Dividend Policy Optimization AI Agents

The Strategic Process of Dividend Distribution

Dividend Policy Optimization is the strategic process of determining the most effective way for a company to distribute profits to its shareholders. It's a delicate balancing act that involves deciding how much of a company's earnings should be paid out as dividends versus reinvested in the business. This process aims to maximize shareholder value while ensuring the company maintains sufficient capital for growth and stability.

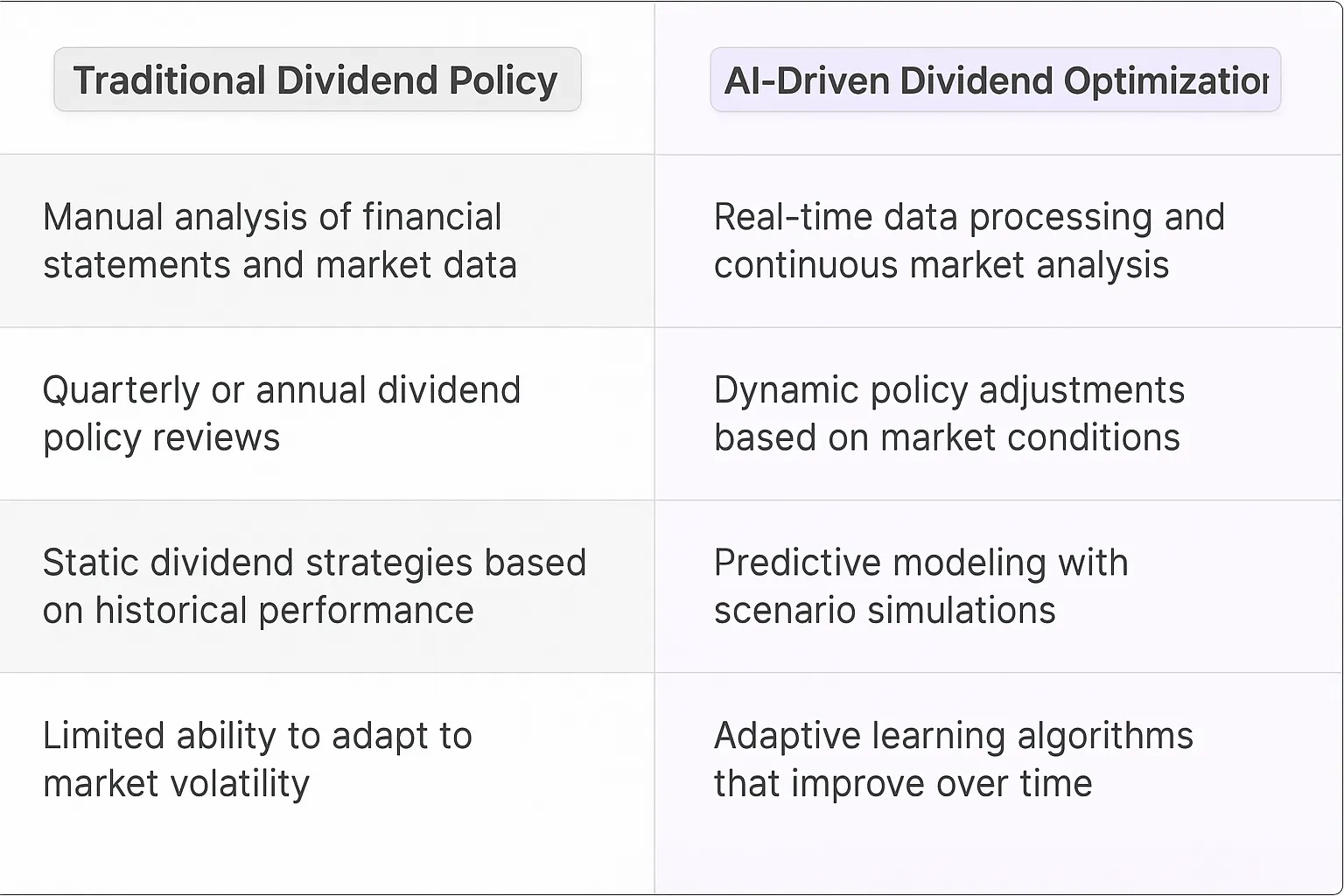

Dividend Policy Optimization powered by AI agents brings several game-changing features to the table:1. Real-time data analysis: AI agents continuously process market data, company financials, and economic indicators to provide up-to-the-minute insights.2. Predictive modeling: These digital teammates can simulate thousands of scenarios, helping companies understand the potential impacts of different dividend strategies.3. Adaptive learning: As market conditions change, AI agents adjust their recommendations, ensuring dividend policies remain optimal even in volatile markets.4. Holistic analysis: By integrating multiple data sources, AI agents provide a comprehensive view that considers financial metrics, market trends, and regulatory requirements.5. Customization: AI agents can tailor dividend strategies to specific industry dynamics and company goals, moving beyond one-size-fits-all approaches.

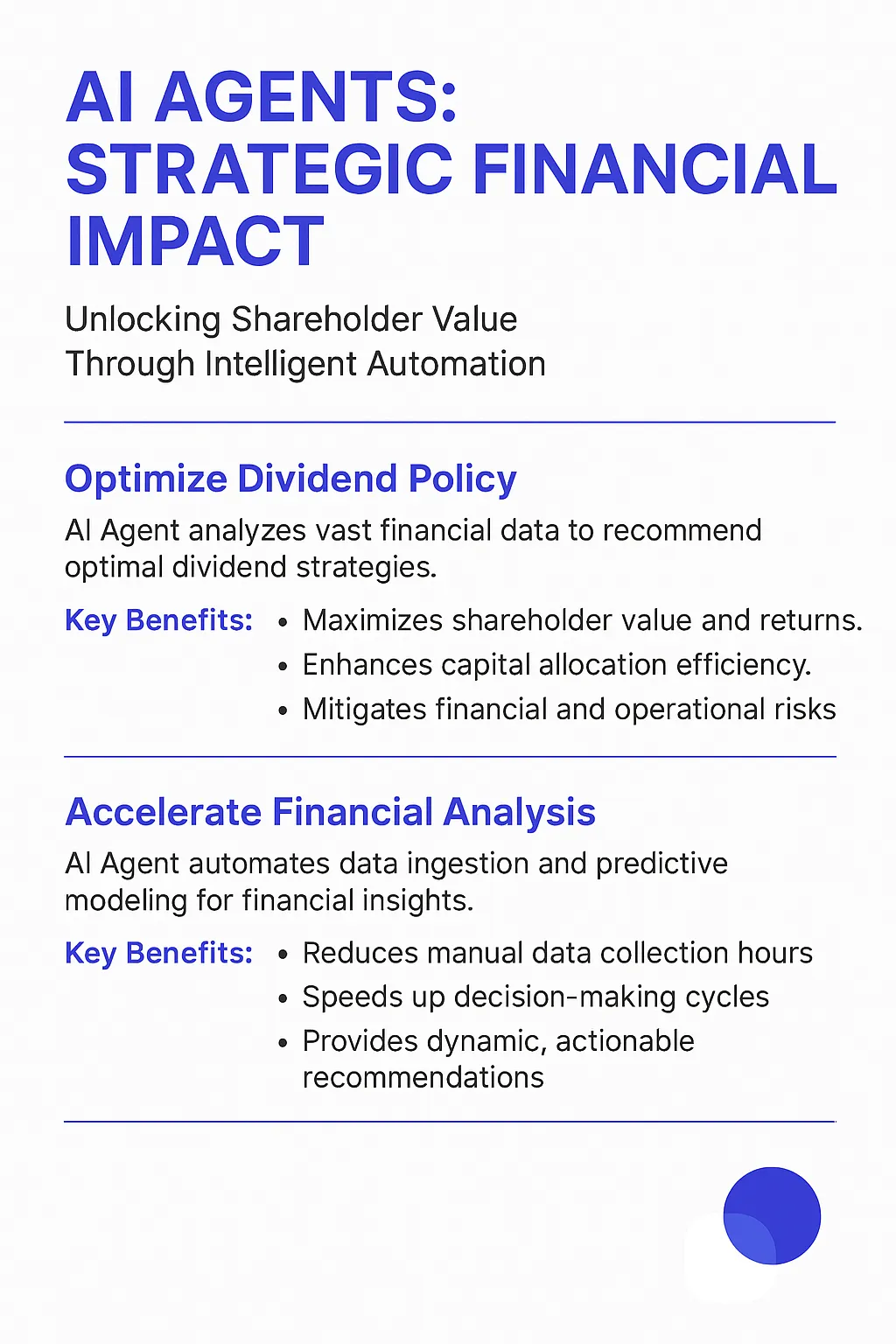

Benefits of AI Agents for Dividend Policy Optimization

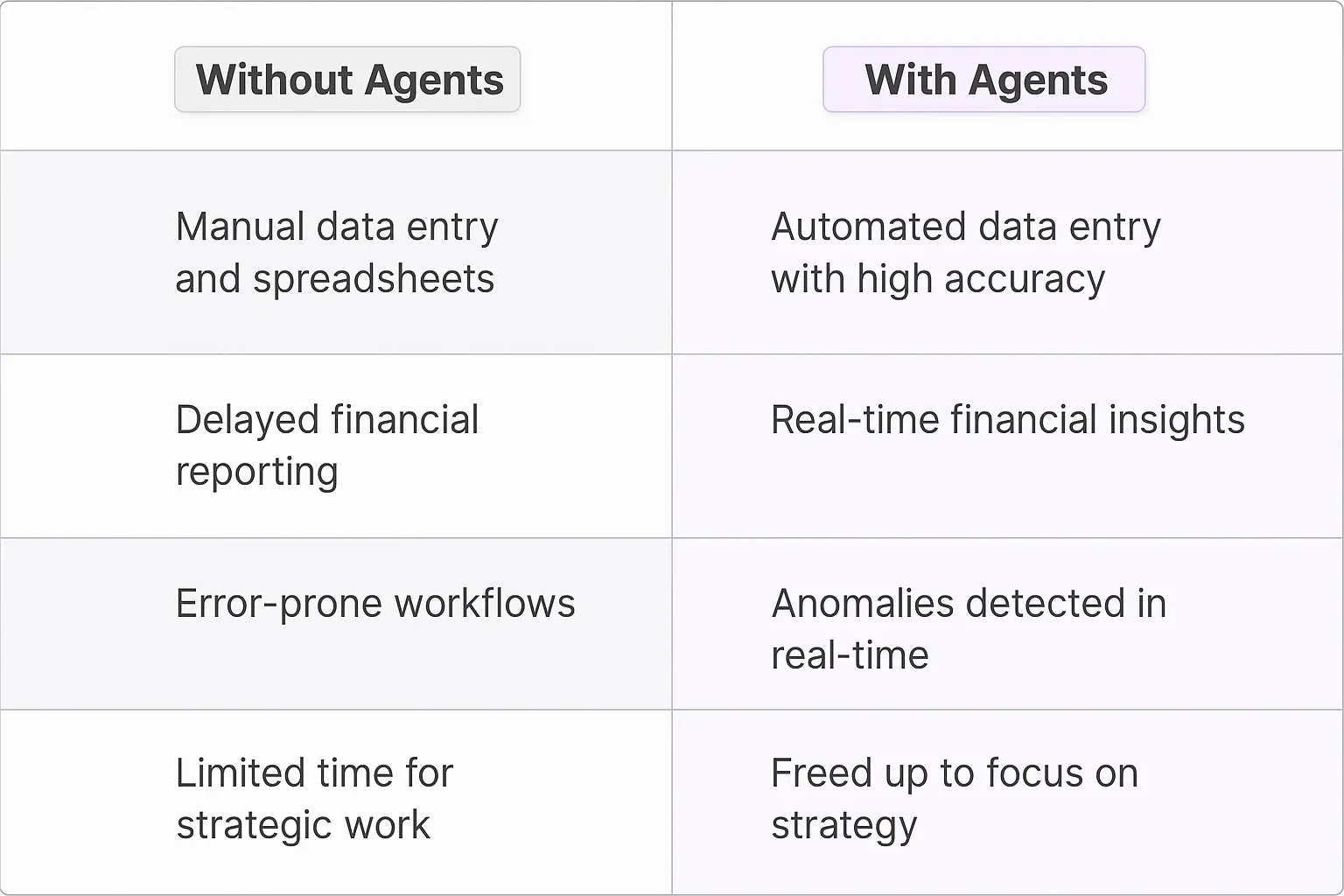

What would have been used before AI Agents?

Before AI agents entered the scene, dividend policy optimization was a complex dance of spreadsheets, human intuition, and endless board meetings. Finance teams would spend weeks crunching numbers, analyzing market trends, and trying to predict shareholder reactions. It was like trying to solve a Rubik's cube blindfolded while riding a unicycle.

Companies relied heavily on historical data and industry benchmarks, often leading to suboptimal decisions that didn't fully capture the nuances of their unique financial situations. The process was slow, prone to human error, and lacked the ability to quickly adapt to market changes. It was like trying to navigate a ship using only a compass and the stars – you might eventually get there, but it's not exactly efficient.

What are the benefits of AI Agents?

Enter AI agents, the financial world's equivalent of giving that ship a state-of-the-art GPS system and an expert navigator. These digital teammates bring a whole new level of sophistication to dividend policy optimization.

First off, AI agents can process vast amounts of data at lightning speed. They're not just looking at your company's financials; they're analyzing market trends, competitor actions, and even social sentiment. It's like having a financial analyst who never sleeps and has perfect recall of every piece of relevant information.

But it's not just about speed and volume. AI agents can identify patterns and correlations that human analysts might miss. They can simulate thousands of scenarios in seconds, helping companies understand the potential impacts of different dividend strategies. It's like having a crystal ball, but one that's powered by data and algorithms instead of mystical energy.

Perhaps most importantly, AI agents can learn and adapt in real-time. As market conditions change, these digital teammates adjust their recommendations accordingly. This dynamic approach ensures that dividend policies remain optimal even in volatile markets. It's like having a financial strategy that's always in beta, constantly improving and refining itself.

The result? More informed decisions, better capital allocation, and happier shareholders. Companies can fine-tune their dividend policies to balance growth investments with shareholder returns more effectively. It's not about replacing human judgment; it's about augmenting it with data-driven insights that were previously out of reach.

In the end, AI agents for dividend policy optimization are like giving your finance team superpowers. They're not just crunching numbers faster; they're elevating the entire decision-making process to a new level of sophistication and agility. And in a world where capital efficiency can make or break a company, that's a game-changer.

Potential Use Cases of AI Agents for Dividend Policy Optimization

Processes

Dividend policy optimization is a complex financial process that can benefit immensely from AI agents. These digital teammates can analyze vast amounts of financial data, market trends, and company-specific information to help firms make informed decisions about their dividend strategies.

One key process where AI agents shine is in scenario modeling. They can rapidly generate and evaluate multiple dividend policy scenarios, considering factors like cash flow projections, investor expectations, and competitive landscape. This allows financial teams to explore a wider range of options and understand their potential impacts more thoroughly than ever before.

Another critical process is real-time market analysis. AI agents can continuously monitor market conditions, peer company actions, and macroeconomic indicators, providing up-to-the-minute insights that can inform dividend policy adjustments. This dynamic approach ensures that dividend strategies remain responsive to changing market conditions.

Tasks

When it comes to specific tasks, AI agents for dividend policy optimization are game-changers. They can crunch numbers at lightning speed, performing complex financial calculations that would take human analysts hours or even days. This includes tasks like:

- Calculating optimal payout ratios based on current and projected financial performance

- Assessing the impact of different dividend policies on stock price and shareholder value

- Analyzing historical dividend data to identify patterns and trends

- Forecasting future earnings and cash flows to ensure dividend sustainability

- Evaluating the tax implications of various dividend strategies for both the company and shareholders

But it's not just about number-crunching. These AI agents can also assist in more nuanced tasks, such as sentiment analysis of investor communications and earnings calls to gauge market expectations around dividends. They can even help draft dividend policy statements and investor presentations, ensuring clear and consistent messaging around the company's dividend strategy.

The real power of AI agents in dividend policy optimization lies in their ability to integrate multiple data sources and perspectives. They can simultaneously consider financial metrics, market trends, competitive positioning, and regulatory requirements to provide a holistic view of the optimal dividend strategy. This comprehensive approach helps companies strike the right balance between rewarding shareholders and reinvesting in the business for long-term growth.

As companies navigate the complexities of dividend policy in an increasingly dynamic business environment, AI agents are becoming indispensable tools. They're not replacing human judgment, but rather augmenting it, allowing financial teams to make more informed, data-driven decisions about one of the most important aspects of corporate finance.

Industry Use Cases

The versatility of AI agents in dividend policy optimization makes them valuable across various industries. Let's dive into some meaty, industry-specific use cases that showcase how AI can reshape workflows and processes in ways that might not be immediately obvious.

These digital teammates aren't just number crunchers; they're becoming integral parts of financial strategy teams, offering insights that can make or break a company's relationship with its shareholders. From tech startups to blue-chip stalwarts, AI is quietly revolutionizing how companies approach their dividend strategies.

What's particularly fascinating is how these AI agents are adapting to the nuances of different sectors. They're not applying a one-size-fits-all approach, but rather learning the intricacies of each industry's cash flow patterns, regulatory environments, and investor expectations. This includes advanced scenario modeling capabilities and real-time market analysis that adapts to sector-specific dynamics. This level of specialization is what's really driving the adoption of AI in dividend policy optimization across the board.

Fintech Disruption: Dividend Policy Optimization AI in Action

The fintech industry is ripe for a shake-up, and dividend policy optimization AI agents are leading the charge. These digital teammates are transforming how investment firms approach dividend strategies, bringing a level of precision and adaptability that human analysts can't match.

Take a mid-sized asset management firm managing a diverse portfolio of dividend-paying stocks. Traditionally, their analysts would spend weeks poring over financial reports, market trends, and economic indicators to determine optimal dividend policies for their holdings. It's a time-consuming process prone to human error and cognitive biases.

Enter the dividend policy optimization AI agent. This digital powerhouse ingests vast amounts of real-time data, from company financials to macroeconomic indicators, social media sentiment, and even geopolitical events. It then applies advanced machine learning algorithms to predict how different dividend strategies might impact stock performance, investor sentiment, and overall portfolio returns.

But here's where it gets really interesting. The AI doesn't just crunch numbers - it learns and adapts. As market conditions shift, the AI continuously refines its models, identifying subtle patterns and correlations that human analysts might miss. It can simulate thousands of scenarios in seconds, stress-testing different dividend policies against various market conditions.

The result? The asset management firm can now dynamically optimize dividend policies across their entire portfolio, reacting to market changes in real-time. They're seeing improved returns, better cash flow management, and increased investor satisfaction. More importantly, they're gaining a competitive edge in a crowded market.

This isn't just incremental improvement - it's a fundamental shift in how dividend policies are managed. The AI isn't replacing human expertise; it's augmenting it, freeing up analysts to focus on higher-level strategy and client relationships.

As these AI agents become more sophisticated, we're likely to see a ripple effect across the entire financial ecosystem. Smaller firms will gain access to capabilities once reserved for Wall Street giants. Investors will benefit from more stable, optimized dividend streams. And the market as a whole could become more efficient and responsive.

The dividend policy optimization AI agent isn't just a tool - it's a glimpse into the future of finance. And for firms willing to embrace this technology, the dividends could be substantial.

Real Estate: AI-Driven Dividend Optimization Reshapes Property Investment

The real estate industry is notorious for its complexity and capital-intensive nature. But what if I told you that AI is about to flip the script on how property investment trusts (REITs) manage their dividend policies? This isn't just another tech trend - it's a fundamental shift that's going to separate the winners from the losers in the coming years.

Let's zoom in on a mid-sized REIT that's been struggling to balance growth with investor expectations for steady dividends. They're sitting on a diverse portfolio of commercial, residential, and industrial properties across multiple markets. Each property type has its own cash flow patterns, market dynamics, and risk profiles. Traditionally, setting dividend policy has been more art than science, relying heavily on the gut feelings of seasoned executives.

Enter the dividend policy optimization AI agent. This digital teammate is a game-changer, capable of processing an insane amount of data that would make a human analyst's head spin. We're talking property-level cash flows, market-specific economic indicators, interest rate forecasts, tenant credit scores, and even satellite imagery showing foot traffic patterns around retail properties.

But here's where it gets really interesting. The AI doesn't just analyze historical data - it's forward-looking and adaptive. It's constantly running simulations, predicting how different dividend strategies might impact stock performance, capital allocation for new acquisitions, and overall portfolio health. As market conditions shift, it adjusts in real-time, identifying opportunities and risks that humans might overlook.

For our REIT, this means they can now tailor their dividend policy with surgical precision. They're no longer stuck with a one-size-fits-all approach. Instead, they can optimize dividends based on the unique characteristics of each property type and market. During a retail slump, they might dial back dividends from those properties while increasing payouts from their booming industrial assets.

The results are transformative. The REIT is seeing improved total returns, better capital allocation, and increased investor confidence. They're able to weather market volatility more effectively and seize opportunities faster than their competitors. It's not just about higher returns - it's about building a more resilient, adaptive business model.

This AI-driven approach to dividend policy is going to create a widening gap in the real estate industry. Early adopters will gain a significant edge, attracting more capital and talent. Laggards risk being left behind, stuck with suboptimal dividend strategies that erode shareholder value over time.

As these AI agents evolve, we'll likely see a ripple effect across the entire real estate ecosystem. Smaller REITs will gain access to sophisticated dividend optimization strategies once reserved for industry giants. Investors will benefit from more stable, predictable dividend streams. And the market as a whole could become more efficient, with capital flowing more freely to its highest and best use.

The dividend policy optimization AI agent isn't just another tech tool for REITs - it's a strategic imperative. In an industry where small improvements in capital efficiency can translate into millions in value, this technology is set to redraw the competitive landscape. For REITs willing to embrace this AI-driven future, the payoff could be enormous.

Considerations

Technical Challenges

Building a Dividend Policy Optimization AI Agent is like trying to solve a Rubik's cube blindfolded while riding a unicycle. It's complex, multifaceted, and one wrong move can send you tumbling.

First off, we're dealing with a data tsunami. Financial markets generate an overwhelming amount of information daily. Our AI needs to gulp down this firehose of data, process it, and extract meaningful insights. It's not just about crunching numbers; it's about understanding the subtle nuances of market behavior, company performance, and economic indicators.

Then there's the algorithmic complexity. We're not just building a simple if-then decision tree. We're talking about sophisticated machine learning models that can adapt to changing market conditions. These models need to balance short-term gains with long-term stability, factor in tax implications, and consider shareholder expectations. It's like trying to play 4D chess while the board keeps morphing.

Let's not forget about the black swan events. Our AI needs to be robust enough to handle unexpected market shocks. It's one thing to optimize dividends during business-as-usual scenarios, but what happens when a global pandemic hits or a major geopolitical event shakes the markets? Our digital teammate needs to be agile enough to pivot strategies on a dime.

Operational Challenges

On the operational front, implementing a Dividend Policy Optimization AI Agent is like trying to retrofit a jet engine onto a horse-drawn carriage. Most companies' existing financial systems weren't built with AI in mind.

Integration is a beast. We're talking about connecting our AI agent to multiple data sources, financial systems, and decision-making processes. It needs to play nice with legacy systems that might be older than some of the engineers working on the project. And let's not even get started on the API nightmares and data format inconsistencies.

Then there's the human factor. Finance teams aren't typically composed of AI enthusiasts. There's going to be resistance, skepticism, and a steep learning curve. We need to build trust in the AI's decisions, which means creating explainable AI models. It's not enough for the AI to spit out a dividend recommendation; it needs to show its work, like your high school math teacher always insisted.

Regulatory compliance is another minefield. Financial decisions, especially those involving dividends, are heavily regulated. Our AI needs to navigate this complex regulatory landscape without tripping any wires. It's like teaching a robot to dance through a laser security system – one wrong move and alarms start blaring.

Lastly, there's the ever-present challenge of keeping the AI up-to-date. Financial markets evolve, regulations change, and new economic theories emerge. Our AI can't be a one-and-done solution. It needs continuous learning and updating, which requires ongoing investment and a dedicated team to manage it.

The challenges extend beyond technical implementation to include sophisticated data processing requirements and complex system integration needs that must be carefully managed throughout the deployment process.

Implementing a Dividend Policy Optimization AI Agent is a high-stakes game. The potential rewards are massive, but so are the challenges. It's not for the faint of heart, but for those who pull it off, it could be the difference between being a market leader and a cautionary tale.

The Future of AI-Driven Dividend Strategies

Dividend Policy Optimization AI Agents are not just another tech trend - they're reshaping how companies approach one of the most critical aspects of corporate finance. By leveraging advanced algorithms and real-time data analysis, these digital teammates are enabling more informed, dynamic, and tailored dividend strategies.

The impact of this technology is far-reaching. From fintech firms gaining a competitive edge to REITs optimizing their complex portfolios, AI agents are proving their worth across industries. They're not replacing human judgment but augmenting it, allowing financial teams to make decisions with unprecedented precision and insight.

However, the road to implementation is not without its challenges. Technical hurdles like data processing and algorithmic complexity, coupled with operational issues such as system integration and regulatory compliance, present significant obstacles. Companies that successfully navigate these challenges stand to gain a substantial advantage in their respective markets.

As this technology continues to evolve, we can expect to see a widening gap between early adopters and laggards. The future of dividend policy optimization is AI-driven, and companies that embrace this shift are positioning themselves for long-term success in an increasingly complex and dynamic financial landscape.