Profit Margin Analysis AI Agents

The Evolution of Profit Margin Analysis in the AI Era

What is Profit Margin Analysis?

Profit margin analysis is the financial X-ray of a business. It's the process of dissecting a company's revenue and costs to understand how efficiently it's turning sales into profits. But in today's fast-paced business environment, traditional methods of analysis are like trying to catch a bullet train with a butterfly net. That's where AI agents come in, turning this crucial financial practice into a real-time, predictive powerhouse.

Key Features of Profit Margin Analysis

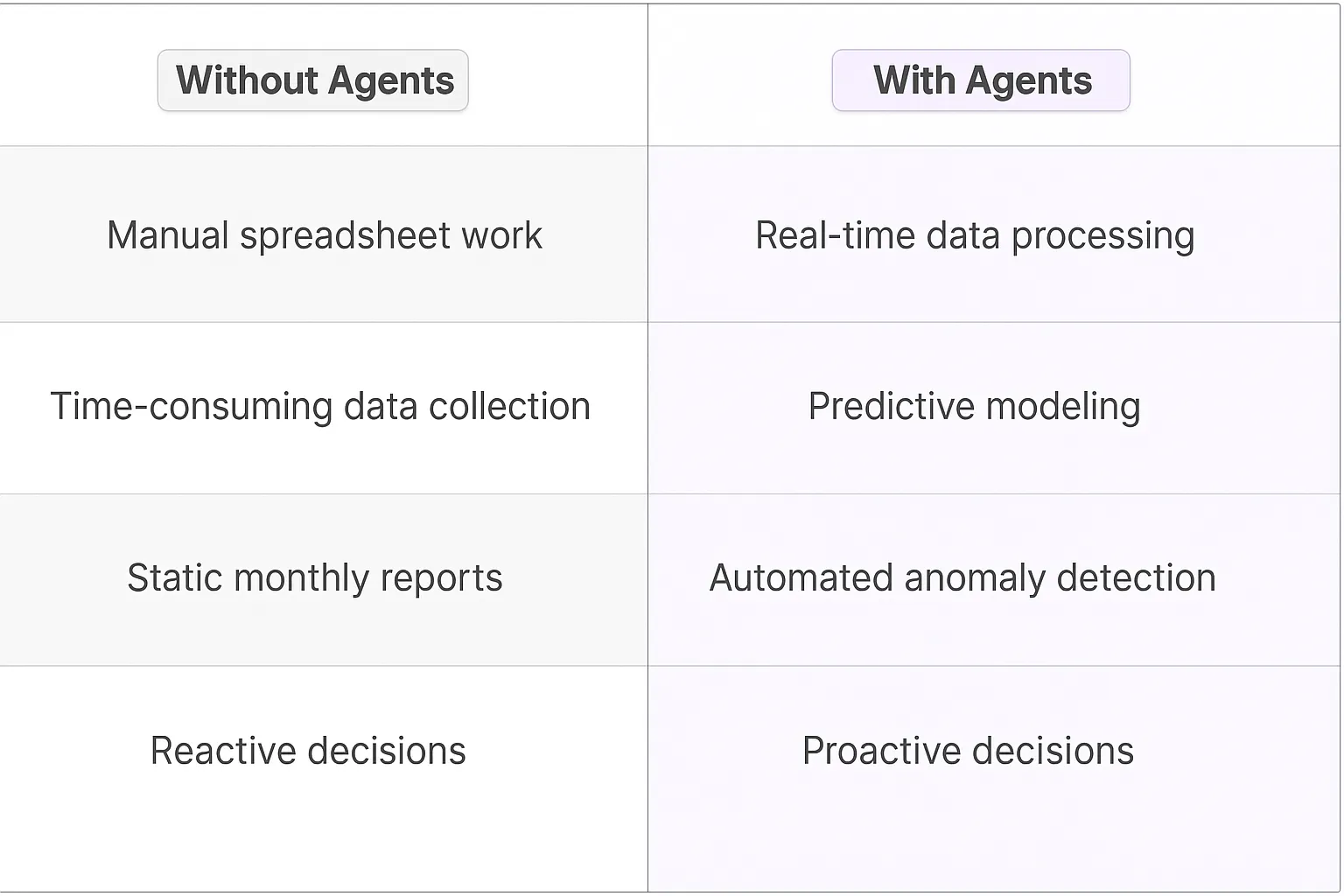

AI-driven profit margin analysis isn't just about crunching numbers faster. It's about unlocking insights that were previously hidden in the data noise. These digital teammates bring several game-changing features to the table:1. Real-time analysis: No more waiting for month-end reports. AI agents provide instant insights as data flows in.2. Predictive modeling: They don't just tell you what happened, but what's likely to happen next.3. Holistic data integration: AI agents can pull in data from multiple sources, including external market factors, for a 360-degree view.4. Automated anomaly detection: They can spot irregularities that might impact profit margins before they become problems.5. Scenario modeling: AI can run thousands of "what-if" scenarios in seconds, stress-testing your profit margins against various market conditions.These features aren't just nice-to-haves; they're becoming essential in a business landscape where margins can make or break a company's future.

Benefits of AI Agents for Profit Margin Analysis

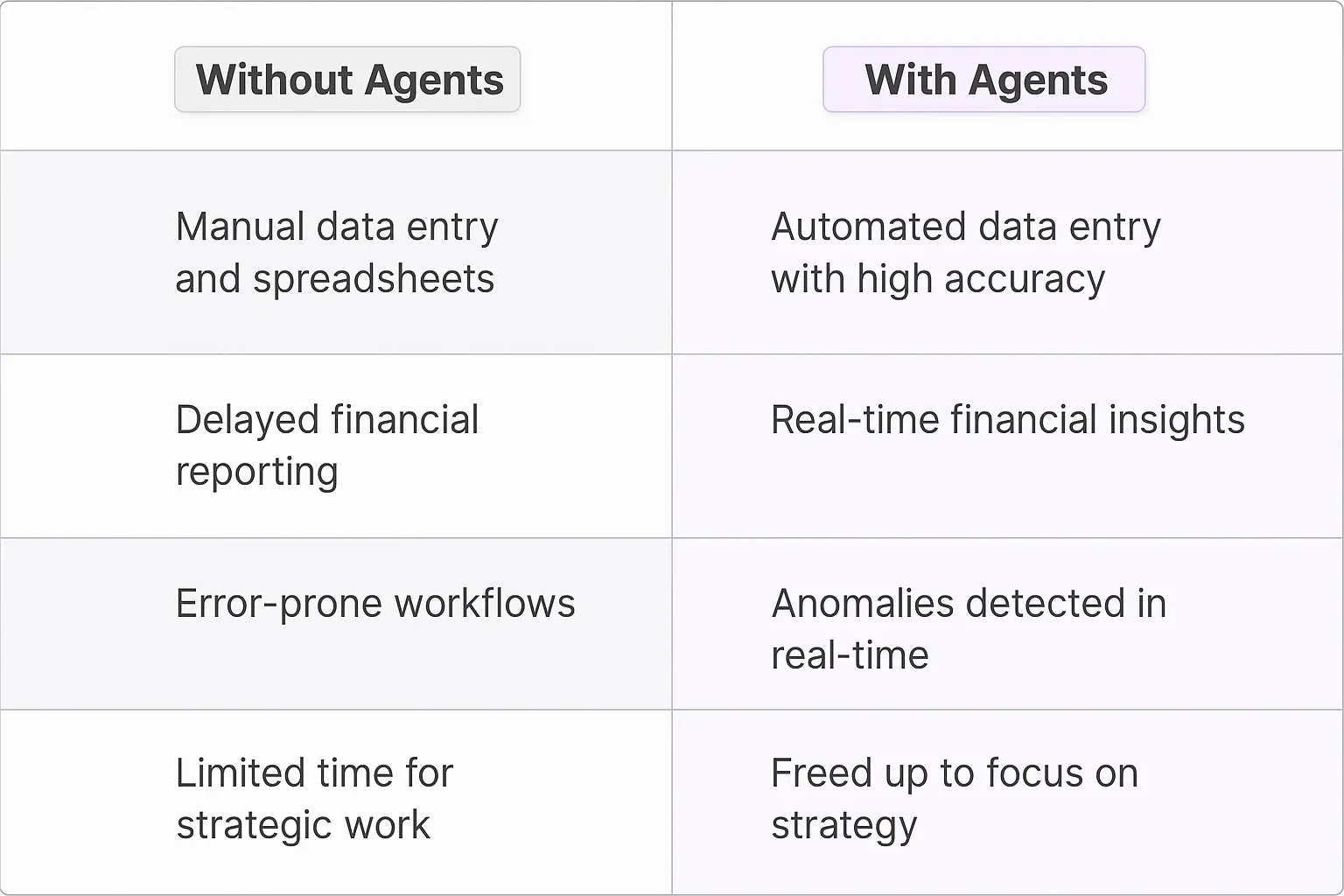

What would have been used before AI Agents?

Before AI agents entered the scene, profit margin analysis was a tedious, time-consuming process. Finance teams would spend hours, if not days, poring over spreadsheets, manually crunching numbers, and trying to make sense of complex financial data. It was like trying to solve a Rubik's cube blindfolded – possible, but incredibly frustrating and prone to errors.

Companies relied heavily on traditional business intelligence tools, which, while useful, often provided static insights that quickly became outdated in our rapidly changing business landscape. These tools were like using a map from the 1990s to navigate today's cities – you might eventually get where you're going, but you'd miss out on all the new shortcuts and developments along the way.

What are the benefits of AI Agents?

Enter AI agents for profit margin analysis, and suddenly it's like we've upgraded from a bicycle to a Tesla. These digital teammates are transforming the way businesses approach financial analysis, offering a suite of benefits that are reshaping the landscape of financial decision-making.

First off, AI agents bring speed and accuracy to a whole new level. They can process vast amounts of financial data in seconds, identifying patterns and trends that would take human analysts weeks to uncover. It's like having a financial savant on your team who never sleeps and never makes calculation errors.

But speed is just the beginning. The real game-changer is the depth of insights these AI agents can provide. They don't just crunch numbers; they contextualize data, considering market trends, historical performance, and even external factors like economic indicators. This holistic approach allows businesses to make more informed decisions, spotting potential issues before they become problems and identifying opportunities that might have been overlooked.

Moreover, AI agents are constantly learning and evolving. Unlike traditional tools that require manual updates, these digital teammates are continuously improving their analysis based on new data and outcomes. It's like having a financial advisor who gets smarter with every decision you make.

Perhaps most importantly, AI agents democratize financial analysis. They make complex financial insights accessible to team members across the organization, not just those with advanced financial degrees. This broader access to financial intelligence can foster a more financially savvy culture throughout the company, leading to better decision-making at all levels.

In essence, AI agents for profit margin analysis are not just tools; they're catalysts for a fundamental shift in how businesses understand and optimize their financial performance. They're turning financial analysis from a rear-view mirror activity into a real-time, predictive powerhouse. And in today's competitive business landscape, that's not just an advantage – it's a necessity.

Potential Use Cases of AI Agents for Profit Margin Analysis

Processes

Profit margin analysis is a critical process for businesses of all sizes. AI agents can transform this traditionally time-consuming task into a dynamic, real-time operation. These digital teammates can continuously monitor financial data, spot trends, and provide actionable insights faster than any human analyst.

One key process where AI shines is in predictive modeling. By analyzing historical data and current market conditions, these agents can forecast future profit margins with impressive accuracy. This allows businesses to make proactive decisions rather than reactive ones.

Another process ripe for AI enhancement is competitive analysis. These agents can scrape publicly available data on competitors' pricing, product offerings, and financial reports to provide a comprehensive view of the competitive landscape and its impact on profit margins.

Tasks

At a more granular level, AI agents excel at numerous tasks within the profit margin analysis workflow. They can automatically categorize expenses, flagging anomalies or misclassifications that might skew margin calculations. This level of detail ensures that profit margin figures are always based on clean, accurate data.

These digital teammates can also perform sensitivity analyses, running thousands of simulations to determine how changes in various factors - from raw material costs to pricing strategies - might affect profit margins. This task, which would take a human analyst days or weeks, can be completed in minutes.

AI agents are also adept at generating customized reports. They can pull relevant data, create visualizations, and even draft executive summaries, freeing up human analysts to focus on strategy and decision-making rather than report compilation.

In the world of e-commerce, these agents can continuously monitor pricing across multiple platforms, suggesting price adjustments to maintain optimal profit margins in real-time. This dynamic pricing capability can be a game-changer in competitive markets.

Lastly, AI agents can serve as always-on financial advisors, alerting decision-makers to potential issues or opportunities related to profit margins. Whether it's a sudden spike in costs or an unexpected market shift, these digital teammates ensure that nothing slips through the cracks.

The integration of AI agents into profit margin analysis isn't just about efficiency - it's about unlocking new levels of financial intelligence and agility. As businesses navigate increasingly complex and fast-paced markets, these digital teammates will become indispensable allies in the quest for sustainable profitability.

Industry Use Cases for Profit Margin Analysis AI Agents

The profit margin analysis game is changing, and AI agents are the MVPs. These digital teammates are reshaping how businesses across sectors dissect their financial performance. Let's dive into some real-world scenarios where AI is not just crunching numbers, but delivering insights that can make or break a company's bottom line.

From retail to manufacturing, healthcare to tech startups, AI agents are becoming the secret weapon for CFOs and financial analysts. They're not just tools; they're becoming integral team members, offering a level of analysis that combines speed, accuracy, and predictive power in ways that were once the stuff of sci-fi.

But here's the kicker: it's not about replacing human expertise. It's about augmenting it. These AI agents are like having a financial savant on call 24/7, one that never sleeps, never takes a coffee break, and can process vast amounts of data in seconds. They're changing the game by allowing humans to focus on strategy while they handle the heavy lifting of data analysis.

So, let's explore how different industries are leveraging these AI powerhouses to dissect profit margins, uncover hidden opportunities, and stay ahead in an increasingly competitive landscape. The examples we're about to dive into aren't just theoretical – they're happening right now, reshaping industries and redefining what's possible in financial analysis.

Retail: Profit Margin Optimization with AI

The retail industry is a perfect playground for profit margin analysis AI agents. These digital teammates can dive deep into the complex web of pricing, inventory, and consumer behavior data that modern retailers swim in daily.

Take a multi-channel clothing retailer, for instance. They're juggling thousands of SKUs across physical stores and e-commerce platforms. Each product has its own cost structure, seasonality, and demand curve. It's a data analyst's dream - or nightmare, depending on how you look at it.

Enter the profit margin analysis AI agent. This isn't just a fancy spreadsheet - it's a dynamic, learning system that can crunch numbers faster than a team of caffeinated accountants. The AI can continuously monitor sales data, correlate it with external factors like weather patterns or social media trends, and suggest real-time pricing adjustments.

But here's where it gets interesting: the AI doesn't just look at individual product margins. It considers the entire ecosystem of the store. It might recommend keeping the price of a low-margin item steady because data shows it often leads to high-margin companion purchases. Or it could suggest a flash sale on winter coats in August, not because it's intuitive, but because the data reveals a pattern of early-bird shoppers willing to pay premium prices for first picks.

The real power comes from the AI's ability to learn and adapt. As it observes the results of its recommendations, it refines its models. Maybe it notices that profit margins spike when certain products are displayed together in-store or featured side-by-side online. It can then feed this insight back to the merchandising team, creating a virtuous cycle of optimization.

For retailers, this level of granular, dynamic profit margin analysis could be the difference between thriving and barely surviving in an industry where margins are often razor-thin. It's not about replacing human decision-making, but augmenting it with a level of data processing and pattern recognition that's simply beyond human capacity.

The end result? A retail operation that's not just more profitable, but more responsive to customer needs and market trends. It's the kind of edge that can turn a good retailer into a great one, all powered by the tireless calculations of an AI agent working behind the scenes.

Manufacturing: AI-Driven Profit Margin Optimization

Let's talk about how AI is reshaping profit margins in manufacturing. This isn't your grandfather's factory floor anymore. We're seeing a seismic shift in how manufacturers approach profitability, and AI is at the epicenter.

Consider a mid-sized auto parts manufacturer. They're not just competing on price anymore; they're in a constant battle for efficiency. Every cent saved on production can mean the difference between winning or losing a contract. This is where profit margin analysis AI agents come into play, and they're not just crunching numbers - they're redefining the game.

These AI agents are like having a team of genius engineers and accountants working 24/7, but with superhuman abilities to process data. They're ingesting information from every corner of the operation - from raw material costs and energy usage to machine downtime and labor productivity. But here's the kicker: they're not just reporting on what happened yesterday. They're predicting what will happen tomorrow, next week, next month.

One of the most fascinating applications I've seen is in dynamic pricing for custom orders. The AI agent can instantly calculate the profitability of a potential order, factoring in current inventory levels, production schedules, and even predictive maintenance needs of the machinery. It's not just saying "yes" or "no" to an order; it's suggesting the optimal price point that balances competitiveness with profitability.

But it goes deeper. These AI agents are starting to influence product design itself. By analyzing profit margins across thousands of parts and variations, they're identifying design tweaks that could shave off production costs without compromising quality. We're talking about changes that human engineers might never spot - like suggesting a 2% increase in the radius of a curve that reduces material waste by 5%.

The real magic happens when these AI agents start to learn and adapt. They're not static systems; they're constantly refining their models based on real-world results. Did that price adjustment actually lead to increased orders? Did the predicted maintenance schedule align with actual machine breakdowns? The AI uses this feedback to get smarter, more accurate, and more valuable over time.

For manufacturers, this level of profit margin analysis is like giving them X-ray vision into their operations. It's not about replacing human judgment; it's about empowering decision-makers with insights they could never access before. The plant manager can now see not just what's happening on the floor, but what's likely to happen next week, next month, next year.

The implications are huge. We're looking at a future where manufacturing becomes increasingly responsive and adaptive. Profit margins won't just be analyzed; they'll be actively managed and optimized in real-time. It's a shift that could redefine competitiveness in the manufacturing sector, separating the data-driven leaders from the laggards.

In the end, these AI agents aren't just tools; they're becoming core to the strategic advantage of smart manufacturers. They're turning data into dollars, and in an industry where margins often live and die by fractions of a percent, that's a game-changer.

Considerations

Technical Challenges

Implementing a Profit Margin Analysis AI Agent isn't a walk in the park. It's more like trying to teach a robot to be Gordon Gekko. The first hurdle? Data integration. Your AI needs to slurp up financial data from various sources - ERP systems, CRM platforms, even those dusty Excel sheets your finance team clings to. But here's the kicker: this data is often as messy as a startup's first office space.

Next up, we've got the algorithm complexity. Profit margin analysis isn't just about subtracting costs from revenue. It's a multi-dimensional problem involving product mix, pricing strategies, and market dynamics. Your AI needs to juggle all these balls without dropping any. It's like asking a first-time juggler to perform at Cirque du Soleil.

Then there's the challenge of real-time processing. In today's market, waiting for end-of-month reports is like using a flip phone in 2023. Your AI needs to crunch numbers faster than a day trader on espresso, providing insights that are fresher than your morning avocado toast.

Operational Challenges

On the operational front, we're dealing with a different beast altogether. First off, there's the human factor. Your finance team might view this AI as a threat, like Skynet for accountants. You need to convince them it's more R2-D2 than Terminator - here to help, not replace.

Then we've got the trust issue. Can you really rely on an AI to make crucial financial decisions? It's like handing over your Amex Black Card to a stranger. You need robust validation processes and human oversight to ensure your AI isn't leading you down a path that ends with you explaining things to angry shareholders.

Let's not forget about regulatory compliance. Your AI needs to play by the rules, which in finance, are about as numerous as stars in the sky. It needs to understand GAAP, IFRS, and probably a few other acronyms we haven't even invented yet.

Finally, there's the challenge of continuous learning. Markets change, business models evolve, and your AI needs to keep up. It's like trying to hit a moving target while riding a unicycle. Your AI needs to be as adaptable as a chameleon in a disco.

Implementing a Profit Margin Analysis AI Agent is no small feat. But for those who can navigate these choppy waters, the potential rewards are as juicy as a perfectly executed growth hack. It's not just about crunching numbers faster; it's about unlocking insights that can propel your business into the stratosphere. And in the end, isn't that what we're all after?

The AI-Powered Future of Financial Decision-Making

AI agents are more than just a technological upgrade for profit margin analysis - they're a paradigm shift. They're turning what was once a retrospective, labor-intensive process into a dynamic, predictive tool that can drive real-time decision-making. From retail to manufacturing, these digital teammates are helping businesses uncover hidden efficiencies, optimize pricing strategies, and stay ahead of market trends.

But let's be clear: this isn't about replacing human expertise. It's about augmenting it. AI agents are freeing up financial professionals to focus on strategy and creative problem-solving, armed with insights that would have been impossible to obtain manually.

As we look to the future, the businesses that thrive will be those that effectively integrate these AI capabilities into their financial operations. They'll be the ones making decisions not just based on what happened last quarter, but on what's likely to happen next quarter. In a world where margins are often razor-thin and competition is fierce, this predictive edge could be the difference between leading the market and playing catch-up.

The profit margin analysis revolution is here, and it's powered by AI. The question isn't whether businesses will adopt these technologies, but how quickly they'll do so - and how effectively they'll leverage them to stay ahead in an increasingly data-driven business landscape.