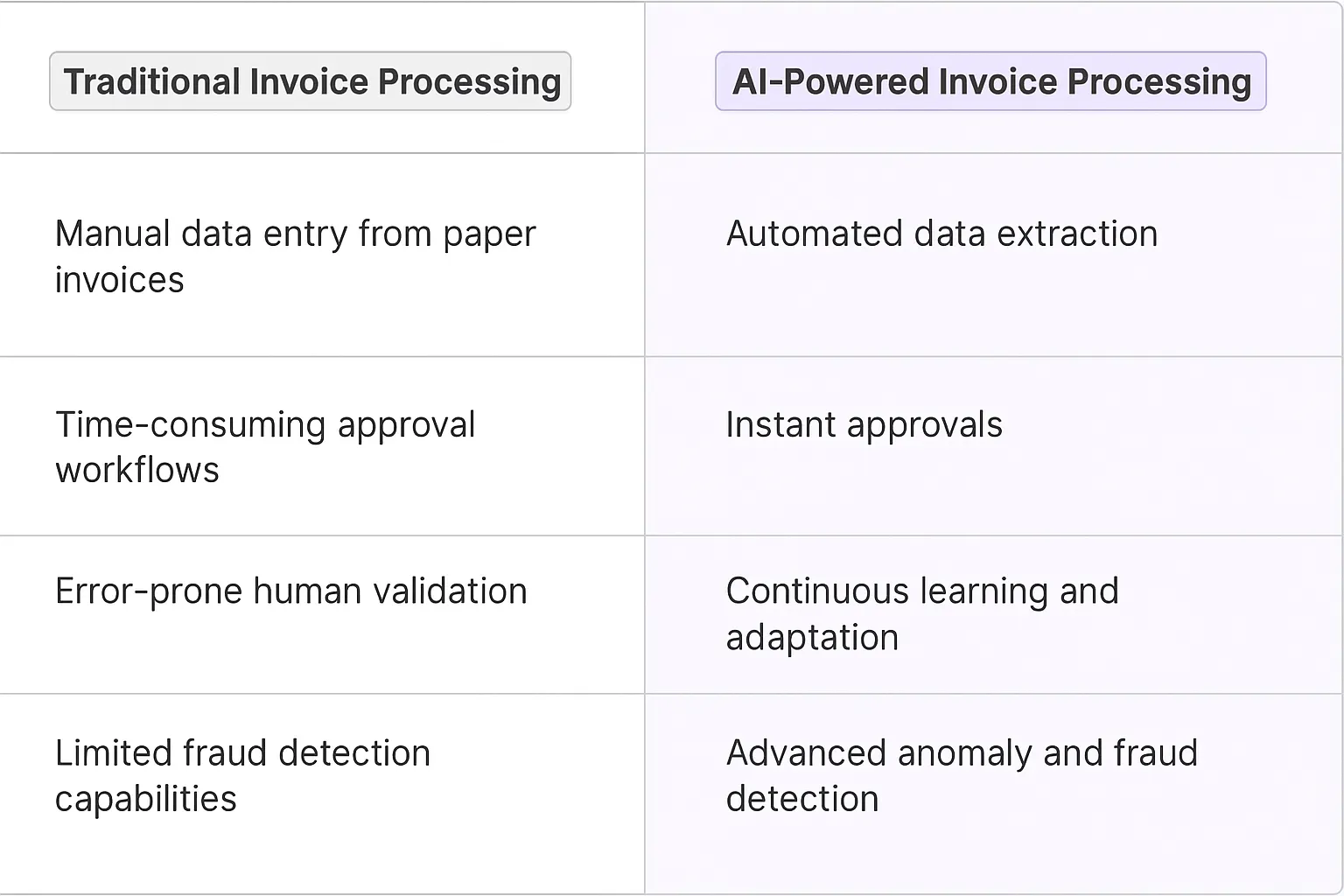

What would have been used before AI Agents?

Before AI agents entered the scene, invoice processing was a tedious, manual slog. Picture armies of accountants hunched over desks, squinting at paper invoices, and manually keying data into clunky legacy systems. It was slow, error-prone, and about as exciting as watching paint dry.

Companies tried to improve this with basic OCR (Optical Character Recognition) and rule-based systems, but these were like putting a Band-Aid on a broken leg. They helped a bit, but still required significant human oversight and couldn't handle complex or non-standard invoices.

What are the benefits of AI Agents?

AI agents are game-changers for invoice processing. They're not just faster; they're smarter, more adaptable, and continuously improving. Here's why they're a big deal:

- Superhuman accuracy: AI agents can extract data from invoices with precision that makes human efforts look amateur. They can handle messy handwriting, weird formats, and even learn to interpret company-specific quirks.

- Speed demons: These digital teammates process invoices at a pace that would make The Flash jealous. What used to take days now happens in seconds.

- Adaptability on steroids: Unlike rigid rule-based systems, AI agents can handle curveballs. New invoice format? No problem. They learn and adapt on the fly.

- 24/7 workhorses: AI agents don't need coffee breaks or sleep. They can churn through invoices round the clock, ensuring your cash flow never hits a bottleneck.

- Fraud detection ninjas: These AI agents don't just process; they protect. They can spot anomalies and potential fraud that human eyes might miss.

- Integration maestros: AI agents play well with others. They can seamlessly connect with your existing financial systems, creating a smooth, automated workflow.

- Scalability without the growing pains: As your business grows, your AI agent team scales effortlessly. No need to hire and train new staff for every uptick in invoice volume.

The bottom line? AI agents for invoice processing aren't just an upgrade; they're a quantum leap. They're transforming a necessary evil of business operations into a strategic advantage. Companies that embrace this tech will find themselves with more accurate financials, faster cash cycles, and teams freed up to focus on high-value work. It's not just about doing things faster; it's about unlocking new possibilities in financial operations and business intelligence.

Potential Use Cases of AI Agents with Invoice Processing Automation

Processes

Invoice processing automation AI agents are game-changers in the financial operations space. They're not just tools; they're digital teammates that can transform how businesses handle their invoicing workflows. Let's dive into some key processes where these AI agents shine:

- Data entry and validation: AI agents can scan invoices, pull out relevant information, and cross-check it against existing records. This process, which used to be a time-sink for accounting teams, now happens in seconds.

- Invoice categorization: These digital teammates can automatically sort invoices by vendor, department, or expense type. It's like having a hyper-efficient filing clerk working 24/7.

- Approval routing: AI agents can learn your company's approval hierarchies and automatically route invoices to the right decision-makers. This cuts down on those annoying email chains and speeds up the whole process.

- Payment scheduling: Once approved, AI agents can queue up payments based on due dates and your company's cash flow situation. It's like having a personal financial planner for your accounts payable.

- Anomaly detection: These AI agents can flag unusual invoices or spending patterns. They're essentially your first line of defense against fraud or errors.

Tasks

Breaking it down further, here are some specific tasks where invoice processing AI agents excel:

- OCR and data capture: They can read and interpret both digital and scanned paper invoices, extracting key data points with high accuracy.

- PO matching: AI agents can automatically match invoices to purchase orders, flagging any discrepancies for human review.

- Duplicate detection: They can identify and flag potential duplicate invoices, saving your company from overpaying.

- Currency conversion: For businesses dealing with international vendors, AI agents can handle real-time currency conversions.

- Compliance checking: These digital teammates can ensure invoices meet tax and regulatory requirements, reducing the risk of compliance issues.

- Vendor communication: AI agents can draft and send follow-up emails for missing information or discrepancies, keeping the process moving without human intervention.

- Reporting and analytics: They can generate real-time reports on invoice processing metrics, giving finance leaders actionable insights into cash flow and spending patterns.

The beauty of these AI agents is that they're not just executing tasks; they're learning and improving over time. They're adapting to your company's unique invoicing patterns and continuously optimizing the process. It's like having a team member who's always on, always learning, and never needs a coffee break.

For finance teams, this means shifting from data entry and manual checks to higher-value activities like financial strategy and vendor relationship management. It's not about replacing humans; it's about augmenting their capabilities and freeing them up to focus on what humans do best: creative problem-solving and strategic thinking.

As these AI agents become more sophisticated, we're moving towards a future where the entire accounts payable process could be largely automated, with humans stepping in only for exception handling and strategic decisions. This isn't just incremental improvement; it's a fundamental reimagining of how financial operations can work.

Industry Use Cases: AI Agents Transforming Invoice Processing

AI agents are reshaping invoice processing across industries, bringing a level of efficiency and accuracy that's hard to ignore. These digital teammates aren't just tools; they're game-changers that are redefining how businesses handle their financial paperwork. Let's dive into some real-world scenarios where AI is making waves in invoice management, showcasing how different sectors are leveraging this tech to stay ahead of the curve.

From manufacturing plants to bustling hospitals, AI agents are tackling invoice processing with a finesse that's turning heads. They're not just speeding things up; they're uncovering insights and patterns that human eyes might miss. It's like having a financial whiz working 24/7, but without the coffee breaks. These AI-powered solutions are becoming the secret weapon for companies looking to sharpen their competitive edge in the digital age.

So, let's explore how various industries are putting AI to work in their invoice processing pipelines. You'll see firsthand how these digital teammates are not just meeting expectations but blowing them out of the water, creating ripple effects that touch every aspect of business operations.

Manufacturing: Transforming Invoice Processing with AI

The manufacturing industry is ripe for a shake-up in invoice processing. Let's face it, most factories are still drowning in paper invoices, manual data entry, and approval bottlenecks. It's like watching a steam engine try to keep up with a Tesla.

Enter AI-powered invoice processing agents. These digital teammates are about to flip the script on how manufacturers handle their finances. Picture a bustling factory floor where the accounts payable team isn't chained to their desks, manually keying in data from stacks of invoices. Instead, they're strategizing on cost-saving measures and supplier relationships.

Here's the kicker: these AI agents don't just scan and input data. They're learning machines that get smarter with every invoice they process. They start recognizing patterns in supplier billing, flagging discrepancies that human eyes might miss. Suddenly, you're catching billing errors before they become costly mistakes.

But it gets better. These AI agents can integrate with your existing ERP systems, automatically routing invoices for approval based on predefined rules. No more invoices gathering dust on someone's desk. The system knows who needs to sign off and nudges them until it's done. It's like having a hyper-efficient, never-sleeping accounts payable clerk who never takes a coffee break.

The real game-changer? Real-time financial insights. With AI processing invoices at lightning speed, manufacturers can get an up-to-the-minute view of their cash flow. This isn't just about paying bills faster; it's about making smarter decisions on everything from production schedules to supplier negotiations.

We're talking about a seismic shift in how manufacturers manage their finances. It's not just about cutting costs or saving time (though it does both in spades). It's about unlocking a level of financial agility and insight that was previously unthinkable in an industry often bogged down by legacy systems and processes.

The manufacturers who jump on this AI train early are going to leave their competitors in the dust. They'll be operating with a level of financial precision and speed that will make traditional invoice processing look like it belongs in a museum. Welcome to the future of manufacturing finance – it's automated, it's intelligent, and it's going to change everything.

Retail: AI-Driven Invoice Processing Reshapes Financial Operations

The retail industry is on the cusp of a major transformation in financial operations, and AI-powered invoice processing is leading the charge. This isn't just about ditching paper invoices; it's a fundamental reimagining of how retailers handle their finances.

Think about the typical retail accounts payable department. It's usually a maze of spreadsheets, manual data entry, and endless email chains for approvals. Now, drop an AI agent into this mix. Suddenly, you've got a digital teammate that's processing invoices 24/7, learning from every transaction, and getting smarter by the minute.

These AI agents are doing more than just OCR scanning. They're pattern recognition machines that start to understand the nuances of your business. They learn which suppliers consistently offer the best terms, which stores are processing invoices most efficiently, and where the bottlenecks in your approval process lie.

But here's where it gets really interesting. In retail, timing is everything. An AI agent processing invoices can sync with inventory management systems to optimize cash flow. It knows when you're running low on hot-selling items and can prioritize those invoices to keep the shelves stocked. It's like having a financial crystal ball that helps you balance inventory costs with sales trends.

The impact on seasonal planning is huge. Retailers can now process and analyze supplier invoices from previous years at lightning speed, informing purchasing decisions for the upcoming season. This level of data-driven decision making was simply not possible when humans were manually keying in every invoice.

And let's talk about fraud detection. In an industry where invoice fraud is a constant threat, these AI agents are like having a team of forensic accountants working around the clock. They can spot anomalies in invoicing patterns that might indicate attempted fraud, potentially saving retailers millions.

The ripple effects go beyond just the finance department. With AI handling the grunt work of invoice processing, retail finance teams can focus on strategic initiatives. They're freed up to negotiate better terms with suppliers, optimize the supply chain, and work on innovative financing models that could give their company a competitive edge.

This shift is going to separate the retail winners from the losers. The companies that embrace AI-driven invoice processing aren't just going to save on back-office costs. They're going to operate with a level of financial agility and insight that will let them respond to market changes faster, negotiate from a position of strength with suppliers, and make smarter, data-driven decisions across the board.

We're looking at a future where retail financial operations are proactive, not reactive. Where cash flow forecasting is accurate to the day, not the month. Where the finance team is a strategic partner in the business, not just a cost center. That's the power of AI in invoice processing, and it's going to reshape retail as we know it.

Considerations

Technical Challenges

Implementing an invoice processing automation AI agent isn't a walk in the park. It's more like trying to teach a robot to dance salsa while juggling flaming torches. The first hurdle? Data diversity. Invoices come in more flavors than a hipster ice cream shop - PDFs, scanned images, emails, even handwritten notes from that one vendor who refuses to enter the digital age.

OCR (Optical Character Recognition) is your first line of defense, but it's far from perfect. It's like trying to read doctor's handwriting after a double espresso - sometimes you nail it, sometimes you're left scratching your head. And let's not forget about those fancy invoices with logos, watermarks, and enough design elements to make a graphic designer weep. Your AI needs to separate the wheat from the chaff, focusing on the important data while ignoring the noise.

Then there's the integration nightmare. Your shiny new AI agent needs to play nice with existing systems - ERP, accounting software, payment platforms. It's like introducing a new player to a well-established sports team mid-season. There will be growing pains, miscommunications, and the occasional spectacular fumble.

Operational Challenges

On the operational front, you're essentially asking your team to trust a digital teammate with handling money. It's like handing your credit card to a stranger and hoping they don't go on a shopping spree. Building that trust takes time, and there will be skeptics. You'll need a robust validation process to catch any AI hiccups before they turn into full-blown financial snafus.

Training the AI is another beast altogether. It's not just about feeding it data; it's about teaching it the nuances of your business. Every company has its quirks - that one supplier who always forgets to include the PO number, or the client who insists on using their own invoice template. Your AI needs to learn these idiosyncrasies, which means a lot of hand-holding in the early stages.

And let's talk about change management. Implementing an AI agent for invoice processing is like telling your accounting team that their trusty abacus is being replaced by a quantum computer. There will be resistance, confusion, and probably a few existential crises. You need a solid plan to retrain your team, redefine roles, and reassure everyone that the AI is here to augment, not replace.

Lastly, there's the ever-present specter of compliance and security. Your AI agent will be handling sensitive financial data, making it a juicy target for cybercriminals. You need Fort Knox-level security measures, coupled with a compliance strategy that would make a tax auditor smile. It's a delicate balance between efficiency and security, like trying to sprint while carrying a glass of water - without spilling a drop.

The Future of Financial Operations: AI-Powered Invoice Processing

Invoice Processing Automation powered by AI agents isn't just a tool; it's a paradigm shift in financial operations. It's taking a process that was once a necessary evil and turning it into a strategic asset. Companies that adopt this technology aren't just saving time and reducing errors - they're gaining a competitive edge through better cash flow management, improved vendor relationships, and data-driven financial insights.

But here's the kicker: this is just the beginning. As AI continues to evolve, we're looking at a future where invoice processing becomes predictive rather than reactive. Imagine a system that not only processes invoices but anticipates cash flow needs, suggests optimal payment timing, and even negotiates better terms with vendors. That's the trajectory we're on.

The companies that embrace this technology now will be the ones setting the pace in their industries tomorrow. They'll operate with a level of financial agility and insight that will make traditional methods look like they belong in a museum. So, the question isn't whether to adopt AI-powered invoice processing - it's how quickly can you get on board before your competitors do.