Capital Expenditure Planning AI Agents

Understanding Capital Expenditure Planning

What is Capital Expenditure Planning?

Capital expenditure planning is the process of determining and budgeting for significant investments in assets that a company expects to use for an extended period. This typically involves large-scale purchases like equipment, property, or technology infrastructure that are crucial for a company's growth and operational efficiency. It's a strategic process that requires careful analysis of financial resources, market conditions, and long-term business objectives.

Key Features of Capital Expenditure Planning

Effective capital expenditure planning involves several critical components:1. Financial forecasting: Projecting future cash flows and financial performance to determine investment capacity.2. Risk assessment: Evaluating potential risks associated with large capital investments.3. ROI analysis: Calculating the expected return on investment for proposed projects.4. Prioritization: Ranking potential investments based on their strategic importance and financial impact.5. Scenario planning: Modeling various economic and market conditions to test the robustness of investment decisions.6. Budgeting and allocation: Determining how to distribute limited capital resources across different projects or departments.7. Compliance: Ensuring that capital expenditures align with regulatory requirements and company policies.

Benefits of AI Agents for Capital Expenditure Planning

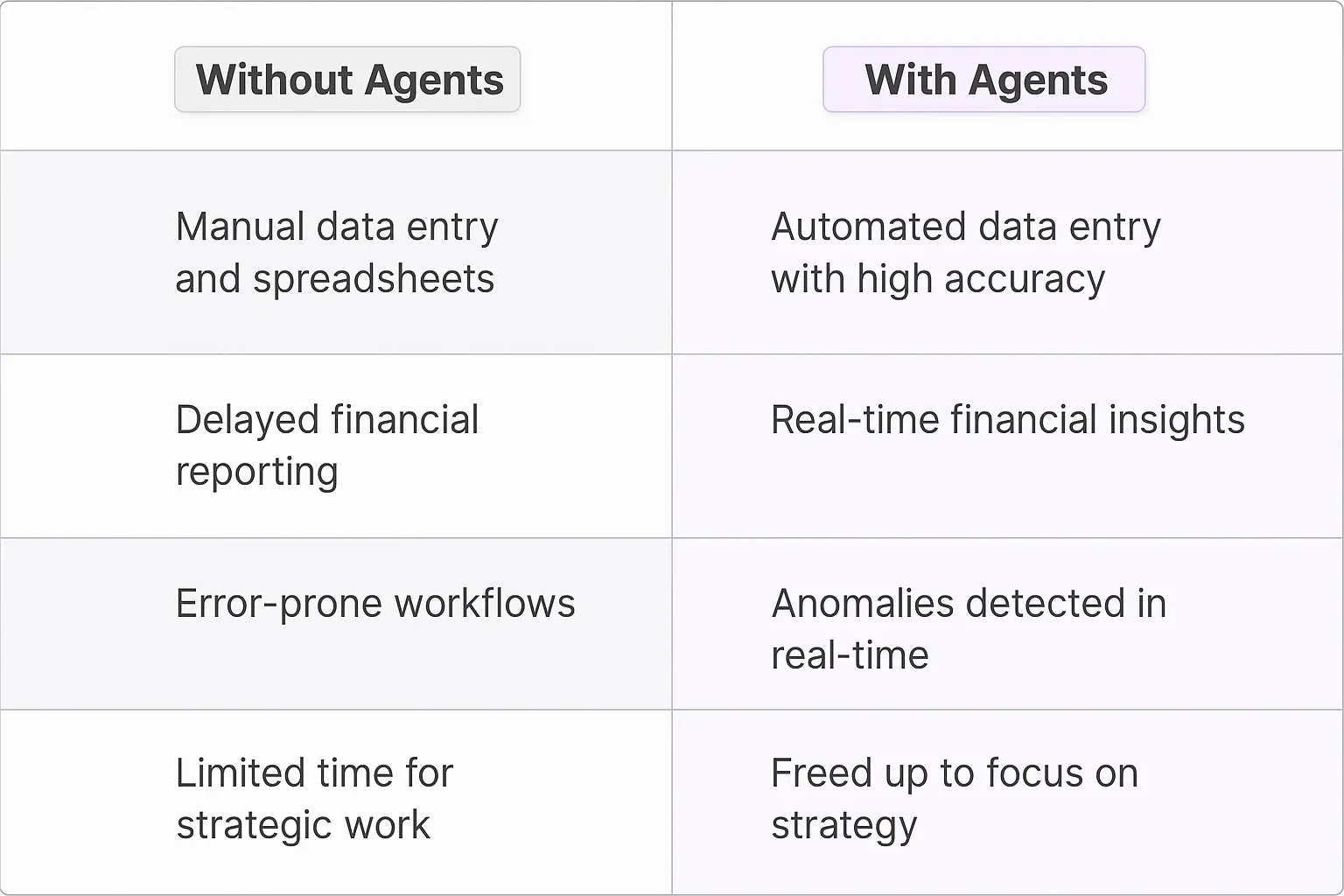

What would have been used before AI Agents?

Before AI agents entered the scene, capital expenditure planning was a laborious process relying heavily on spreadsheets, manual data entry, and human judgment. Finance teams would spend countless hours gathering data from various departments, reconciling inconsistencies, and creating projections based on historical trends. The process was not only time-consuming but also prone to errors and biases.

Companies often relied on legacy software systems that offered basic forecasting capabilities but lacked the ability to adapt to rapidly changing market conditions. These tools were essentially glorified calculators, unable to provide the nuanced insights needed for strategic decision-making in today's complex business environment.

What are the benefits of AI Agents?

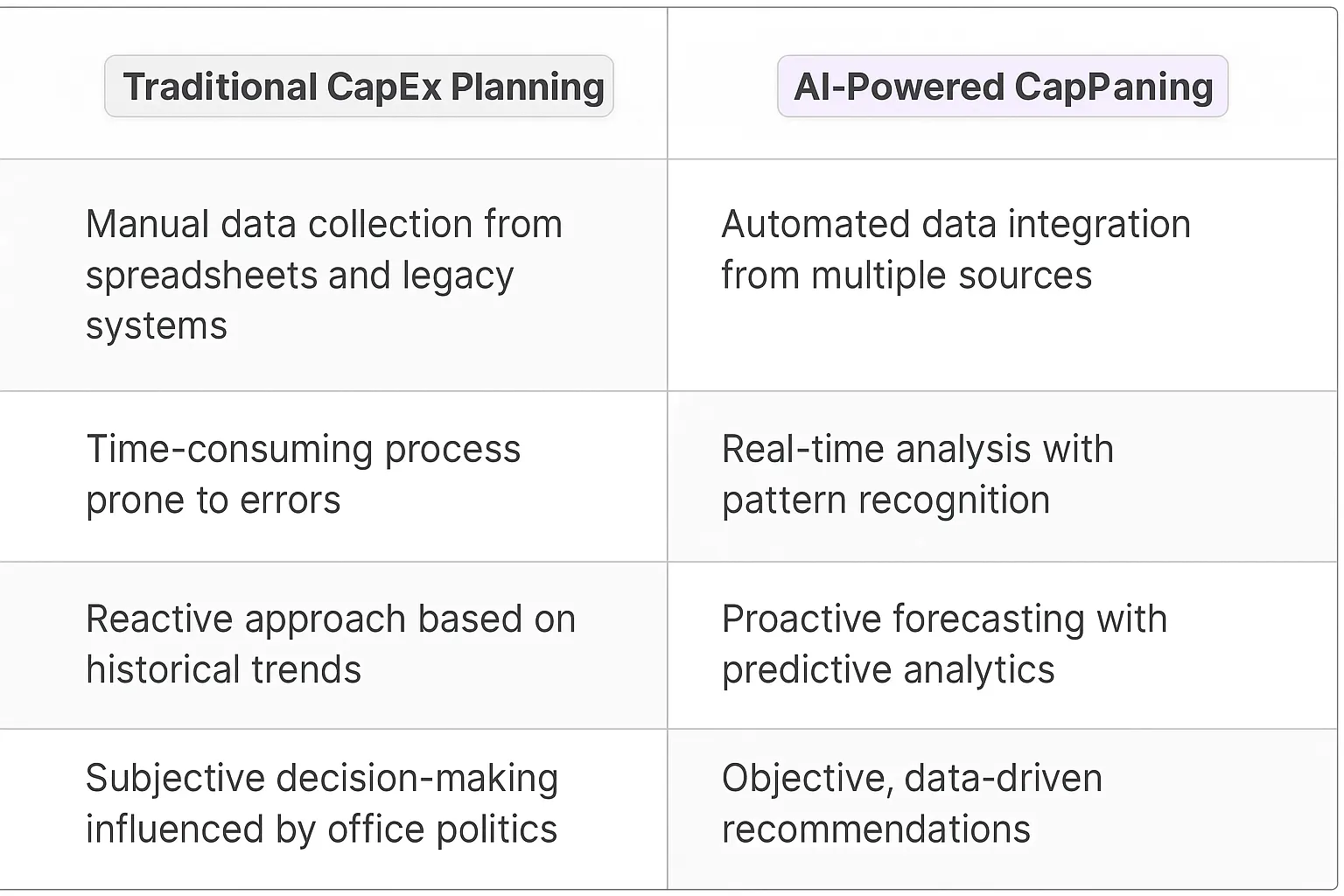

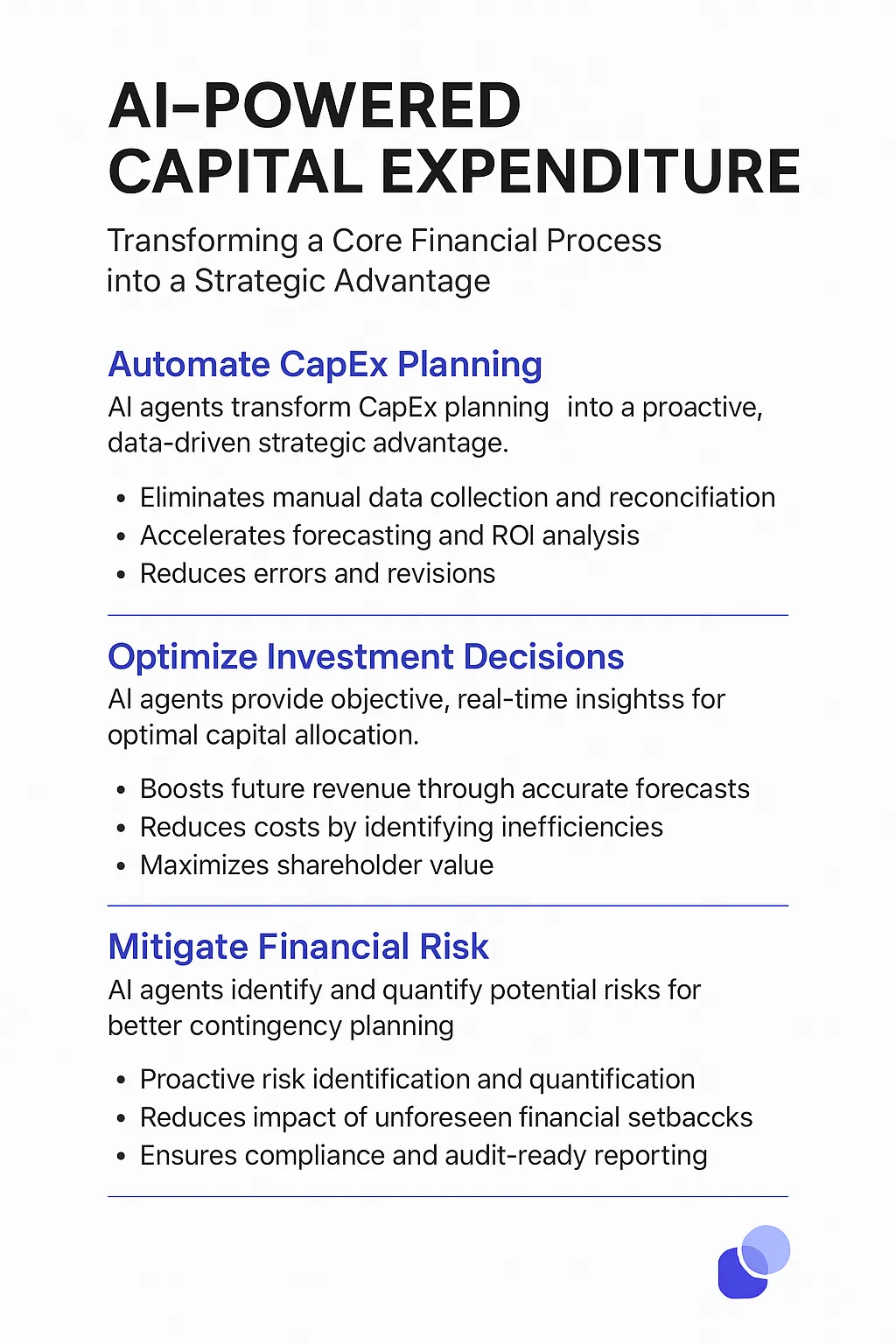

AI agents are transforming capital expenditure planning from a reactive, backwards-looking process into a proactive, forward-thinking strategy. These digital teammates bring a level of sophistication and adaptability that traditional methods simply can't match.

First, AI agents excel at pattern recognition and predictive analytics. They can analyze vast amounts of historical data, market trends, and economic indicators to generate more accurate forecasts. This isn't just about crunching numbers faster; it's about uncovering hidden correlations and insights that humans might miss.

Second, AI agents enable real-time scenario planning. In the past, running multiple "what-if" scenarios was a time-consuming process. Now, finance teams can instantly model the impact of different variables on their capex plans. This agility is crucial in a world where market conditions can change overnight.

Third, AI agents bring a level of objectivity to the planning process. They're not influenced by office politics or personal biases. This can lead to more balanced and data-driven decisions, especially when it comes to allocating resources across different departments or projects.

Finally, AI agents are learning machines. They continuously improve their models based on new data and outcomes. This means that over time, their predictions and recommendations become increasingly accurate and valuable.

The integration of AI agents into capital expenditure planning isn't just an incremental improvement - it's a fundamental shift in how companies approach financial forecasting. It's moving us from a world of educated guesses to one of data-driven certainty, and that's a game-changer for any business looking to optimize its capital allocation.

Potential Use Cases of AI Agents with Capital Expenditure Planning

Processes

Capital expenditure planning is a critical process for businesses, often involving complex financial modeling and strategic decision-making. AI agents can transform this process, bringing a level of sophistication and efficiency that's game-changing. Here's how:

- Financial Forecasting: AI agents can analyze historical data, market trends, and economic indicators to generate more accurate financial forecasts. They can run multiple scenarios simultaneously, providing a comprehensive view of potential outcomes.

- Risk Assessment: By processing vast amounts of data, AI agents can identify potential risks associated with capital investments that human analysts might overlook. They can quantify these risks and suggest mitigation strategies.

- Budget Optimization: AI agents can continuously monitor and adjust budgets based on real-time data, ensuring optimal allocation of resources across different projects and departments.

- Project Prioritization: Using predefined criteria and machine learning algorithms, AI agents can rank proposed capital projects, helping decision-makers focus on investments with the highest potential returns.

Tasks

Breaking down the capital expenditure planning process, AI agents can handle numerous tasks with precision and speed:

- Data Collection and Analysis: AI agents can gather relevant data from various sources, clean it, and perform initial analysis, saving hours of manual work.

- ROI Calculations: They can quickly calculate and compare ROI for different investment options, considering factors like depreciation, tax implications, and opportunity costs.

- Cash Flow Modeling: AI agents can create detailed cash flow models for each proposed project, factoring in variables like inflation rates and market volatility.

- Sensitivity Analysis: They can perform complex sensitivity analyses, showing how changes in key variables might affect the outcome of an investment.

- Report Generation: AI agents can compile comprehensive reports, including visualizations and executive summaries, tailored to different stakeholders' needs.

- Regulatory Compliance Checks: They can ensure that proposed investments comply with relevant regulations and internal policies, flagging potential issues.

The integration of AI agents into capital expenditure planning isn't just an incremental improvement - it's a fundamental shift in how businesses approach financial decision-making. These digital teammates are not replacing human judgment, but rather enhancing it, providing insights and analysis at a scale and speed previously unimaginable.

As companies continue to navigate increasingly complex financial landscapes, those who leverage AI in their capital expenditure planning will gain a significant competitive edge. They'll be able to make faster, more informed decisions, optimize their resource allocation, and ultimately drive better financial outcomes.

The future of capital expenditure planning is here, and it's powered by AI. Companies that embrace this technology now will be setting themselves up for success in the years to come. It's not just about doing things faster or cheaper - it's about making smarter, data-driven decisions that can shape the future of the business.

Industry Use Cases

AI agents are reshaping capital expenditure planning across sectors, offering a level of precision and foresight that was once unimaginable. These digital teammates aren't just crunching numbers; they're providing strategic insights that can make or break major investment decisions. Let's dive into some industry-specific scenarios where AI is transforming CapEx planning, turning what was once a laborious process into a dynamic, data-driven strategy session.

From manufacturing plants weighing equipment upgrades to tech startups allocating funds for server infrastructure, AI agents are becoming the unsung heroes of financial planning. They're not replacing human judgment, but rather enhancing it, offering a blend of data analysis and predictive modeling that allows companies to see around corners and make smarter bets on their future.

The following use cases illustrate how AI is becoming an indispensable ally in capital expenditure planning, helping businesses navigate the complexities of long-term investments with greater confidence and clarity.

Manufacturing: Precision-Driven CapEx Planning with AI

Let's dive into how AI agents are reshaping capital expenditure planning in manufacturing. This isn't just about crunching numbers; it's about creating a symbiotic relationship between human expertise and machine intelligence.

Take a large-scale automotive manufacturer. They're not just building cars; they're orchestrating a complex dance of machinery, robotics, and human skill. Every piece of equipment on that factory floor represents a significant investment decision.

Enter the CapEx Planning AI agent. This digital teammate doesn't just analyze historical data; it's constantly learning from real-time production metrics, market trends, and even global supply chain fluctuations. It's like having a financial analyst, market researcher, and production engineer rolled into one, working 24/7.

When the plant manager is considering upgrading a welding robot, the AI agent doesn't just provide a cost-benefit analysis. It simulates how this upgrade would ripple through the entire production line. It factors in potential energy savings, maintenance schedules, and even how it might affect the ergonomics for human workers nearby.

But here's where it gets really interesting. The AI agent isn't making decisions in a vacuum. It's engaging in a dialogue with the plant manager, the CFO, and even the line workers. It's asking questions, challenging assumptions, and learning from every interaction.

This collaborative approach leads to more nuanced, context-aware decisions. Maybe the numbers say to upgrade now, but the AI agent has learned that waiting three months could align with a major model changeover, minimizing disruption. Or perhaps it identifies an opportunity to repurpose existing equipment in a way humans hadn't considered.

The result? A manufacturing operation that's not just efficient, but adaptive and forward-thinking. Capital expenditures become strategic investments in future capability, not just replacements of old with new.

This isn't about AI replacing human decision-makers. It's about augmenting human intuition with data-driven insights, creating a feedback loop that gets smarter with every investment cycle. In the high-stakes world of manufacturing CapEx, this AI-human collaboration isn't just an advantage – it's becoming the new standard for staying competitive.

Real Estate: AI-Driven CapEx Optimization for Property Portfolios

The real estate industry is ripe for AI disruption, especially when it comes to capital expenditure planning. Let's zoom in on how AI agents are transforming CapEx decisions for large property management firms.

Consider a major real estate investment trust (REIT) managing a diverse portfolio of commercial properties across multiple cities. Each building is a unique asset with its own maintenance needs, energy profile, and market positioning. Traditional CapEx planning here often feels like throwing darts in the dark.

An AI-powered CapEx planner in this context is a game-changer. It's not just crunching numbers; it's synthesizing data from an intricate web of sources. Think IoT sensors monitoring building systems, local market data, tenant satisfaction surveys, and even climate models predicting future HVAC needs.

When a property manager is weighing whether to invest in a new smart building system for a downtown office tower, the AI doesn't just provide an ROI calculation. It models how this upgrade could affect tenant retention rates, energy costs over the next decade, and even the property's resilience to climate change-related events.

The AI agent becomes a strategic partner in portfolio-wide decision making. It might identify that while upgrading Building A seems logical, the capital would actually yield a higher return if invested in repositioning Building B for a emerging tech tenant demographic.

What's fascinating is how this AI learns and adapts. It's not just applying pre-programmed rules; it's constantly refining its models based on real-world outcomes. Did that lobby renovation actually boost occupancy rates as predicted? The AI takes note and adjusts future recommendations accordingly.

This isn't about replacing the seasoned judgment of real estate professionals. Instead, it's about augmenting their expertise with a level of data analysis and predictive modeling that would be impossible for any human team to match.

The result is a real estate portfolio that's not just well-maintained, but strategically evolved. CapEx decisions become less about reactive maintenance and more about proactive value creation. In a market where location is everything, this AI-human collaboration ensures that every dollar spent is optimizing not just a building, but its place in the broader market ecosystem.

As someone who's spent years at the intersection of tech and business growth, I see this as a pivotal shift. The REITs and property management firms that embrace this AI-driven approach to CapEx aren't just saving money; they're positioning themselves to outmaneuver competitors and capture emerging market opportunities at a pace that was previously unthinkable.

Considerations for Implementing a Capital Expenditure Planning AI Agent

Technical Challenges

Implementing a CapEx planning AI agent isn't just about slapping some machine learning algorithms onto your financial data. It's a complex dance of data integration, model training, and system architecture that would make even the most seasoned tech leads sweat.

First off, you're dealing with a data hydra. Financial information is scattered across ERP systems, spreadsheets, and sometimes even lurking in the depths of email threads. Wrangling this data into a coherent, clean dataset is like trying to herd cats – if those cats were made of numbers and had a vendetta against consistency.

Then there's the model itself. You can't just use an off-the-shelf solution here. CapEx planning requires a nuanced understanding of your specific business context, industry trends, and even regulatory environments. You're looking at developing a custom model that can handle time-series forecasting, scenario analysis, and risk assessment. It's not rocket science, but it's pretty darn close.

And let's not forget about integration. Your shiny new AI agent needs to play nice with existing financial systems, dashboards, and reporting tools. It's like introducing a new player to a well-established team – there's bound to be some friction and a learning curve.

Operational Challenges

On the operational side, you're essentially asking your finance team to trust a digital teammate with one of the most critical aspects of business planning. That's a tough sell, especially for the old guard who've been doing this manually since before Excel was cool.

There's a significant change management component here. You need to train your team not just on how to use the AI agent, but on how to interpret its outputs, when to trust it, and when to apply human judgment. It's like teaching someone to drive a car when they've only ever ridden horses – the principles might be similar, but the execution is entirely different.

Data governance becomes a whole new ballgame. With an AI agent making recommendations on million-dollar decisions, you need ironclad processes for data quality, model monitoring, and audit trails. One garbage-in, garbage-out scenario could cost you big time.

And let's talk about the elephant in the room – job security fears. Implementing an AI agent for CapEx planning might make some of your financial analysts nervous. You need a clear strategy for how this technology will augment, not replace, human expertise. It's about enhancing capabilities, not eliminating headcount.

Lastly, there's the challenge of managing expectations. AI isn't magic. It won't suddenly make your CapEx planning perfect or eliminate all risks. Setting realistic expectations about what the AI can and can't do is crucial. Otherwise, you're setting yourself up for a hype cycle that ends in disappointment and wasted resources.

Implementing a CapEx planning AI agent is a journey, not a destination. It requires technical prowess, change management skills, and a hefty dose of patience. But get it right, and you're looking at a potential game-changer for your financial planning processes.

Embracing AI for Smarter Capital Investment Strategies

The integration of AI agents into capital expenditure planning marks a pivotal shift in financial strategy. These digital teammates are not just enhancing existing processes; they're fundamentally changing how businesses approach long-term investments. By providing deeper insights, more accurate forecasts, and real-time scenario analysis, AI agents are enabling companies to make smarter, more agile decisions about their capital allocations.

However, the journey to fully leveraging AI in CapEx planning is not without its challenges. From technical hurdles in data integration to operational challenges in change management, businesses must navigate a complex landscape to reap the full benefits of this technology. The key lies in viewing AI not as a replacement for human expertise, but as a powerful tool to augment and enhance decision-making capabilities.

As we look to the future, it's clear that AI-driven capital expenditure planning will become a critical differentiator in the business world. Companies that successfully implement these systems will gain a significant edge in optimizing their resources, managing risks, and capitalizing on market opportunities. The era of AI in financial planning is here, and it's reshaping the very foundations of how businesses invest in their future.