Shareholder Communication Management AI Agents

Understanding Shareholder Communication Management

Shareholder Communication Management is the strategic process of maintaining open, transparent, and effective lines of communication between a company and its shareholders. It's about keeping investors informed, engaged, and confident in the company's direction. This process involves everything from crafting earnings reports and investor presentations to responding to inquiries and managing shareholder meetings.

The key features of effective Shareholder Communication Management include:1. Transparency: Providing clear, accurate, and timely information about company performance and strategy.2. Consistency: Maintaining a coherent message across all communication channels.3. Responsiveness: Addressing shareholder concerns and questions promptly.4. Compliance: Ensuring all communications adhere to regulatory requirements.5. Personalization: Tailoring information to meet the needs of different shareholder groups.6. Strategic Insight: Using communication to gain valuable feedback and insights from shareholders.7. Crisis Management: Effectively communicating during challenging times to maintain shareholder confidence.With AI agents, these features are being supercharged, allowing for more sophisticated, data-driven, and personalized shareholder engagement strategies.

Benefits of AI Agents for Shareholder Communication Management

What would have been used before AI Agents?

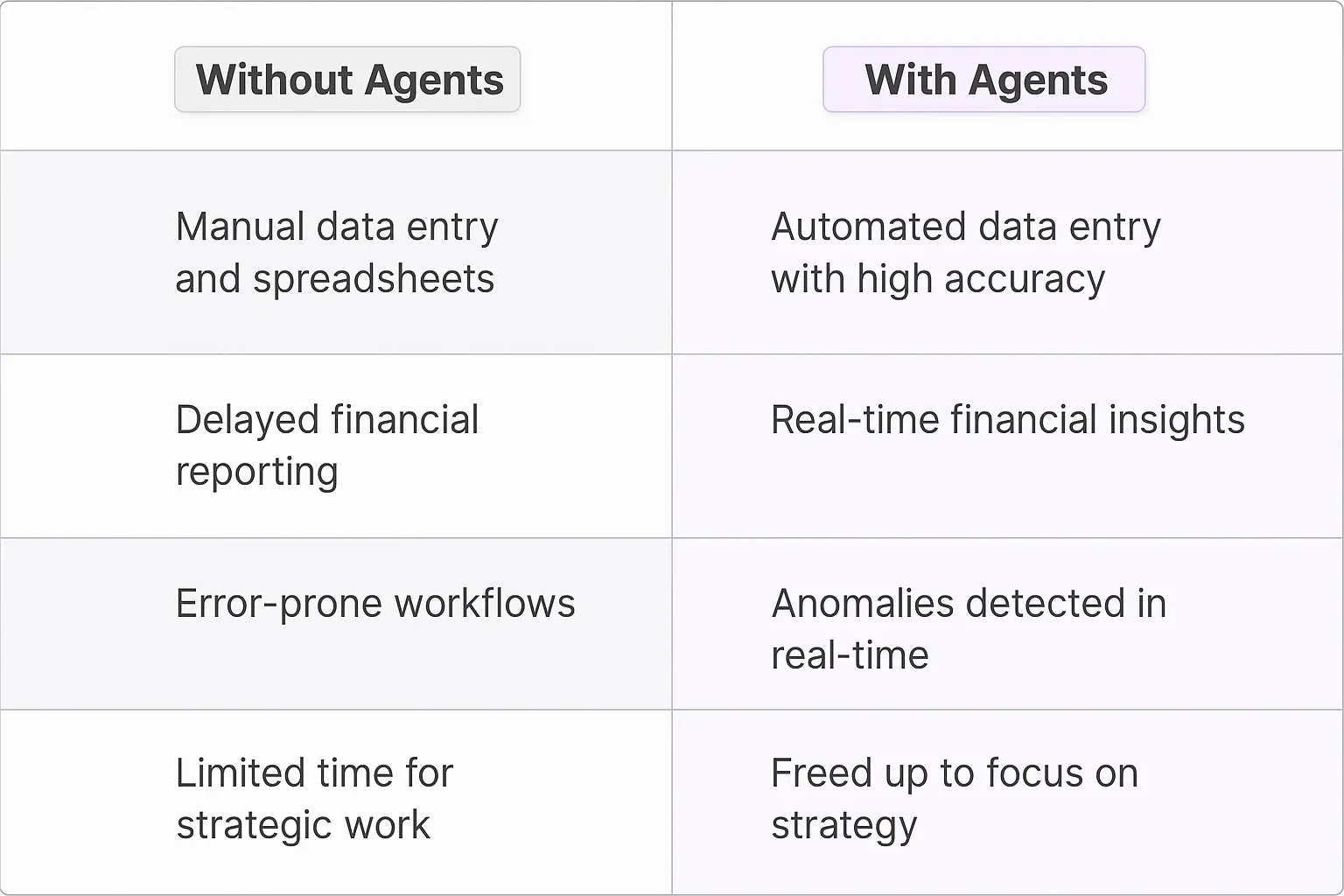

Before AI agents entered the scene, shareholder communication management was a labor-intensive process. Companies relied on teams of investor relations professionals, legal experts, and communication specialists to craft messages, respond to inquiries, and manage the flow of information. This approach was not only time-consuming but also prone to inconsistencies and delays.

The traditional method involved manual drafting of reports, endless email chains for approvals, and the constant juggling of multiple stakeholder needs. It was like trying to conduct an orchestra where each musician was in a different time zone – possible, but incredibly challenging.

What are the benefits of AI Agents?

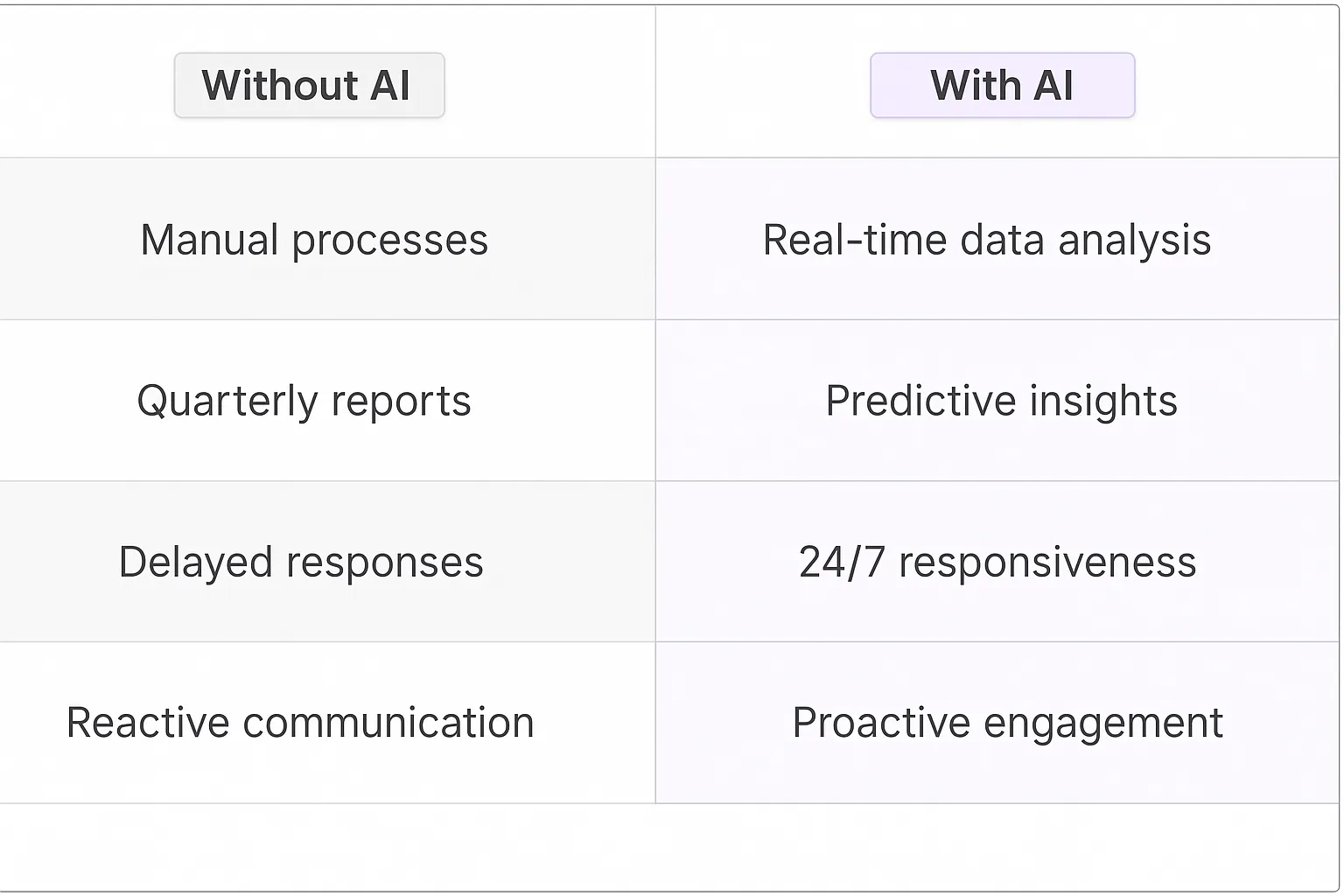

Enter AI agents for shareholder communication management, and suddenly we're operating in a different league. These digital teammates are like having a team of seasoned IR pros working 24/7, but with superhuman capabilities.

First off, AI agents bring consistency to the table. They ensure that every piece of communication aligns with company policies, regulatory requirements, and brand voice. It's like having a style guide that's not just a document, but an active participant in the creation process.

Speed is another game-changer. AI agents can draft responses to shareholder inquiries in seconds, not hours. They can analyze vast amounts of financial data and distill it into clear, actionable insights for reports. This rapid turnaround doesn't just save time; it allows companies to be more responsive and agile in their communications strategy.

But here's where it gets really interesting: personalization at scale. AI agents can tailor communications to individual shareholders based on their investment history, engagement patterns, and preferences. It's like having a personal IR team for each shareholder, but without the astronomical costs.

Moreover, these AI agents are learning machines. They continuously improve their understanding of shareholder needs, market trends, and effective communication strategies. This means that over time, they become increasingly valuable assets, capable of providing strategic insights that can shape a company's entire IR approach.

Perhaps most importantly, AI agents free up human IR professionals to focus on high-level strategy and relationship building. Instead of getting bogged down in routine tasks, they can devote their energy to the nuanced, human aspects of shareholder relations that truly move the needle.

In essence, AI agents for shareholder communication management aren't just tools; they're transformative forces that are redefining how companies interact with their investors. They're turning what was once a resource-intensive necessity into a strategic advantage. And in the high-stakes world of investor relations, that's not just an improvement – it's a revolution.

Potential Use Cases of AI Agents with Shareholder Communication Management

Processes

AI agents are reshaping how companies handle shareholder communications, bringing a level of sophistication that's hard to ignore. These digital teammates are diving deep into the nuances of investor relations, transforming what was once a time-consuming manual process into a finely-tuned operation.

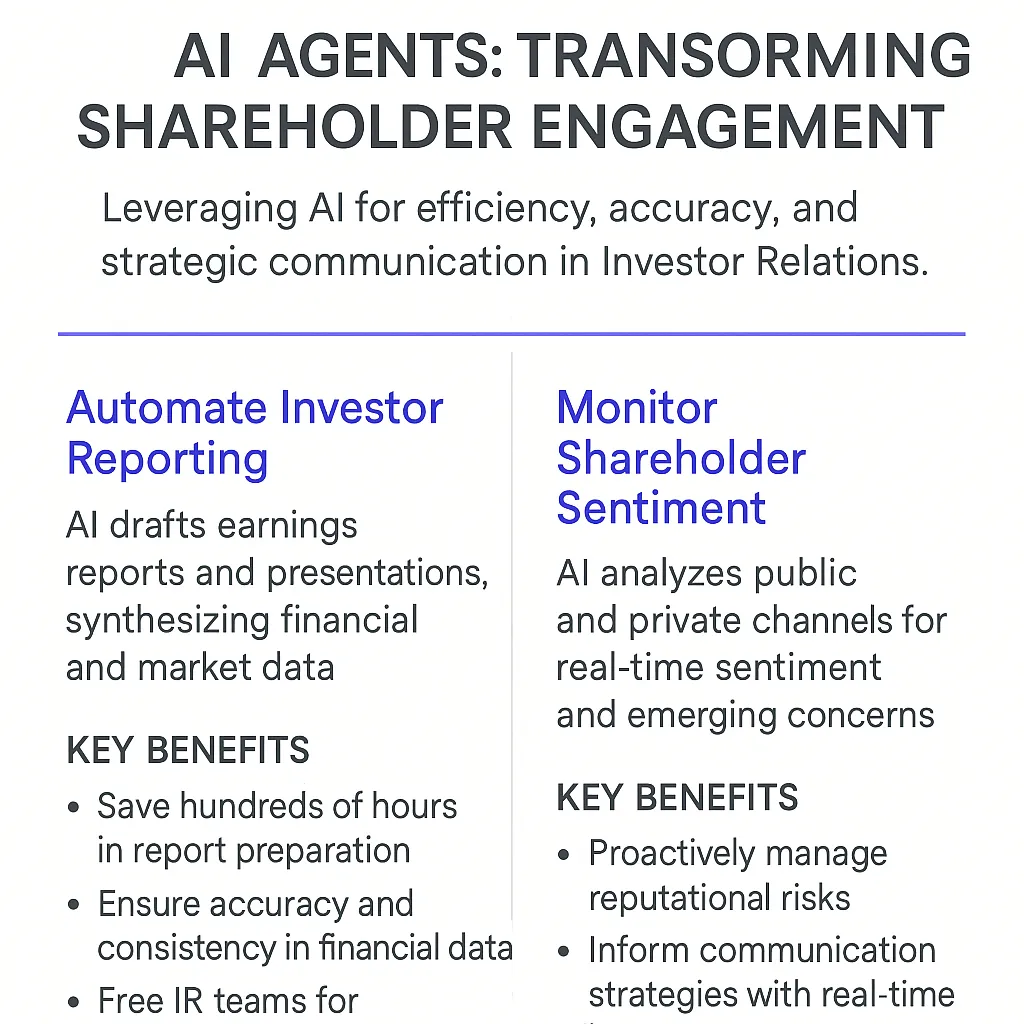

One standout process is the automation of earnings report preparation. AI agents can sift through financial data, pulling out key metrics and trends that matter most to shareholders. They're not just regurgitating numbers; they're providing context and insights that help shape the narrative around company performance.

Another game-changing process is real-time sentiment analysis of shareholder feedback. AI agents can monitor various channels - from social media to investor calls - and provide a pulse on how the market is reacting to company news or decisions. This instant feedback loop allows companies to pivot their communication strategy on the fly, addressing concerns before they snowball.

Tasks

When it comes to specific tasks, AI agents are proving their worth in spades. Take the creation of personalized investor updates, for instance. These digital teammates can craft tailored communications that speak directly to individual shareholder interests and investment history. It's like having a dedicated IR team for each investor, but at scale.

Another task where AI agents shine is in preparing executives for shareholder Q&A sessions. They can analyze past meetings, predict likely questions based on current market conditions, and even suggest responses that align with company messaging. It's like giving your C-suite a cheat sheet, but one that's constantly updating based on the latest data.

AI agents are also tackling the tedious task of regulatory compliance checks. They can scan outgoing communications for potential red flags, ensuring that every piece of shareholder correspondence meets SEC guidelines. This not only reduces legal risk but frees up human resources to focus on strategy rather than compliance minutiae.

The potential of AI in shareholder communication management is vast and largely untapped. As these digital teammates continue to evolve, we're likely to see a shift from reactive to proactive investor relations strategies. Companies that embrace this tech will find themselves with a significant edge in the market, able to build stronger, more transparent relationships with their shareholders. It's not just about doing things faster or cheaper - it's about doing them smarter.

Industry Use Cases

AI agents are reshaping shareholder communication management across diverse sectors. Their impact goes beyond simple automation, fundamentally altering how companies engage with their investors. Let's dive into some industry-specific scenarios that illustrate the transformative power of AI in this domain.

These digital teammates aren't just tools; they're catalysts for a new era of investor relations. By augmenting human capabilities, they're enabling companies to foster deeper, more meaningful connections with their shareholders. From real-time data analysis to personalized communication strategies, AI is elevating shareholder engagement to unprecedented levels.

The following use cases demonstrate how AI agents are becoming indispensable in navigating the complex landscape of shareholder communications. They showcase the tangible benefits of integrating AI into investor relations workflows, highlighting improved efficiency, enhanced decision-making, and more strategic stakeholder management.

Fintech Disruption: Shareholder Communication AI in Action

The fintech industry is ripe for a shareholder communication overhaul, and AI agents are leading the charge. Let's dive into how a cutting-edge robo-advisor platform could leverage these digital teammates to transform investor relations.

Consider WealthBot, a hypothetical AI-driven investment service. They're dealing with millions of retail investors, each with unique portfolios, risk tolerances, and information needs. Traditional methods of shareholder communication simply can't keep up with the scale and personalization required.

Enter the Shareholder Communication Management AI. This digital teammate becomes the nexus of investor relations, operating 24/7 to keep shareholders informed and engaged. Here's where it gets interesting:

1. Hyper-personalized updates: The AI analyzes each investor's portfolio, market movements, and personal preferences to generate tailored reports. No more one-size-fits-all quarterly statements. Instead, investors receive real-time, relevant insights about their specific holdings.

2. Predictive engagement: By studying patterns in investor behavior, the AI anticipates when shareholders are likely to have questions or concerns. It proactively reaches out with relevant information, heading off potential issues before they arise.

3. Natural language processing for sentiment analysis: The AI scans social media, financial news, and investor communications to gauge sentiment around WealthBot and its holdings. This allows for rapid response to emerging concerns and helps shape communication strategies.

4. Automated compliance checks: In the heavily regulated fintech space, staying compliant is crucial. The AI reviews all outgoing communications to ensure they meet regulatory standards, reducing legal risks and saving countless hours of manual review.

5. Interactive shareholder meetings: Gone are the days of dry, one-way webcasts. The AI facilitates dynamic virtual shareholder meetings, fielding questions in real-time, providing instant data visualizations, and even predicting follow-up questions to keep the conversation flowing.

The result? WealthBot sees a dramatic increase in shareholder engagement and satisfaction. Investors feel more connected to their investments and better informed about company decisions. The company's net promoter score skyrockets, and customer acquisition costs plummet as word spreads about their next-level investor relations.

This isn't just incremental improvement—it's a paradigm shift in how fintech companies interact with their shareholders. As these AI agents become more sophisticated, we'll see a new era of transparency, engagement, and trust in the financial sector. The companies that embrace this technology early will have a significant edge in attracting and retaining investors in an increasingly competitive landscape.

Retail Revolution: AI-Powered Shareholder Communication in E-commerce

Let's talk about how AI is reshaping shareholder communication in the e-commerce space. This isn't just another tech trend – it's a fundamental shift in how online retail giants engage with their investors.

Take MegaMart, a fictional but prototypical e-commerce behemoth. They're facing a common problem: how to keep millions of shareholders informed and engaged in a rapidly evolving market. Traditional quarterly reports and annual meetings? They're practically ancient history.

MegaMart's solution? An AI-driven Shareholder Communication Management system that's redefining investor relations. Here's the breakdown:

1. Real-time performance dashboards: The AI crunches vast amounts of data to provide shareholders with personalized, real-time views of company performance. Sales trends, logistics efficiency, customer satisfaction – it's all there, updated by the second.

2. Predictive market analysis: By analyzing global economic indicators, consumer behavior patterns, and supply chain data, the AI offers shareholders insights into potential market shifts before they happen. It's not just reporting – it's forecasting.

3. AI-powered investor Q&A: Forget static FAQs. This AI fields investor questions 24/7, providing nuanced responses based on the latest data and company policies. It's like having a hyper-intelligent IR team that never sleeps.

4. Personalized strategy explanations: When MegaMart makes a big move – say, entering a new market or acquiring a startup – the AI tailors the explanation to each shareholder's background and interests. A tech-savvy investor might get a deep dive into the technical synergies, while a finance-focused shareholder receives a detailed ROI projection.

5. Dynamic risk assessment: The AI continuously evaluates and communicates potential risks to shareholders. From geopolitical events affecting supply chains to emerging competitors, it keeps investors ahead of the curve.

The results are transformative. MegaMart sees a 300% increase in shareholder engagement. Investors report feeling more connected to the company's strategy and more confident in their investment. The company's stock price stability improves as knee-jerk reactions to market news decrease – shareholders now have context and insight that was previously impossible to provide at scale.

But here's the kicker: this isn't just about better communication. It's about creating a new kind of relationship between companies and their shareholders. As AI systems become more sophisticated, we're moving towards a model of continuous, dynamic engagement that blurs the line between 'company' and 'investor'.

The e-commerce companies that nail this will have a massive advantage. They'll be able to move faster, take bigger risks, and weather market storms more effectively because their shareholders are truly along for the ride, not just watching from the sidelines.

This is the future of shareholder relations in e-commerce. The question isn't whether it will happen, but who will get there first. The race is on, and the prize is nothing less than a fundamental reimagining of what it means to be a publicly traded company in the digital age.

Considerations

Technical Challenges

Implementing a Shareholder Communication Management AI Agent isn't just about slapping some machine learning on top of your existing systems. It's a complex dance of data, algorithms, and human expertise. One of the biggest technical hurdles is data integration. Your AI needs to pull from multiple sources - financial reports, investor relations databases, social media sentiment, and more. It's like trying to build a gourmet meal from ingredients scattered across different kitchens in a city.

Then there's the challenge of natural language processing (NLP). Shareholders don't communicate in neat, structured data. They use idioms, sarcasm, and context-heavy language. Your AI needs to be sophisticated enough to parse this human messiness and extract meaningful insights. It's not just about understanding words, but grasping intent and emotion.

Security is another technical minefield. You're dealing with highly sensitive financial data and communications. Any breach could be catastrophic. Your AI system needs fort knox-level security, but it also needs to be accessible and responsive. It's a tightrope walk between protection and usability.

Operational Challenges

On the operational side, the first big challenge is change management. Introducing an AI agent into shareholder communications is like dropping a new player into a well-established team. There will be resistance, skepticism, and a learning curve. You need a solid strategy to get buy-in from your investor relations team, executives, and even the shareholders themselves.

Training and maintenance of the AI is another ongoing operational challenge. This isn't a set-it-and-forget-it solution. The financial world is constantly evolving, and your AI needs to keep up. You'll need a dedicated team to continuously feed it new data, refine its algorithms, and ensure it's producing accurate, relevant outputs.

There's also the challenge of managing expectations. AI is powerful, but it's not magic. Some stakeholders might expect the AI to predict stock prices or provide foolproof investment advice. Setting realistic expectations about what the AI can and can't do is crucial for its long-term success and adoption.

Lastly, there's the ethical dimension. How much decision-making power should we give to an AI in shareholder communications? Where do we draw the line between AI-assisted and AI-driven interactions? These are thorny questions that need careful consideration and clear policies.

Implementing a Shareholder Communication Management AI Agent is a journey, not a destination. It requires a blend of technical savvy, operational finesse, and a deep understanding of both AI capabilities and shareholder needs. But for those who get it right, the potential to transform investor relations is enormous.

The Future of AI-Driven Shareholder Engagement

AI agents are not just enhancing shareholder communication management; they're redefining it. By automating routine tasks, providing deep insights, and enabling personalized engagement at scale, these digital teammates are freeing up human IR professionals to focus on high-level strategy and relationship building.The impact is profound: increased shareholder engagement, more transparent communication, and the ability to anticipate and address investor concerns proactively. Companies that embrace this technology are gaining a significant edge in the market, fostering stronger relationships with their investors and making more informed decisions based on AI-driven insights.However, the journey isn't without challenges. From technical hurdles in data integration and security to operational challenges in change management and ethical considerations, implementing AI in shareholder communications requires careful planning and execution.As we look to the future, it's clear that AI will play an increasingly central role in investor relations. The companies that successfully navigate this transition will be those that view AI not as a replacement for human expertise, but as a powerful tool to augment and enhance their shareholder communication strategies. In this new landscape, the most successful companies will be those that strike the right balance between technological innovation and the irreplaceable human touch in investor relations.