Post-Merger Integration Planning AI Agents

Understanding Post-Merger Integration Planning

Post-merger integration planning is the strategic process of combining two organizations after a merger or acquisition. It's the blueprint for how the newly formed entity will operate, covering everything from organizational structure and culture to systems and processes. This planning phase is crucial for realizing the anticipated synergies and value creation that drove the merger in the first place.

Effective post-merger integration planning typically includes:1. Cultural alignment: Bridging differences in corporate cultures to create a unified organization.2. Operational synergies: Identifying and capitalizing on complementary strengths and efficiencies.3. Systems integration: Merging IT infrastructures and business processes seamlessly.4. Talent retention: Strategies to keep key personnel and manage redundancies.5. Risk management: Identifying and mitigating potential integration pitfalls.6. Communication strategy: Ensuring clear, consistent messaging to all stakeholders.7. Timeline and milestones: Setting realistic goals and tracking progress throughout the integration process.

Benefits of AI Agents for Post-Merger Integration Planning

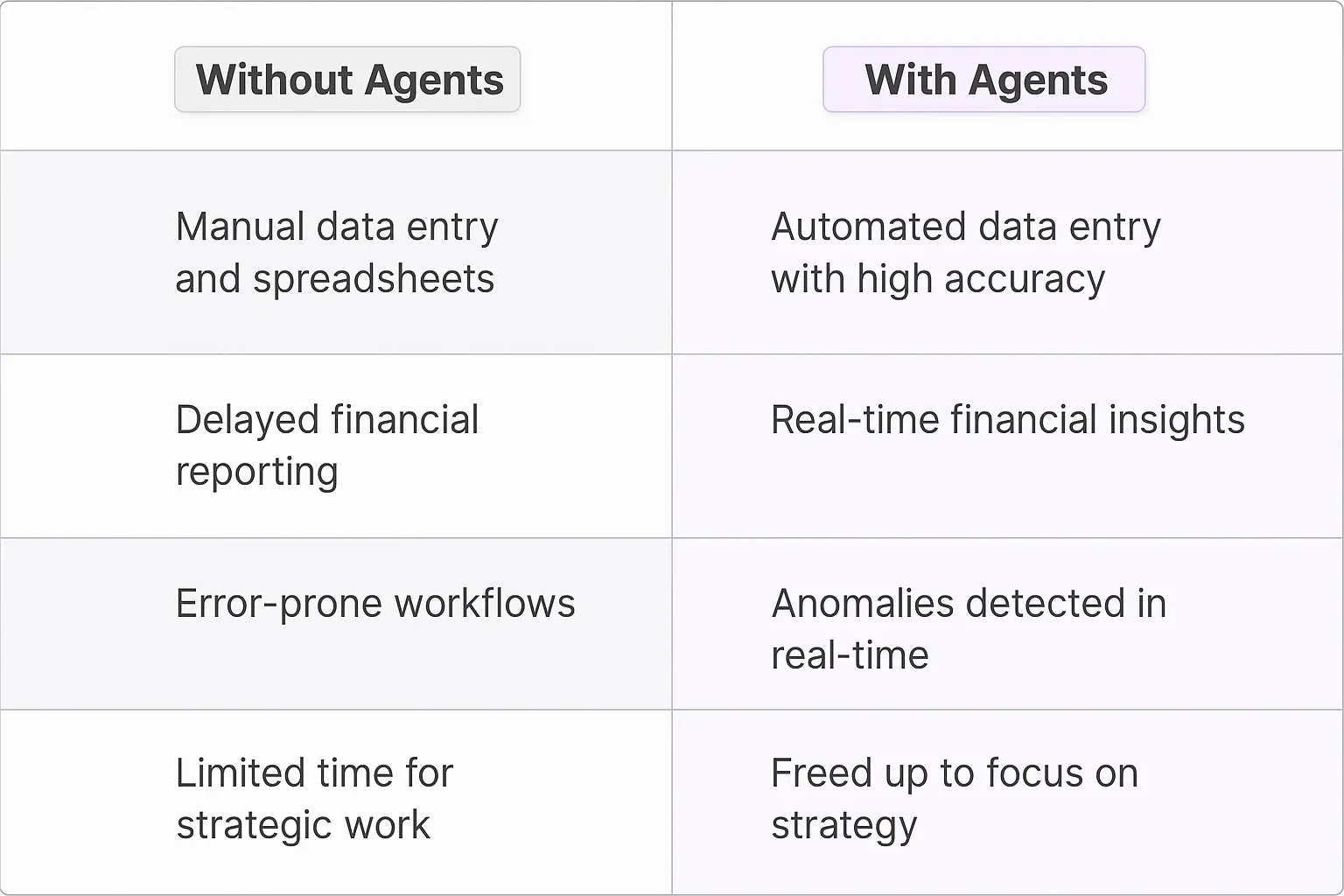

What would have been used before AI Agents?

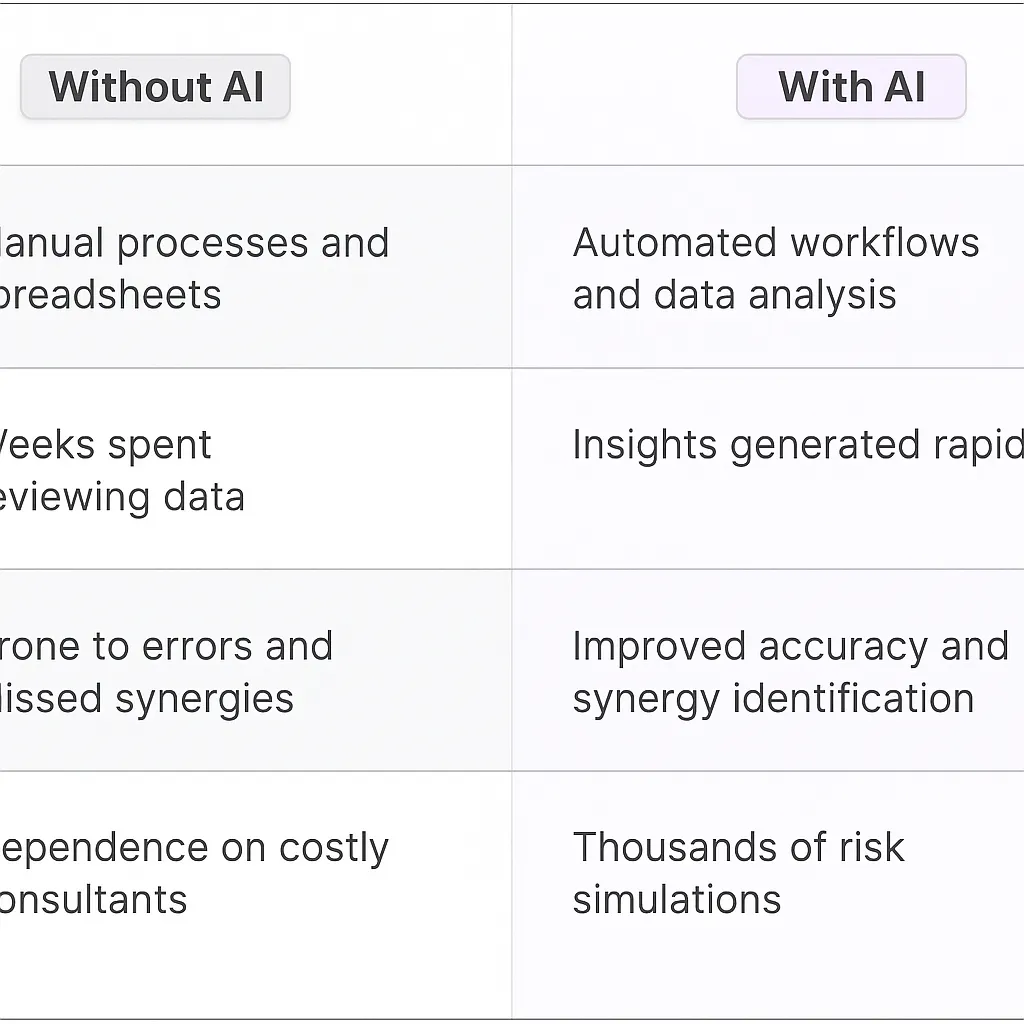

Before AI agents entered the scene, post-merger integration planning was a labyrinth of spreadsheets, endless email threads, and marathon meetings. Companies relied on armies of consultants, each billing eye-watering hourly rates, to navigate the complexities of merging two distinct entities. The process was slow, error-prone, and often resulted in missed opportunities and cultural clashes.

Teams would spend weeks, if not months, manually combing through data, trying to identify synergies and potential pitfalls. It was like trying to solve a Rubik's cube blindfolded – possible, but incredibly inefficient and frustrating.

What are the benefits of AI Agents?

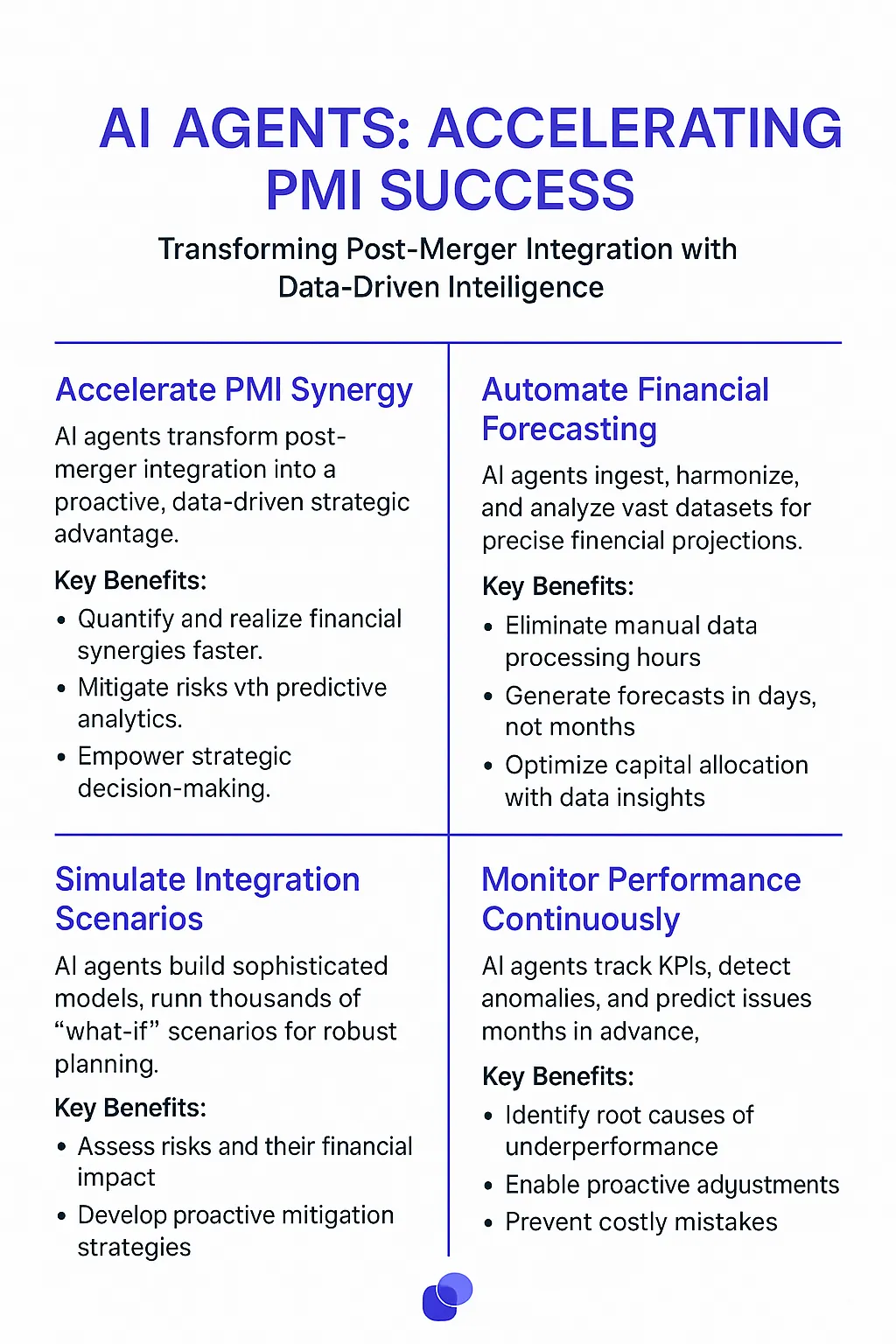

Enter AI agents – the digital teammates that are rewriting the playbook for post-merger integration. These aren't your run-of-the-mill chatbots; we're talking about sophisticated algorithms that can process vast amounts of data, identify patterns, and generate actionable insights at a speed that would make even the most caffeinated consultant's head spin.

First off, AI agents bring a level of objectivity to the table that's hard to match with human analysts. They don't have egos, they don't play office politics, and they certainly don't have a preference for keeping their old stapler. This neutrality is crucial when dealing with the sensitive task of merging two corporate cultures.

But the real magic happens in the data analysis. AI agents can simultaneously analyze financial records, HR data, customer information, and market trends. They can spot potential synergies that might take humans weeks to uncover. For example, an AI agent might identify that Company A's supply chain expertise perfectly complements Company B's product innovation, creating a 1+1=3 scenario that could be the cornerstone of the merger's success.

Risk assessment is another area where AI agents shine. They can run thousands of simulations, stress-testing various integration scenarios to identify potential roadblocks before they become real-world problems. This predictive power allows leadership to make informed decisions and pivot strategies early in the process, potentially saving millions in missteps.

Perhaps most importantly, AI agents can help maintain momentum throughout the integration process. Mergers often lose steam as the initial excitement wears off and the grind of integration sets in. AI agents can continuously monitor progress, flag areas that are falling behind, and even suggest corrective actions. It's like having a tireless project manager who's always on call and never needs a coffee break.

The cost savings are significant too. While the initial investment in AI technology might seem steep, it pales in comparison to the ongoing costs of large consulting teams. Plus, the speed at which AI agents operate means companies can start realizing synergies and efficiencies much faster, accelerating the ROI of the merger.

In essence, AI agents are transforming post-merger integration from a high-stakes guessing game into a data-driven, strategic process. They're not replacing human expertise, but rather augmenting it, allowing leaders to focus on the big-picture decisions that truly require human judgment. As these technologies continue to evolve, we're likely to see even more innovative applications that could make rocky mergers a thing of the past.

Potential Use Cases of AI Agents for Post-Merger Integration Planning

Processes

Post-merger integration is a complex beast, often fraught with pitfalls and unexpected challenges. AI agents can be game-changers in this arena, offering a level of precision and foresight that human teams alone might struggle to achieve. These digital teammates can analyze vast datasets from both companies, identifying synergies and potential friction points that might otherwise slip through the cracks.

One key process where AI shines is in cultural integration. By parsing through employee surveys, communication patterns, and performance metrics, AI agents can map out the cultural landscapes of both organizations. They can then suggest tailored strategies to bridge gaps and foster a unified corporate culture. This isn't just about feel-good HR initiatives; it's about creating a cohesive workforce that can execute on the merged entity's vision.

Another critical process is financial forecasting and synergy realization. AI agents can crunch numbers at a scale and speed that would make even the most caffeinated analyst's head spin. They can simulate countless scenarios, factoring in market trends, competitive landscapes, and internal metrics to provide leadership with a clear picture of the merged entity's financial trajectory.

Tasks

When it comes to specific tasks, AI agents are like Swiss Army knives for integration teams. They can tackle everything from the mundane to the mission-critical. For instance, these digital teammates can automate the tedious process of harmonizing product catalogs. They can analyze product descriptions, pricing structures, and market positioning to suggest optimal ways to consolidate and streamline the combined company's offerings.

AI agents can also play a crucial role in talent retention and allocation. By analyzing employee skills, performance history, and career trajectories, they can suggest optimal team structures and identify key personnel who might be flight risks during the transition. This isn't about replacing HR; it's about giving HR superpowers to make data-driven decisions that keep the best talent engaged and productive.

On the IT front, AI agents can be invaluable in mapping out system integrations. They can analyze the tech stacks of both companies, identify redundancies, and suggest migration paths that minimize disruption. This isn't just about avoiding downtime; it's about creating a unified digital infrastructure that can support the merged entity's growth ambitions.

The beauty of AI in post-merger integration is its ability to learn and adapt. As the integration process unfolds, these digital teammates can continuously refine their models, providing increasingly accurate insights and recommendations. They're not just static tools; they're evolving partners in the integration journey.

In the high-stakes world of M&A, where time is money and mistakes can be costly, AI agents offer a powerful edge. They're not replacing human judgment; they're augmenting it, allowing integration teams to move faster, see clearer, and execute more effectively. As we look to the future of M&A, it's clear that AI will be an indispensable ally in turning merger visions into reality.

Industry Use Cases

AI agents are reshaping post-merger integration planning across sectors, offering a level of precision and efficiency that's hard to match with traditional methods. These digital teammates aren't just tools; they're game-changers that are redefining how companies approach the complex dance of merging operations, cultures, and systems.

Let's dive into some industry-specific scenarios where AI agents are making waves in post-merger integration. These examples aren't just theoretical - they're based on real-world applications that are already yielding impressive results. From finance to tech to healthcare, AI is proving to be the secret weapon in smooth, successful mergers.

What's particularly exciting is how these AI agents are adapting to the unique challenges of each industry. They're not one-size-fits-all solutions, but rather highly specialized digital teammates that can be fine-tuned to address specific pain points in the merger process. This level of customization is what's driving their adoption across diverse sectors.

As we explore these use cases, keep in mind that we're just scratching the surface of what's possible. The potential for AI in post-merger integration is vast, and we're likely to see even more innovative applications emerge as the technology continues to evolve. The sophisticated data analysis capabilities and strategic change management approaches are already transforming how organizations navigate complex integrations.

Fintech Fusion: AI-Powered Post-Merger Integration

Let's dive into the fintech world, where mergers and acquisitions are as common as new app updates. Picture two digital banking giants joining forces – we're talking about a merger that could reshape how millions manage their money.

Enter the Post-Merger Integration Planning AI Agent. This digital teammate isn't just crunching numbers; it's orchestrating a symphony of data, processes, and people across both organizations.

First up, the AI digs deep into each company's tech stack. It's not just listing APIs and databases; it's mapping out how these systems talk to each other, identifying potential conflicts, and even suggesting optimal integration paths. This isn't your typical IT audit – it's like having a tech-savvy marriage counselor for software systems.

But here's where it gets interesting. The AI doesn't stop at tech. It analyzes customer data from both banks, identifying overlaps and unique segments. It then crafts personalized communication strategies for each customer type, ensuring no one feels lost in the shuffle. This isn't just about preventing churn; it's about turning a potential pain point into a growth opportunity.

On the HR front, the AI becomes a cultural matchmaker. By analyzing everything from internal communications to performance reviews, it identifies potential cultural clashes and suggests targeted team-building exercises. It's like having an organizational psychologist working 24/7 to ensure the human side of the merger doesn't get overlooked.

The real magic happens when the AI starts predicting. Using historical data from similar mergers and real-time feedback, it forecasts potential roadblocks weeks before they occur. This isn't just risk management; it's like having a crystal ball for your merger strategy.

In the fintech world, where speed and precision are everything, this AI-driven approach to post-merger integration isn't just an efficiency play. It's the difference between a merger that limps along and one that leaps forward, capturing market share and innovating at a pace that leaves competitors in the dust.

This isn't about replacing human decision-makers. It's about empowering them with insights and foresight that would be impossible to achieve manually. In the high-stakes game of fintech mergers, this AI agent isn't just a tool – it's the ace up your sleeve.

Automotive Acceleration: AI-Driven Merger in the Electric Vehicle Space

The automotive industry is undergoing a seismic shift, with electric vehicles (EVs) at the forefront. When two EV manufacturers decide to merge, it's not just about combining assembly lines – it's about fusing innovation cultures, supply chains, and entirely new approaches to transportation.

A Post-Merger Integration Planning AI Agent in this scenario becomes the ultimate automotive engineer, but for business processes. It's not just aligning nuts and bolts; it's synchronizing entire ecosystems.

The AI starts by dissecting the supply chains of both companies. It's not merely listing suppliers; it's creating a dynamic map of dependencies, lead times, and potential bottlenecks. By analyzing historical data and current market trends, it predicts future supply constraints and suggests preemptive actions. This isn't just procurement optimization; it's supply chain clairvoyance.

On the R&D front, the AI becomes a patent matchmaker. It scours through thousands of patents and ongoing research projects from both companies, identifying complementary technologies and potential breakthrough combinations. It's not just avoiding redundancies; it's catalyzing innovation synergies that human researchers might take years to discover.

The AI doesn't stop at the factory floor. It dives into the sales and marketing strategies of both companies, analyzing customer segments, brand perceptions, and dealer networks. By cross-referencing this data with broader market trends, it crafts a unified go-to-market strategy that leverages the strengths of both brands. This isn't just about maintaining market share; it's about creating a multiplier effect in market penetration.

Perhaps most crucially, the AI tackles the thorny issue of corporate culture. By analyzing internal communications, project management styles, and even the language used in company documents, it identifies potential friction points between the merging teams. It then suggests targeted initiatives to bridge these gaps, from joint hackathons to cross-functional mentorship programs. This isn't just about avoiding culture clash; it's about forging a new, stronger corporate identity.

The real power of this AI agent shines in its predictive capabilities. By continuously monitoring key performance indicators across the merged entity and comparing them against industry benchmarks, it can forecast potential issues months in advance. Whether it's a looming production shortfall or an emerging market opportunity, the AI provides actionable insights that keep the merged company ahead of the curve.

In the fast-evolving EV market, where first-mover advantages can make or break a company, this AI-driven approach to post-merger integration isn't just a nice-to-have. It's the difference between creating a Tesla challenger and becoming another cautionary tale in automotive history.

This AI agent isn't replacing the visionary leaders or passionate engineers driving the EV revolution. Instead, it's amplifying their capabilities, allowing them to focus on groundbreaking innovations while ensuring the merged company operates as a well-oiled machine. The seamless system integrations enable teams to collaborate more effectively across previously separate organizations. In the high-stakes race to dominate the future of transportation, this AI isn't just a tool – it's the nitrous oxide in the engine of progress.

Considerations

When it comes to implementing a Post-Merger Integration Planning AI Agent, we're diving into uncharted waters. It's like trying to teach a robot to navigate the complex social dynamics of a corporate marriage. Let's break down the key challenges:

Technical Challenges

First off, we're dealing with a data integration nightmare. Merging two companies means combining vastly different tech stacks, databases, and systems. Our AI agent needs to be a polyglot, speaking the language of legacy systems and cutting-edge tech alike.

Then there's the machine learning model itself. Training it to understand the nuances of corporate culture, organizational structures, and industry-specific jargon is no small feat. We're essentially asking it to become a seasoned M&A consultant overnight.

Security and compliance are another can of worms. With sensitive financial and strategic data flowing through the AI, we need Fort Knox-level protection. One data breach could tank the entire merger faster than you can say "antitrust lawsuit".

Operational Challenges

On the operational side, we're looking at a human-AI collaboration that's more complex than a game of 4D chess. Employees from both companies need to trust and effectively work with this digital teammate. That's a tall order when people are already anxious about their job security post-merger.

Change management becomes crucial. We're not just introducing new tech; we're potentially reshaping entire workflows and decision-making processes. It's like trying to change the tires on a car while it's still moving.

There's also the risk of over-reliance. If the AI becomes the go-to oracle for all integration decisions, we might miss out on the human intuition and experience that's critical in these delicate situations. Finding the right balance is key.

The complexity of data integration requires specialized expertise, often necessitating the involvement of an experienced consultant who can navigate both technical and organizational challenges.

Lastly, we can't ignore the potential for bias. If our AI is trained on historical M&A data, it might perpetuate past mistakes or outdated practices. We need to ensure it's not just efficient, but also fair and forward-thinking in its recommendations.

Implementing a Post-Merger Integration Planning AI Agent is like trying to solve a Rubik's cube blindfolded. It's complex, risky, but potentially game-changing if we get it right. The companies that crack this code will have a serious edge in the M&A game.

The Future of M&A: AI-Powered Integration Planning

AI agents are not just tools; they're transformative forces in post-merger integration planning. They're turning what was once a high-stakes guessing game into a data-driven, strategic process. By processing vast amounts of data, identifying patterns, and generating actionable insights at unprecedented speeds, these digital teammates are enabling companies to navigate the complexities of mergers with greater precision and confidence.

The real power of AI in this context lies in its ability to augment human expertise. It's not about replacing seasoned M&A professionals, but rather empowering them with deeper insights and predictive capabilities. This human-AI collaboration is setting a new standard for merger success rates.

As AI technology continues to evolve, we can expect even more sophisticated applications in post-merger integration. The companies that embrace these digital teammates early and effectively will likely find themselves with a significant competitive advantage in the M&A landscape.

The future of post-merger integration is here, and it's powered by AI. The question isn't whether to adopt these technologies, but how quickly and effectively companies can integrate them into their M&A playbooks. Those who do will be better positioned to turn their merger visions into reality, creating value and driving growth in an increasingly complex business environment. This strategic process represents the next evolution in how organizations approach transformational change.